City of Columbus Tax Exemption Certificate Youngstown 2022-2026

Understanding the City of Columbus Tax Exemption Certificate

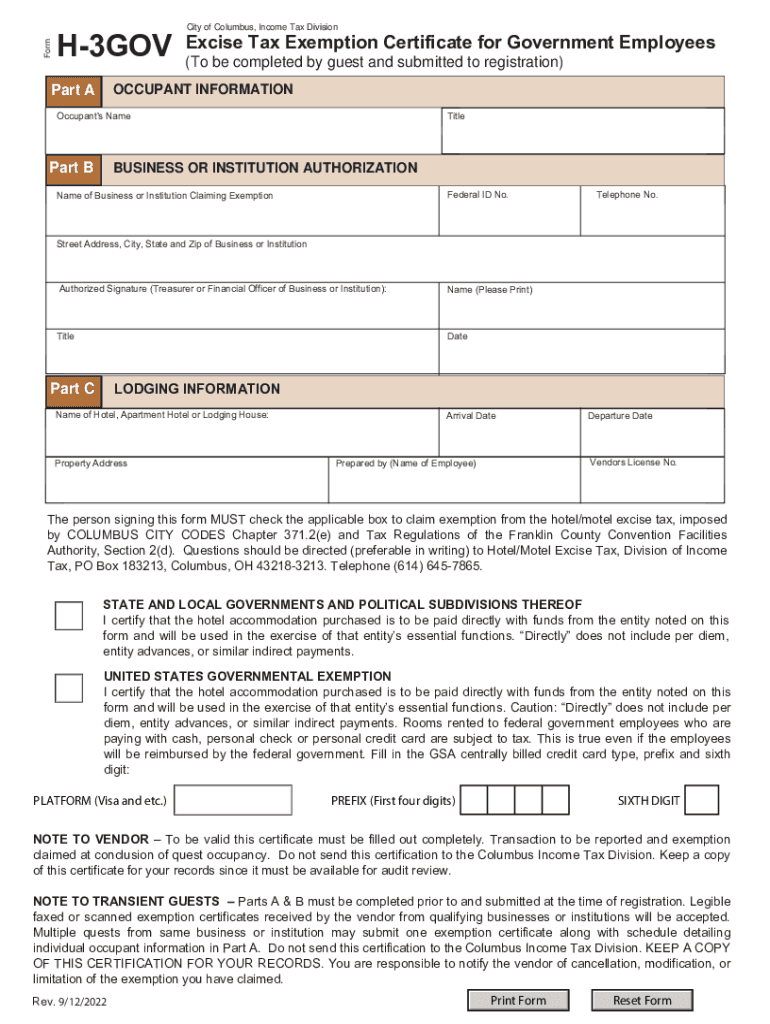

The City of Columbus Tax Exemption Certificate is a crucial document for businesses and individuals seeking to claim tax exemptions for lodging and other related expenses. This certificate allows eligible taxpayers to avoid paying sales tax on certain purchases, particularly in the hospitality sector. Understanding the specific requirements and uses of this certificate can help ensure compliance with local tax regulations.

How to Complete the City of Columbus Tax Exemption Certificate

Filling out the City of Columbus Tax Exemption Certificate involves several key steps. First, gather all necessary information, including your business name, address, and tax identification number. Next, accurately complete the form by providing details about the specific transaction for which you are claiming the exemption. Ensure that you sign and date the certificate before submission. It is important to keep a copy of the completed form for your records.

Eligibility Criteria for the City of Columbus Tax Exemption Certificate

To qualify for the City of Columbus Tax Exemption Certificate, applicants must meet certain eligibility criteria. Generally, the certificate is available to non-profit organizations, government entities, and businesses engaged in specific activities that are exempt from sales tax. It is essential to review the local regulations to confirm eligibility and ensure compliance with all requirements before applying.

Required Documents for the City of Columbus Tax Exemption Certificate

When applying for the City of Columbus Tax Exemption Certificate, certain documents are typically required. These may include proof of tax-exempt status, such as a letter from the IRS or state tax authority, along with identification details of the applicant. Additionally, any supporting documentation that verifies the nature of the transaction may be necessary. Having these documents ready can streamline the application process.

Legal Use of the City of Columbus Tax Exemption Certificate

The legal use of the City of Columbus Tax Exemption Certificate is strictly regulated. It is intended for specific transactions that qualify under local tax laws. Misuse of the certificate, such as using it for ineligible purchases, can result in penalties or fines. It is crucial for users to understand the legal implications and ensure that the certificate is only used for authorized purposes.

Steps to Obtain the City of Columbus Tax Exemption Certificate

Obtaining the City of Columbus Tax Exemption Certificate involves a straightforward process. Begin by reviewing the eligibility criteria and required documents. Next, complete the application form accurately. Once the form is filled out, submit it to the appropriate local tax authority for approval. After processing, you will receive your certificate, which can then be used for qualifying transactions.

Quick guide on how to complete city of columbus tax exemption certificate youngstown

Complete City Of Columbus Tax Exemption Certificate Youngstown seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruption. Manage City Of Columbus Tax Exemption Certificate Youngstown on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven workflow today.

The easiest way to modify and electronically sign City Of Columbus Tax Exemption Certificate Youngstown with ease

- Locate City Of Columbus Tax Exemption Certificate Youngstown and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign City Of Columbus Tax Exemption Certificate Youngstown to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of columbus tax exemption certificate youngstown

Create this form in 5 minutes!

How to create an eSignature for the city of columbus tax exemption certificate youngstown

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio tax exempt lodging form?

The Ohio tax exempt lodging form is a document used by businesses and individuals to claim exemption from state lodging taxes in Ohio. This form is essential for those who qualify and can save money during their stay. Completing the form accurately ensures compliance with state regulations and allows for a smooth check-in process at participating lodging facilities.

-

How do I complete the Ohio tax exempt lodging form?

Completing the Ohio tax exempt lodging form involves filling out required information such as the name of the exempt entity, address, and purpose of exemption. You can obtain the form on the Ohio Department of Taxation website or through airSlate SignNow. Make sure to keep all relevant documentation ready to avoid any issues during submission.

-

Can I eSign the Ohio tax exempt lodging form using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the Ohio tax exempt lodging form conveniently. Our platform provides an easy-to-use interface for creating and signing documents. The electronic signature is legally binding, making the process quick and efficient.

-

Is there a fee associated with using airSlate SignNow for the Ohio tax exempt lodging form?

While the Ohio tax exempt lodging form itself does not incur a fee, using airSlate SignNow involves a subscription cost depending on the features you choose. However, the solution is known for its cost-effective pricing and can signNowly save time and resources in document management.

-

What are the benefits of using airSlate SignNow for the Ohio tax exempt lodging form?

Using airSlate SignNow for the Ohio tax exempt lodging form streamlines the process of document preparation and signing. You can easily track your forms, ensure compliance, and eliminate the need for physical paperwork. Moreover, it enhances collaboration with stakeholders and speeds up the approval process.

-

Does airSlate SignNow offer integrations with other applications for the Ohio tax exempt lodging form?

Yes, airSlate SignNow offers various integrations with popular applications and services, allowing you to manage the Ohio tax exempt lodging form seamlessly. You can connect with CRMs, cloud storage services, and productivity tools to enhance your workflow. This integration capability ensures you have everything you need at your fingertips.

-

How secure is airSlate SignNow when handling the Ohio tax exempt lodging form?

airSlate SignNow employs industry-standard security measures to protect your documents, including the Ohio tax exempt lodging form. We use encryption technology to safeguard sensitive information and ensure secure eSignature transactions. Your data's confidentiality and integrity are our top priorities.

Get more for City Of Columbus Tax Exemption Certificate Youngstown

- Persuasive writing organizer julian high school form

- Application for ticket refund metra form

- Chicago teachers union sweatshirt form

- Chicago tempered glass form

- Payment south holland 482768584 form

- Camper information form skokie

- Illinois religious exemption form

- Illinois youth soccer association sanctioned tournament roster form

Find out other City Of Columbus Tax Exemption Certificate Youngstown

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online