How to Establish a Solok Plan Form

What is the How To Establish A Solok Plan

The How To Establish A Solok Plan is a specialized document designed for self-employed individuals and small business owners. This plan allows for the establishment of a Solo 401(k), which is a retirement savings option tailored for business owners without employees. This plan enables individuals to save for retirement while enjoying tax advantages. It is crucial for those looking to maximize their retirement contributions and investment opportunities.

Steps to complete the How To Establish A Solok Plan

Completing the How To Establish A Solok Plan involves several key steps:

- Determine eligibility: Ensure that you meet the criteria for establishing a Solo 401(k).

- Choose a provider: Select a financial institution or service that offers Solo 401(k) plans.

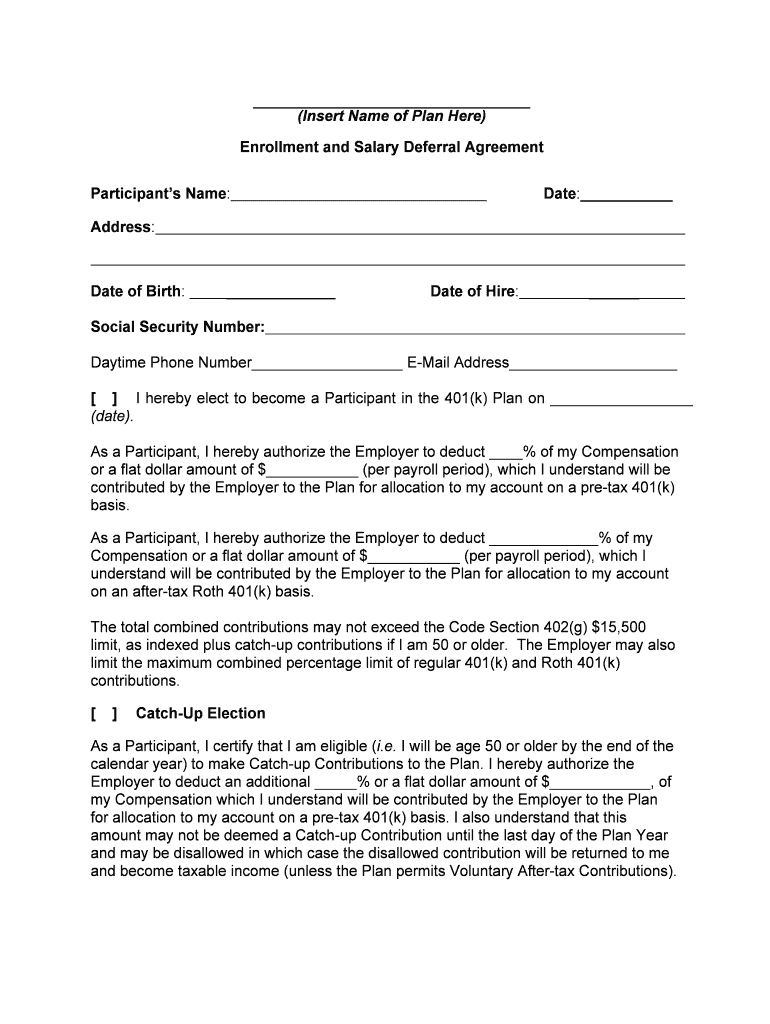

- Complete the application: Fill out the necessary forms accurately, providing all required information.

- Fund the account: Make initial contributions to your Solo 401(k) as per IRS guidelines.

- Maintain records: Keep detailed records of contributions and transactions for tax purposes.

Legal use of the How To Establish A Solok Plan

The How To Establish A Solok Plan must comply with federal regulations set forth by the IRS. This includes adhering to contribution limits, distribution rules, and reporting requirements. Proper legal use ensures that the plan remains tax-advantaged and avoids penalties. It is essential to understand the legal framework surrounding retirement plans to ensure compliance and protect your investments.

Key elements of the How To Establish A Solok Plan

Several key elements define the How To Establish A Solok Plan:

- Eligibility criteria: Must be a self-employed individual or a business owner without employees.

- Contribution limits: Allows for higher contribution limits compared to traditional IRAs.

- Investment options: Offers a variety of investment choices, including stocks, bonds, and mutual funds.

- Tax advantages: Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal.

How to obtain the How To Establish A Solok Plan

To obtain the How To Establish A Solok Plan, individuals should follow these steps:

- Research providers: Look for financial institutions that offer Solo 401(k) plans.

- Request the plan documents: Contact the chosen provider to obtain the necessary forms and documentation.

- Review terms and conditions: Carefully read through the plan details to understand fees, investment options, and rules.

- Submit the application: Complete and return the application to the provider to initiate the establishment of the plan.

Required Documents

Establishing the How To Establish A Solok Plan requires several important documents:

- Identification: A valid ID to verify your identity.

- Business documentation: Proof of self-employment or business ownership, such as a tax return.

- Completed application form: The specific form provided by the financial institution.

- Trust agreement: If applicable, a document outlining the terms of the Solo 401(k) trust.

Quick guide on how to complete how to establish a solok plan

Easily Prepare How To Establish A Solok Plan on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to find the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage How To Establish A Solok Plan on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign How To Establish A Solok Plan Effortlessly

- Obtain How To Establish A Solok Plan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your method of delivery for your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign How To Establish A Solok Plan to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best way to get started on how to establish a Solok plan?

To get started on how to establish a Solok plan, begin by assessing your business goals and needs. Define your objectives clearly and identify the resources you have at your disposal. This foundational step will guide you in creating an effective Solok plan that meets your specific requirements.

-

What features should I consider when learning how to establish a Solok plan?

When looking to establish a Solok plan, consider features that enhance document management, such as eSigning, templates, and integration capabilities. Ensure that the solution you choose is user-friendly and supports automation to streamline your processes. Evaluating these features will help you develop a more efficient Solok plan.

-

How does airSlate SignNow help in establishing a Solok plan?

airSlate SignNow assists in establishing a Solok plan by providing an easy-to-use interface for document management. With robust eSigning features and workflow automation, it empowers businesses to implement a seamless solok strategy. This solution simplifies the process of gathering approvals and signatures, which is crucial for any Solok plan.

-

What are the benefits of using airSlate SignNow for my Solok plan?

Using airSlate SignNow for your Solok plan offers numerous benefits, including increased efficiency, reduced turnaround times, and cost savings. The platform's automation features help eliminate manual tasks, allowing your team to focus on core activities. Additionally, it ensures secure and compliant document handling, which is vital for any business.

-

What pricing options are available for airSlate SignNow to support my Solok plan?

airSlate SignNow offers flexible pricing plans to accommodate different business sizes and needs, making it easier to establish a Solok plan. You'll find options ranging from basic to advanced features, allowing you to choose a plan that fits your budget. Assess your requirements to select the best pricing model for your Solok strategy.

-

Can airSlate SignNow integrate with other tools I use for my Solok plan?

Yes, airSlate SignNow integrates seamlessly with a variety of third-party applications to support your Solok plan. You can easily connect it with CRM systems, cloud storage, and productivity tools, enhancing the overall workflow. This integration capability enables better collaboration and streamlines your operational processes.

-

How long does it take to set up a Solok plan with airSlate SignNow?

Setting up a Solok plan with airSlate SignNow can be accomplished in a matter of hours as the platform is designed for easy implementation. Utilize the available resources and guides to expedite the process, ensuring all team members are onboarded quickly. This rapid setup is one of the key advantages of using airSlate SignNow.

Get more for How To Establish A Solok Plan

Find out other How To Establish A Solok Plan

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template