Hawaii Tax Clearance Form 2018

What is the Hawaii Tax Clearance Form

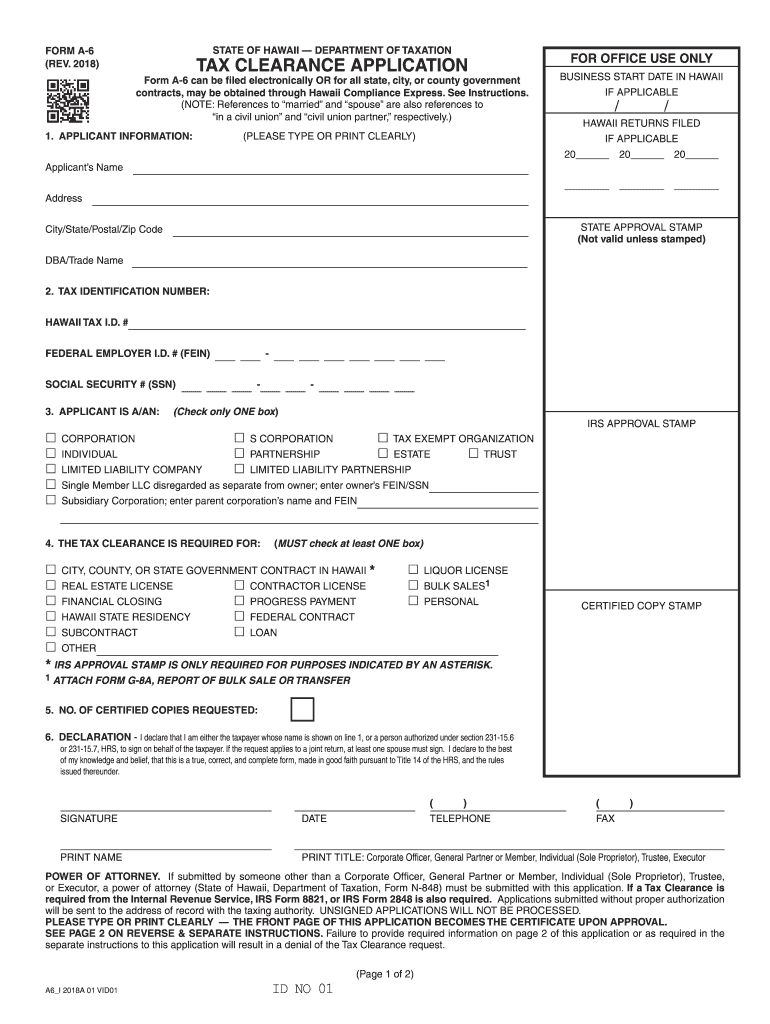

The Hawaii Tax Clearance Form, also known as Form A-6, is an essential document that certifies an individual's or business's compliance with state tax obligations. This form is typically required when applying for licenses, permits, or contracts with the state of Hawaii. It verifies that the applicant has filed all necessary tax returns and paid any outstanding taxes, ensuring that they are in good standing with the Hawaii Department of Taxation. The form is crucial for maintaining transparency and accountability in tax reporting.

Steps to Complete the Hawaii Tax Clearance Form

Completing the Hawaii Tax Clearance Form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your tax identification number and details about your tax history.

- Access the form online or obtain a physical copy from the Hawaii Department of Taxation.

- Fill out the form accurately, providing all required information, including personal or business details.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, following the specific submission guidelines provided.

How to Obtain the Hawaii Tax Clearance Form

The Hawaii Tax Clearance Form can be obtained through various means. It is available for download from the Hawaii Department of Taxation's official website. Alternatively, individuals can request a physical copy by contacting the department directly. For those who prefer a digital approach, the form can also be filled out and submitted online, streamlining the process and reducing the need for paper documentation.

Legal Use of the Hawaii Tax Clearance Form

The legal use of the Hawaii Tax Clearance Form is primarily for verifying tax compliance. It is often required for various legal and business transactions, such as applying for state contracts or permits. By submitting this form, individuals and businesses demonstrate their adherence to tax laws, which is crucial for maintaining good standing with state authorities. Failure to provide a valid tax clearance can result in delays or denials in obtaining necessary approvals.

Key Elements of the Hawaii Tax Clearance Form

Understanding the key elements of the Hawaii Tax Clearance Form is essential for accurate completion. The form typically includes:

- Taxpayer identification information, such as name and address.

- Details regarding the taxpayer's tax account status.

- Certification statements confirming compliance with tax obligations.

- Signature and date fields to validate the submission.

Each of these components plays a vital role in ensuring that the form serves its purpose effectively.

Form Submission Methods

The Hawaii Tax Clearance Form can be submitted through various methods to accommodate different preferences. Individuals can choose to submit the form online via the Hawaii Department of Taxation's website, which offers a convenient and efficient option. Alternatively, the form can be mailed to the appropriate department address or delivered in person at designated offices. Each submission method has specific guidelines, so it is important to follow the instructions carefully to ensure timely processing.

Quick guide on how to complete form a 6 tax 2018 2019

Your assistance manual on preparing your Hawaii Tax Clearance Form

If you’re curious about how to generate and submit your Hawaii Tax Clearance Form, here are several brief instructions on how to simplify tax reporting.

To begin, you just need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to update information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Hawaii Tax Clearance Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Browset our catalog to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Hawaii Tax Clearance Form in our editor.

- Enter the necessary fillable fields with your details (text content, figures, check marks).

- Utilize the Sign Tool to append your legally-binding eSignature (if needed).

- Review your document and amend any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in traditional form can lead to increased return errors and delays in refunds. Of course, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form a 6 tax 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form a 6 tax 2018 2019

How to generate an eSignature for the Form A 6 Tax 2018 2019 online

How to make an electronic signature for the Form A 6 Tax 2018 2019 in Google Chrome

How to create an electronic signature for putting it on the Form A 6 Tax 2018 2019 in Gmail

How to generate an electronic signature for the Form A 6 Tax 2018 2019 right from your mobile device

How to create an electronic signature for the Form A 6 Tax 2018 2019 on iOS

How to make an electronic signature for the Form A 6 Tax 2018 2019 on Android OS

People also ask

-

What is the 6 Hawaii form and how can airSlate SignNow help with it?

The 6 Hawaii form is essential for specific administrative processes in Hawaii. With airSlate SignNow, you can easily upload, manage, and electronically sign this form, ensuring compliance and accuracy in your submissions.

-

How much does it cost to use airSlate SignNow for the 6 Hawaii form?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. You can choose a plan that allows for convenient management and signing of the 6 Hawaii form without breaking your budget.

-

What features does airSlate SignNow provide for handling the 6 Hawaii form?

airSlate SignNow offers robust features such as document templates, customizable workflows, and secure eSignatures for the 6 Hawaii form. These features streamline the process, making it faster and more efficient.

-

Can I integrate airSlate SignNow with other applications for the 6 Hawaii form?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive and Salesforce, enhancing your team's ability to manage the 6 Hawaii form alongside other documentation.

-

What are the benefits of using airSlate SignNow for the 6 Hawaii form?

Using airSlate SignNow for the 6 Hawaii form increases efficiency, reduces paper usage, and enhances security with encrypted signatures. This means quicker turnaround times and peace of mind for your business transactions.

-

Is the 6 Hawaii form easy to fill out and eSign with airSlate SignNow?

Absolutely! airSlate SignNow makes the process of filling out and eSigning the 6 Hawaii form user-friendly and straightforward. Its intuitive interface allows users of all skill levels to navigate the document easily.

-

How does airSlate SignNow ensure the security of my 6 Hawaii form?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your 6 Hawaii form. This ensures that your sensitive information remains confidential and secure throughout the signatory process.

Get more for Hawaii Tax Clearance Form

Find out other Hawaii Tax Clearance Form

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document