Ohio Hotel Tax Exempt Form 2009

What is the Ohio Hotel Tax Exempt Form

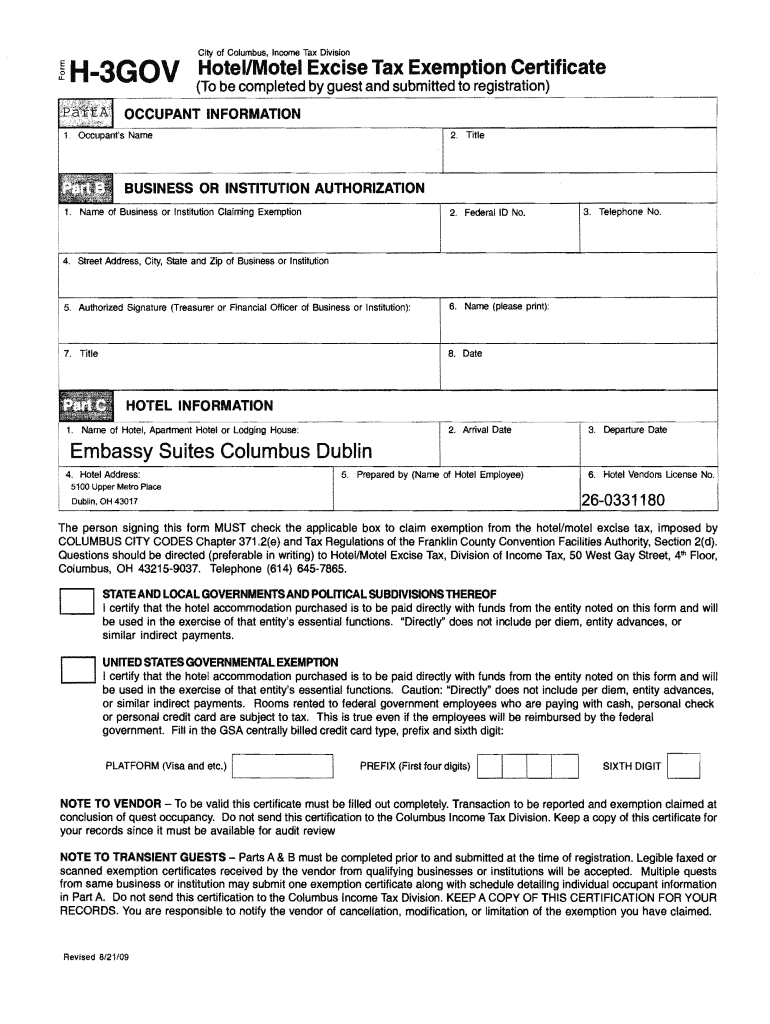

The Ohio Hotel Tax Exempt Form is a document that allows qualifying individuals and organizations to claim exemption from hotel lodging taxes in Ohio. This form is essential for those who are eligible, such as government entities, certain non-profit organizations, and educational institutions. By submitting this form, travelers can avoid paying the hotel tax, which can lead to significant savings during their stays.

How to use the Ohio Hotel Tax Exempt Form

Using the Ohio Hotel Tax Exempt Form involves a straightforward process. First, ensure that you meet the eligibility criteria for tax exemption. Next, obtain the form from an official source or your hotel. Fill out the required fields accurately, providing necessary details such as your name, organization, and the purpose of your stay. Once completed, present the form to the hotel at check-in to receive the tax exemption.

Steps to complete the Ohio Hotel Tax Exempt Form

Completing the Ohio Hotel Tax Exempt Form requires careful attention to detail. Follow these steps:

- Download or request the form from your hotel.

- Fill in your personal information, including your name and address.

- Indicate the name of your organization and its tax-exempt status.

- Provide the purpose of your stay, ensuring it aligns with the exemption criteria.

- Sign and date the form to validate it.

Legal use of the Ohio Hotel Tax Exempt Form

The legal use of the Ohio Hotel Tax Exempt Form is governed by state laws and regulations. It is important to ensure that the form is used only by eligible entities. Misuse or fraudulent claims can lead to penalties, including fines or back taxes owed. Always verify your eligibility and retain copies of the submitted forms for your records.

Key elements of the Ohio Hotel Tax Exempt Form

The Ohio Hotel Tax Exempt Form includes several key elements that must be accurately completed. These elements typically consist of:

- Name and address of the individual or organization.

- Tax identification number of the exempt entity.

- Purpose of the stay, which must qualify for tax exemption.

- Signature of the authorized representative of the organization.

Eligibility Criteria

Eligibility for using the Ohio Hotel Tax Exempt Form is typically limited to specific groups. Common eligible parties include:

- Government agencies.

- Non-profit organizations recognized under IRS regulations.

- Educational institutions.

It is essential to check the specific requirements and ensure that your organization meets these criteria before submitting the form.

Quick guide on how to complete ohio state hotel tax exempt form

Your assistance manual on preparing your Ohio Hotel Tax Exempt Form

If you’re curious about how to complete and submit your Ohio Hotel Tax Exempt Form, here are a few straightforward instructions to streamline tax processing.

To start, simply register your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, create, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revisit to adjust responses as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Ohio Hotel Tax Exempt Form in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Ohio Hotel Tax Exempt Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that paper filing can lead to increased return errors and prolonged reimbursements. Of course, before e-filing your taxes, refer to the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ohio state hotel tax exempt form

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the ohio state hotel tax exempt form

How to generate an eSignature for the Ohio State Hotel Tax Exempt Form online

How to generate an electronic signature for the Ohio State Hotel Tax Exempt Form in Chrome

How to generate an electronic signature for signing the Ohio State Hotel Tax Exempt Form in Gmail

How to make an eSignature for the Ohio State Hotel Tax Exempt Form right from your mobile device

How to create an eSignature for the Ohio State Hotel Tax Exempt Form on iOS devices

How to make an electronic signature for the Ohio State Hotel Tax Exempt Form on Android devices

People also ask

-

What is the federal tax exempt form hotel?

The federal tax exempt form hotel is a document that allows organizations to avoid paying sales tax on hotel accommodations. This form is essential for tax-exempt entities, such as non-profits or government agencies, to ensure compliance with tax regulations while minimizing costs.

-

How can airSlate SignNow help with the federal tax exempt form hotel?

airSlate SignNow streamlines the process of filling out and signing the federal tax exempt form hotel. With our user-friendly eSignature platform, users can quickly complete and send the document electronically, saving time and ensuring accuracy.

-

Is there a cost associated with using the federal tax exempt form hotel on airSlate SignNow?

Using the federal tax exempt form hotel through airSlate SignNow comes with an affordable pricing structure tailored to meet different business needs. We offer various subscription plans, ensuring you can select a cost-effective solution that fits your budget while accessing all necessary features.

-

Can I integrate airSlate SignNow with other tools for managing the federal tax exempt form hotel?

Yes, airSlate SignNow offers seamless integrations with various business tools, enabling you to manage the federal tax exempt form hotel efficiently. Whether you use CRM systems or project management software, our platform easily connects, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for the federal tax exempt form hotel?

By using airSlate SignNow for the federal tax exempt form hotel, you benefit from enhanced speed and convenience in the signing process. Our platform ensures that your documents are secure and legally binding while facilitating quick turnaround times, improving overall efficiency.

-

Is airSlate SignNow secure for handling the federal tax exempt form hotel?

Absolutely! airSlate SignNow prioritizes security and compliance for all your documents, including the federal tax exempt form hotel. We use advanced encryption and authentication measures to protect sensitive information, ensuring your data is safe.

-

How do I get started with airSlate SignNow for the federal tax exempt form hotel?

Getting started with airSlate SignNow for the federal tax exempt form hotel is easy. Simply sign up for a free trial on our website, explore the platform's features, and begin creating, signing, and managing your forms in minutes!

Get more for Ohio Hotel Tax Exempt Form

- Individual as owner form

- California real estate deed forms fill in the blank deeds

- Chapter 113 oregon state legislature form

- California law probate code pg 31 chapter 2 mailing in form

- Notice that notice of completion has been form

- California mechanics lien forms free downloadable

- Bidder instructions 1 printout bid bond form and

- Control number ca 022 77 form

Find out other Ohio Hotel Tax Exempt Form

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter