Refund Property Tax Form 2019

What is the Refund Property Tax Form

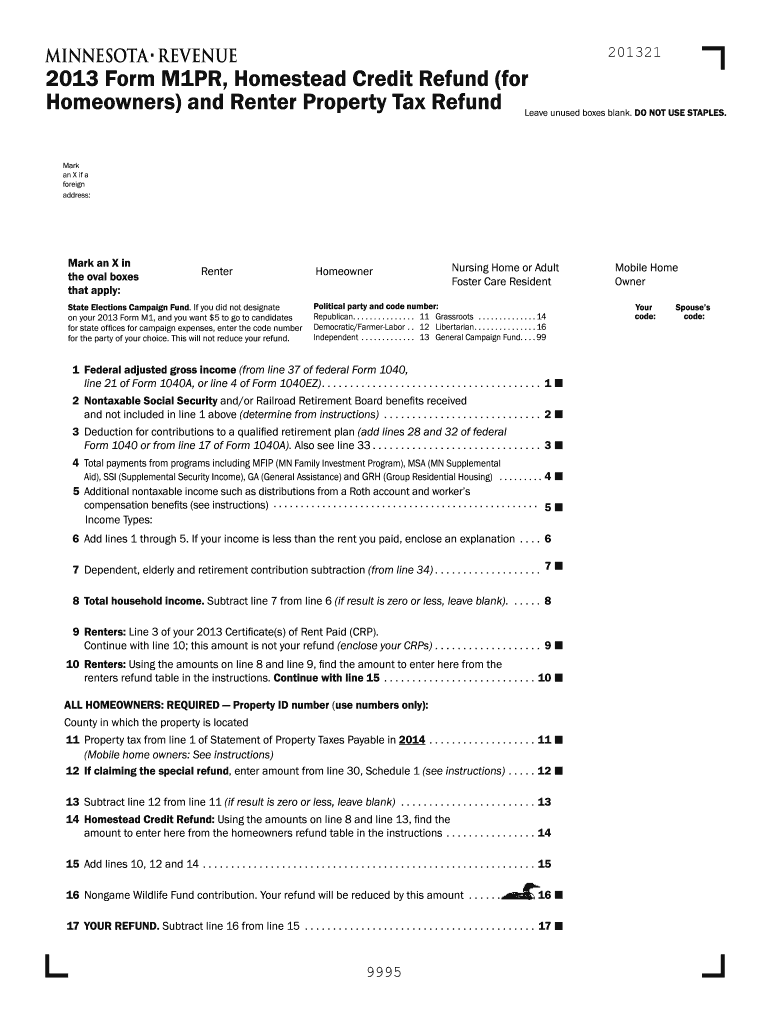

The Refund Property Tax Form is a document used by property owners in the United States to request a refund of property taxes that have been overpaid or incorrectly assessed. This form is essential for ensuring that taxpayers can reclaim funds that are rightfully theirs due to billing errors or changes in property value. Each state may have its own version of this form, tailored to its specific tax laws and regulations.

How to use the Refund Property Tax Form

Using the Refund Property Tax Form involves several steps to ensure that the request is processed smoothly. First, gather all necessary documentation, including proof of payment and any relevant assessment notices. Next, fill out the form accurately, providing all required information such as your property details and the reason for the refund request. Once completed, submit the form according to your state’s guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Refund Property Tax Form

Completing the Refund Property Tax Form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the form from your local tax authority.

- Fill in your personal information, including name, address, and property identification number.

- Provide details regarding the tax payments in question, including dates and amounts.

- Attach necessary supporting documents, such as payment receipts and assessment notices.

- Review the form for accuracy and completeness before submission.

Legal use of the Refund Property Tax Form

The Refund Property Tax Form must be completed and submitted in accordance with state laws to be legally valid. This includes adhering to any specific requirements regarding signatures, documentation, and submission methods. It is important to ensure that the form is filled out truthfully and accurately, as fraudulent claims can result in penalties or legal repercussions.

Required Documents

When submitting the Refund Property Tax Form, certain documents are typically required to support your claim. These may include:

- Proof of payment for the taxes in question, such as receipts or bank statements.

- Property tax assessment notices that detail the amounts assessed.

- Any correspondence with tax authorities regarding disputes or corrections.

Filing Deadlines / Important Dates

Each state has specific deadlines for filing the Refund Property Tax Form, which can vary based on local regulations. It is essential to be aware of these dates to ensure your claim is processed in a timely manner. Missing a deadline may result in the forfeiture of your right to a refund. Check with your local tax authority for the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete 2013 refund property tax form

Effortlessly Prepare Refund Property Tax Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and seamlessly. Handle Refund Property Tax Form on any platform using airSlate SignNow's Android or iOS applications, and simplify any document-related processes today.

The easiest method to modify and electronically sign Refund Property Tax Form effortlessly

- Locate Refund Property Tax Form and click Get Form to begin.

- Utilize the tools offered to fill out your document.

- Emphasize signNow sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, be it via email, text (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Refund Property Tax Form and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 refund property tax form

Create this form in 5 minutes!

How to create an eSignature for the 2013 refund property tax form

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a Refund Property Tax Form?

A Refund Property Tax Form is a document used by property owners to request a refund for overpaid property taxes. This form typically includes details about the property and the amount that needs to be refunded. Using airSlate SignNow, you can easily fill out and eSign this form digitally, streamlining the process.

-

How can airSlate SignNow help with the Refund Property Tax Form?

airSlate SignNow provides a simple and efficient platform for completing and eSigning your Refund Property Tax Form. With our user-friendly interface, you can quickly fill in the required information and send the document securely. This saves time and reduces the hassle associated with traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for the Refund Property Tax Form?

Yes, airSlate SignNow offers affordable pricing plans suitable for individuals and businesses. Depending on your needs, you can choose a plan that allows for unlimited document signing and storage. This investment makes managing your Refund Property Tax Form and other documents more efficient and cost-effective.

-

What features does airSlate SignNow offer for handling the Refund Property Tax Form?

airSlate SignNow offers features such as document templates, real-time tracking, and cloud storage which makes managing your Refund Property Tax Form seamless. Additionally, you can add custom fields and set reminders for document signing, improving your overall workflow and ensuring nothing is overlooked.

-

Can I integrate airSlate SignNow with other applications for my Refund Property Tax Form?

Yes, airSlate SignNow allows integrations with various applications such as Google Drive, Dropbox, and Salesforce. This means you can easily import or export your Refund Property Tax Form and manage your documents alongside other tools you already use. These integrations enhance productivity and make document management simpler.

-

Is it safe to eSign my Refund Property Tax Form with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security with advanced encryption technology. Your Refund Property Tax Form and any personal information are protected throughout the signing process. Additionally, you can access an audit trail that tracks the document's journey, ensuring transparency and compliance.

-

How long does it take to process a Refund Property Tax Form using airSlate SignNow?

The processing time for a Refund Property Tax Form can vary depending on the local authorities' response time. However, using airSlate SignNow can signNowly speed up the initial submission and signing process, allowing you to focus on other important tasks while waiting for the response.

Get more for Refund Property Tax Form

- Emt certificate template form

- Hair salon waiver form

- Montana office of public instruction re dissemination form

- Cbp 6043 form

- Cara mengisi borang permohonan lesen berniaga sabah form

- Schools first direct deposit form

- Zenox pump zps 800 manual form

- Michigan department of state licensing unit medical examination report form

Find out other Refund Property Tax Form

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast