Minnesota M1nr Form 2020

What is the Minnesota M1nr Form

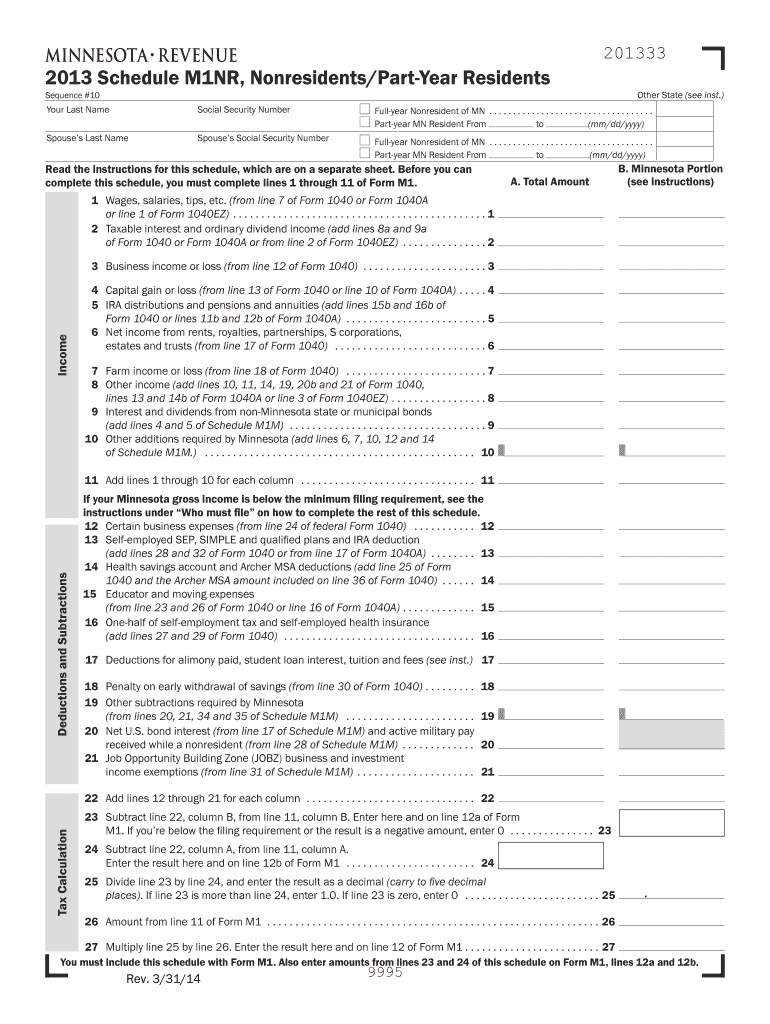

The Minnesota M1nr Form is a tax document used by non-residents of Minnesota to report income earned within the state. This form is essential for individuals who earn income from Minnesota sources but do not reside in the state. It allows these taxpayers to calculate their state tax liability based on the income earned in Minnesota, ensuring compliance with state tax laws.

How to use the Minnesota M1nr Form

To use the Minnesota M1nr Form, individuals must first gather all necessary financial documents, including W-2s and 1099s that report income earned in Minnesota. Once these documents are collected, taxpayers can fill out the form by entering their income details, deductions, and any applicable credits. It is important to follow the instructions carefully to ensure accurate reporting and avoid potential penalties.

Steps to complete the Minnesota M1nr Form

Completing the Minnesota M1nr Form involves several key steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Download the Minnesota M1nr Form from the Minnesota Department of Revenue website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your Minnesota-source income on the form, ensuring to include all applicable income types.

- Calculate your deductions and credits to determine your taxable income.

- Complete the tax calculation section to find your total tax liability.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal use of the Minnesota M1nr Form

The Minnesota M1nr Form is legally recognized for tax purposes when filled out accurately and submitted on time. Compliance with state tax laws is crucial, as failure to file the form or inaccuracies can result in penalties. The form must be submitted by the specified deadlines to avoid interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Minnesota M1nr Form. Typically, the deadline for filing is April 15 of the following year for income earned in the previous calendar year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Minnesota Department of Revenue website for any updates or changes to the filing schedule.

Required Documents

To complete the Minnesota M1nr Form, several documents are required:

- W-2 forms from employers reporting Minnesota wages.

- 1099 forms for any freelance or contract work completed in Minnesota.

- Records of any other income earned within the state.

- Documentation for deductions and credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota M1nr Form can be submitted in various ways. Taxpayers may choose to file online using the Minnesota Department of Revenue's e-filing system, which offers a convenient and efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to select the one that best suits the taxpayer's needs.

Quick guide on how to complete minnesota m1nr form 2013

Effortlessly Prepare Minnesota M1nr Form on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Minnesota M1nr Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and eSign Minnesota M1nr Form with Ease

- Obtain Minnesota M1nr Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Minnesota M1nr Form and guarantee effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota m1nr form 2013

Create this form in 5 minutes!

How to create an eSignature for the minnesota m1nr form 2013

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Minnesota M1nr Form?

The Minnesota M1nr Form is a state tax form used by non-residents to report income earned in Minnesota. It allows non-residents to calculate their Minnesota tax liability based on their income sources. Understanding this form is essential for accurate tax filing and compliance.

-

How can airSlate SignNow help with the Minnesota M1nr Form?

airSlate SignNow streamlines the process of completing and submitting the Minnesota M1nr Form by providing an easy-to-use eSignature solution. With our platform, you can fill out your tax forms electronically and securely sign them, ensuring a hassle-free filing experience. Enjoy a cost-effective way to manage your tax documents with airSlate SignNow.

-

Is there a cost associated with using airSlate SignNow for the Minnesota M1nr Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs, including options for individual users and businesses. Each plan includes access to essential features for effectively handling documents like the Minnesota M1nr Form. You can find a pricing tier that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Minnesota M1nr Form?

airSlate SignNow provides a range of features to simplify the completion of the Minnesota M1nr Form, including customizable templates, in-app editing tools, and secure electronic signatures. Additionally, users can easily track document status and receive notifications, making the entire process efficient and user-friendly.

-

Can I integrate airSlate SignNow with other tools for the Minnesota M1nr Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage documents such as the Minnesota M1nr Form. Integrations with tools like Google Drive, Salesforce, and other popular platforms facilitate easy access to your tax documents without disrupting your workflow.

-

How secure is my information when using airSlate SignNow for the Minnesota M1nr Form?

Security is a top priority at airSlate SignNow. When working on your Minnesota M1nr Form, you can rest assured that your information is protected with advanced encryption and compliance with industry security standards. Our platform also offers secure access and user authentication features to safeguard your data.

-

What are the benefits of using airSlate SignNow for filing the Minnesota M1nr Form?

Using airSlate SignNow for your Minnesota M1nr Form offers numerous benefits, including time savings, efficiency, and enhanced accuracy in document management. With electronic signatures and easy tracking, you can ensure timely submission without the stress of traditional paperwork. Additionally, our user-friendly interface makes it accessible for all users.

Get more for Minnesota M1nr Form

- Stable tally sheet form

- Liheap louisiana online application form

- 6 month asq pdf form

- Real estate assistant training pdf form

- Prolia order form

- Acceptance of service sca fc 105 west virginia judiciary courtswv form

- Support needs assessment form sna for grade r onlysupport needs assessment form sna for grade r onlysupport needs assessment

- Epo001one copy to court one copy to restrained pe form

Find out other Minnesota M1nr Form

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF