Investment LetterIntrastate Offering Form

What is the Investment Letter Intrastate Offering

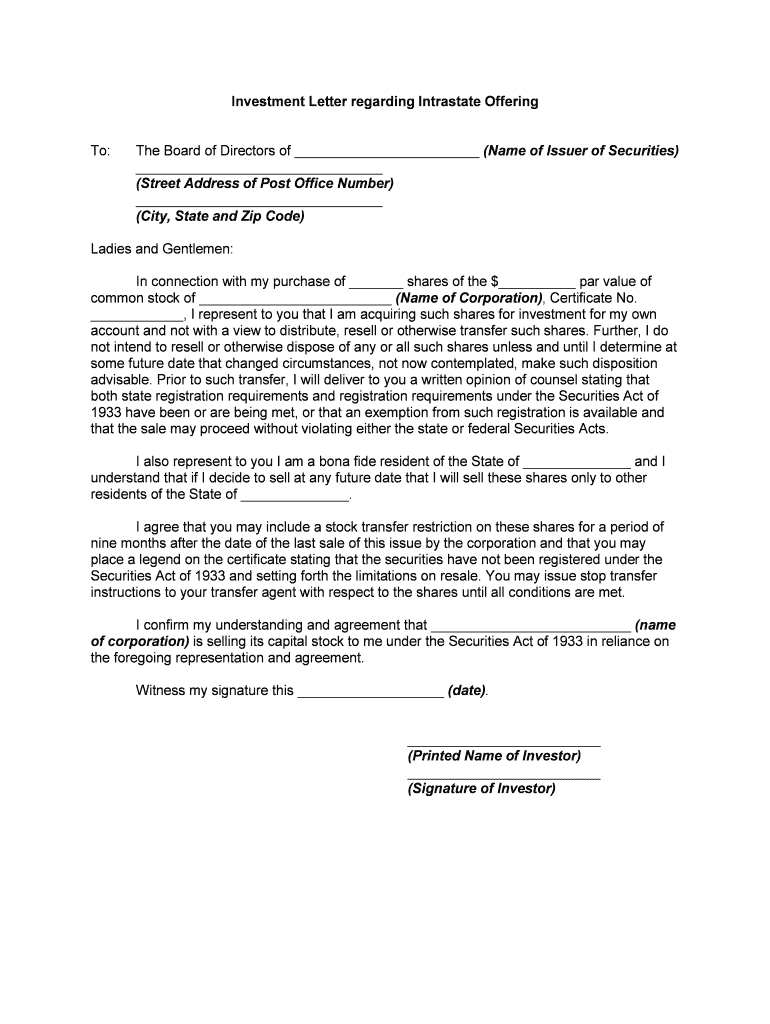

The Investment Letter Intrastate Offering is a legal document used in the context of securities offerings within a single state. It allows companies to raise capital from investors who are residents of that state, thereby avoiding federal registration requirements. This form is essential for businesses looking to attract local investors while complying with state regulations. The primary purpose of the investment letter is to affirm that the investor understands the risks associated with the investment and acknowledges that the securities are not registered with the SEC.

How to use the Investment Letter Intrastate Offering

Using the Investment Letter Intrastate Offering involves several steps to ensure compliance and effectiveness. First, the issuer must prepare the letter, detailing the terms of the offering and the nature of the investment. Next, the investor must review the document carefully, ensuring they understand the risks involved. After this review, the investor signs the letter, confirming their acceptance of the terms. This signed document can then be stored electronically or physically, depending on the issuer's preference. Utilizing a reliable eSignature platform can streamline this process, ensuring that all signatures are legally binding and securely stored.

Steps to complete the Investment Letter Intrastate Offering

Completing the Investment Letter Intrastate Offering involves a structured process:

- Draft the investment letter, including details such as the offering amount, terms, and investor qualifications.

- Provide clear instructions for the investor on how to complete the letter.

- Ensure that the investor reads and understands the risks associated with the investment.

- Have the investor sign the letter using a secure eSignature solution.

- Store the completed letter in compliance with state regulations and internal record-keeping policies.

Legal use of the Investment Letter Intrastate Offering

The legal use of the Investment Letter Intrastate Offering is governed by state securities laws, which vary by jurisdiction. It is crucial for issuers to ensure that they comply with these laws to avoid penalties. The letter serves as a declaration that the investor is aware of the investment's risks and that the offering is exempt from federal registration. Compliance with the relevant state regulations is essential for the validity of the offering and the protection of both the issuer and the investor.

Key elements of the Investment Letter Intrastate Offering

Key elements of the Investment Letter Intrastate Offering include:

- Investor Information: Details about the investor, including name, address, and state of residence.

- Offering Details: Specifics about the investment opportunity, including the amount being offered and the terms of the investment.

- Risk Disclosure: A clear statement outlining the risks associated with the investment.

- Signature Section: A designated area for the investor to sign, indicating their acceptance of the terms.

State-specific rules for the Investment Letter Intrastate Offering

State-specific rules for the Investment Letter Intrastate Offering can significantly impact how the form is executed. Each state has its own regulations regarding securities offerings, including limits on the amount that can be raised and the types of investors that can participate. It is essential for issuers to familiarize themselves with their state's laws to ensure compliance. This may involve consulting with legal professionals or state regulatory agencies to understand the specific requirements and restrictions applicable to their offering.

Quick guide on how to complete investment letterintrastate offering

Prepare Investment LetterIntrastate Offering effortlessly on any device

Online document management has become widely accepted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle Investment LetterIntrastate Offering across any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and electronically sign Investment LetterIntrastate Offering with ease

- Locate Investment LetterIntrastate Offering and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and press the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Investment LetterIntrastate Offering and ensure effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Investment Letter for an Intrastate Offering?

An Investment Letter for an Intrastate Offering is a legal document that outlines the terms of an investment in a local business offering securities within a specific state. This letter protects both the investors and the business by ensuring compliance with state laws and regulations. It is essential for verifying that all participants understand the risks and the nature of the offering.

-

How does airSlate SignNow simplify the creation of Investment Letters for Intrastate Offerings?

airSlate SignNow simplifies the creation of Investment Letters for Intrastate Offerings by providing customizable templates that help businesses draft documents quickly and accurately. The platform's eSignature feature ensures that all parties can sign the document electronically, streamlining the process signNowly. This means that businesses can focus more on their offerings and less on paperwork.

-

What are the pricing options for using airSlate SignNow for my Investment Letter needs?

airSlate SignNow offers flexible pricing plans tailored to various business sizes and needs, allowing you to effectively manage your Investment Letter for Intrastate Offering requirements without breaking the bank. Pricing is designed to be cost-effective, making it accessible for startups and established companies alike. You can choose from monthly or annual subscriptions based on your usage and budget.

-

Can I integrate airSlate SignNow with other tools for my Intrastate Offering needs?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications such as CRMs and document management systems. This means you can streamline your workflow and manage your Investment Letter for Intrastate Offering alongside other tools you already use. Integration helps enhance efficiency and ensures all your documents are managed in one central location.

-

What are the key benefits of using airSlate SignNow for my Investment Letters?

Using airSlate SignNow for your Investment Letters for Intrastate Offerings provides numerous benefits, including time savings, enhanced security, and improved compliance. The platform ensures that your documents are legally binding and that all signatures are stored securely. Additionally, the user-friendly interface allows for easy tracking of document statuses, contributing to a smoother process.

-

Is airSlate SignNow secure for handling Investment Letters associated with Intrastate Offerings?

Absolutely! airSlate SignNow employs top-notch security measures such as encryption and secure cloud storage to protect your Investment Letters for Intrastate Offerings. This ensures that sensitive information remains confidential and secure throughout the signing process. Compliance with industry standards gives you peace of mind regarding the security of your documents.

-

How can I get started with airSlate SignNow for creating my Investment Letter for an Intrastate Offering?

Getting started with airSlate SignNow is easy. Simply sign up for an account, choose the appropriate pricing plan, and start exploring the customizable templates designed for Investment Letters related to Intrastate Offerings. The user-friendly dashboard guides you through the process, making it simple to create, send, and eSign your documents.

Get more for Investment LetterIntrastate Offering

Find out other Investment LetterIntrastate Offering

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors