Form of S Corporation Revocation, Tax Allocation and

What is the Form of S Corporation Revocation, Tax Allocation And

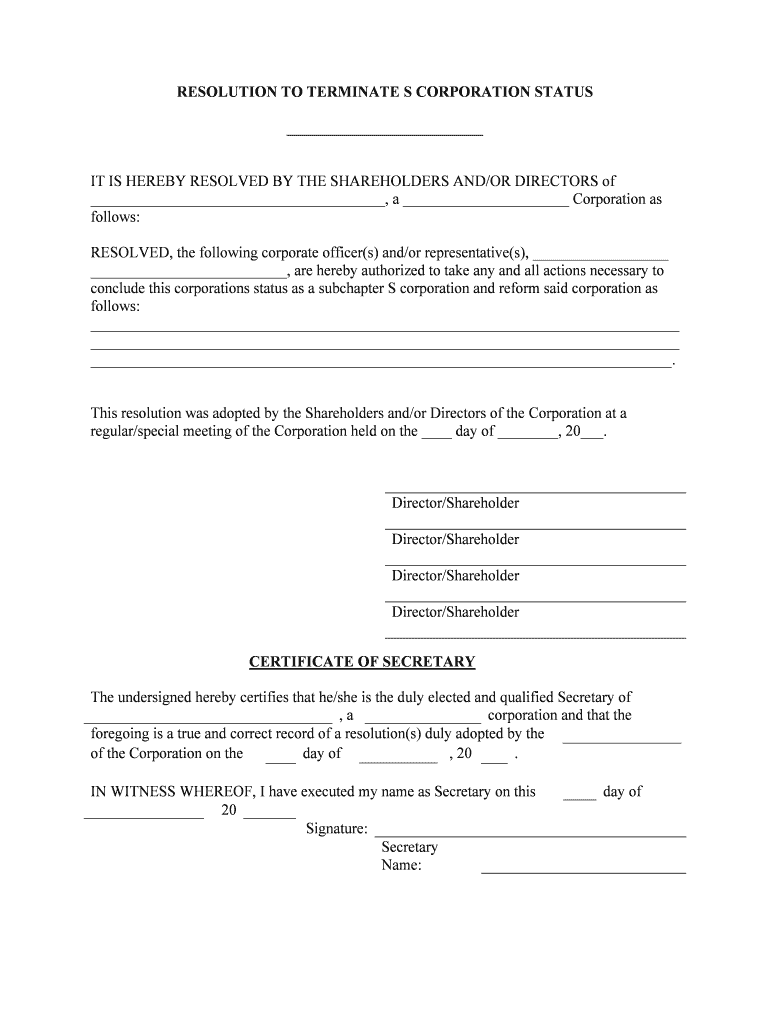

The Form of S Corporation Revocation, Tax Allocation And is a crucial document used by corporations in the United States that wish to revoke their S corporation status. This form outlines the decision to revert to a C corporation status, which can have significant tax implications. The form also addresses tax allocation among shareholders, ensuring that all parties understand their responsibilities and rights regarding tax liabilities following the revocation. Understanding the implications of this form is essential for compliance with IRS regulations and for maintaining proper financial management within the business.

Steps to complete the Form of S Corporation Revocation, Tax Allocation And

Completing the Form of S Corporation Revocation, Tax Allocation And involves several key steps. First, gather all necessary information, including the corporation's name, address, and tax identification number. Next, ensure that all shareholders are in agreement with the decision to revoke the S corporation status, as their signatures may be required. Fill out the form accurately, paying close attention to sections that outline the tax allocation. After completing the form, review it for any errors before submitting it to the IRS. It is advisable to keep a copy of the completed form for your records.

Legal use of the Form of S Corporation Revocation, Tax Allocation And

The legal use of the Form of S Corporation Revocation, Tax Allocation And is governed by IRS guidelines. To ensure that the revocation is valid, the form must be filled out correctly and submitted within the appropriate time frame. The revocation takes effect on the first day of the tax year in which the form is filed, provided it meets the necessary legal requirements. Failure to comply with these regulations can lead to penalties or complications in tax filings, making it essential to understand the legal implications of this form thoroughly.

Filing Deadlines / Important Dates

Filing deadlines for the Form of S Corporation Revocation, Tax Allocation And are critical for ensuring compliance with IRS regulations. Generally, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is March 15. It is important to note that late submissions may result in the loss of S corporation status for the current tax year, so timely filing is essential.

IRS Guidelines

The IRS provides specific guidelines for the Form of S Corporation Revocation, Tax Allocation And, which must be adhered to for the revocation to be accepted. These guidelines include requirements for shareholder consent, the proper completion of the form, and adherence to filing deadlines. Additionally, the IRS may require supporting documentation to validate the revocation. Familiarizing yourself with these guidelines can help ensure a smooth process and prevent potential issues with tax compliance.

Required Documents

When preparing to file the Form of S Corporation Revocation, Tax Allocation And, certain documents may be required. These typically include the corporation's articles of incorporation, a list of shareholders, and any prior tax returns that may be relevant to the revocation process. Having these documents ready can facilitate the completion of the form and ensure that all necessary information is provided to the IRS.

Who Issues the Form

The Form of S Corporation Revocation, Tax Allocation And is issued by the Internal Revenue Service (IRS). This federal agency is responsible for overseeing tax compliance and ensuring that corporations adhere to the regulations surrounding S corporation status. Understanding the role of the IRS in this process can help corporations navigate the complexities of tax law and maintain compliance with federal requirements.

Quick guide on how to complete form of s corporation revocation tax allocation and

Effortlessly prepare Form Of S Corporation Revocation, Tax Allocation And on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form Of S Corporation Revocation, Tax Allocation And on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Form Of S Corporation Revocation, Tax Allocation And with ease

- Locate Form Of S Corporation Revocation, Tax Allocation And and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight signNow sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form Of S Corporation Revocation, Tax Allocation And and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Form Of S Corporation Revocation, Tax Allocation And process?

The Form Of S Corporation Revocation, Tax Allocation And process is a formal procedure that allows an S Corporation to revoke its S corporation status. This means that the corporation will be treated as a C corporation for tax purposes. Understanding this process is crucial for businesses looking to change their tax structure effectively.

-

How does airSlate SignNow facilitate the Form Of S Corporation Revocation, Tax Allocation And?

airSlate SignNow streamlines the process of completing and submitting the Form Of S Corporation Revocation, Tax Allocation And. With our user-friendly platform, businesses can easily eSign documents and manage their tax documents efficiently, ensuring compliance and reducing the risk of errors.

-

What are the pricing options for airSlate SignNow focusing on Form Of S Corporation Revocation, Tax Allocation And?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses looking to handle the Form Of S Corporation Revocation, Tax Allocation And. Each plan is designed to provide value by enabling hassle-free eSigning and document management at competitive prices.

-

What features does airSlate SignNow offer for managing the Form Of S Corporation Revocation, Tax Allocation And?

airSlate SignNow provides essential features for managing the Form Of S Corporation Revocation, Tax Allocation And, including customizable templates, secure eSigning, and real-time tracking. These features empower businesses to handle their documents with ease and efficiency.

-

Can airSlate SignNow integrate with other software for the Form Of S Corporation Revocation, Tax Allocation And?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing the management of the Form Of S Corporation Revocation, Tax Allocation And. This integration allows businesses to synchronize their workflows and improve overall productivity.

-

What are the benefits of using airSlate SignNow for Form Of S Corporation Revocation, Tax Allocation And?

Utilizing airSlate SignNow for the Form Of S Corporation Revocation, Tax Allocation And offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform ensures that businesses can focus on their core operations while maintaining compliance with tax laws.

-

Is customer support available for questions about Form Of S Corporation Revocation, Tax Allocation And?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries regarding the Form Of S Corporation Revocation, Tax Allocation And. Our knowledgeable team is ready to help ensure that businesses can effectively navigate their document management needs.

Get more for Form Of S Corporation Revocation, Tax Allocation And

Find out other Form Of S Corporation Revocation, Tax Allocation And

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed