Minnesota Form Tax 2020

What is the Minnesota Form Tax

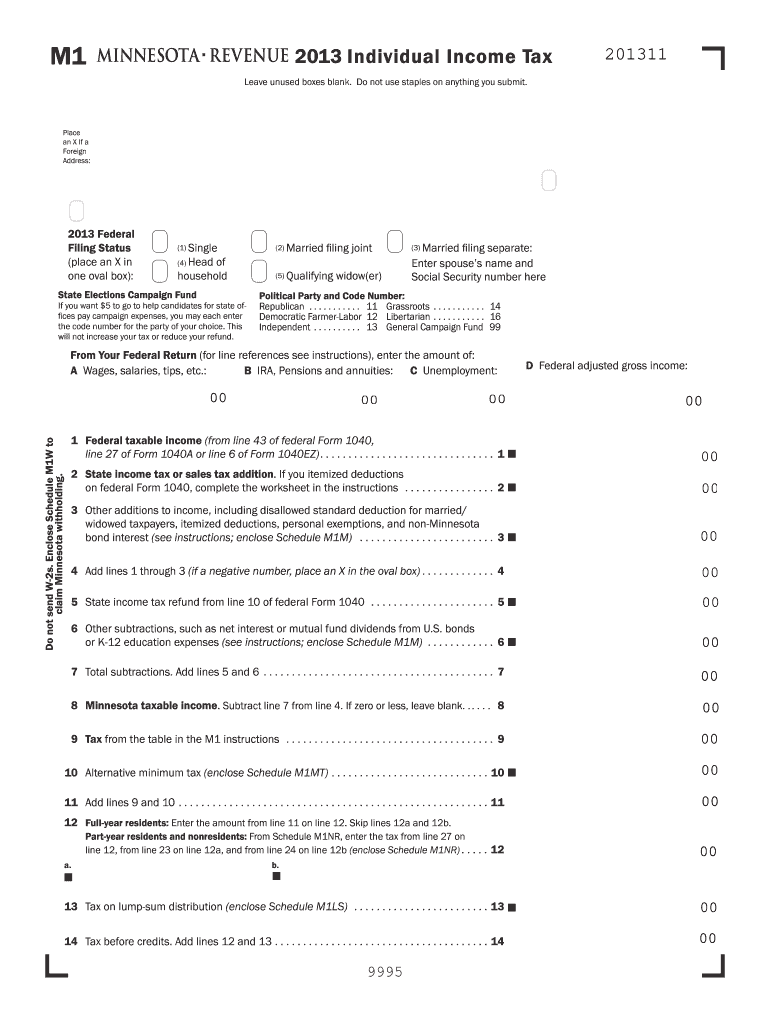

The Minnesota Form Tax refers to the various tax forms required by the state of Minnesota for individuals and businesses to report their income, deductions, and credits. These forms are essential for complying with state tax laws and ensuring accurate tax assessments. The Minnesota Department of Revenue oversees these forms, which include personal income tax forms, corporate tax forms, and sales tax forms, among others. Each form serves a specific purpose and is designed to gather necessary information for tax calculations and compliance.

How to use the Minnesota Form Tax

Using the Minnesota Form Tax involves several steps to ensure accurate completion and submission. First, identify the specific form required for your tax situation, such as the Minnesota Individual Income Tax Form or the Corporate Franchise Tax Form. Next, gather all necessary documentation, including income statements, deduction records, and any relevant tax credits. Fill out the form carefully, following the instructions provided. It is crucial to review the completed form for accuracy before submission. Finally, submit the form through the appropriate channels, either electronically or by mail, depending on the form type.

Steps to complete the Minnesota Form Tax

Completing the Minnesota Form Tax requires a systematic approach. Begin by selecting the correct form based on your filing status and type of income. Then, follow these steps:

- Gather all relevant documents, including W-2s, 1099s, and receipts for deductions.

- Carefully read the instructions for the specific form you are using.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check all calculations to avoid errors.

- Sign and date the form as required.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Minnesota Form Tax

The legal use of the Minnesota Form Tax is governed by state tax laws and regulations. To ensure compliance, it is essential to use the most current version of the form and adhere to all filing requirements. E-signatures are accepted for electronic submissions, provided they meet the legal standards set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Properly completed forms are legally binding and must be filed by the stipulated deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form Tax vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 each year. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Businesses may have different deadlines based on their tax structure and fiscal year. It is important to stay informed about any changes to deadlines and to mark them on your calendar to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Minnesota Form Tax, allowing taxpayers to choose the option that best suits their needs. Forms can be submitted online through the Minnesota Department of Revenue's e-filing system, which offers a convenient and secure way to file. Alternatively, taxpayers can mail their completed forms to the appropriate address provided in the form instructions. In-person submissions may also be possible at designated state offices, although this option may be limited. Each method has its own processing times and requirements, so it is advisable to check the latest guidelines before submitting.

Quick guide on how to complete 2013 minnesota form tax

Complete Minnesota Form Tax effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Form Tax on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to modify and electronically sign Minnesota Form Tax with ease

- Find Minnesota Form Tax and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Minnesota Form Tax to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 minnesota form tax

Create this form in 5 minutes!

How to create an eSignature for the 2013 minnesota form tax

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Minnesota Form Tax?

airSlate SignNow is a robust eSignature platform that enables businesses to send, sign, and manage documents securely. For those dealing with Minnesota Form Tax, our solution simplifies the signing process, ensuring that tax documents are handled efficiently and in compliance with state regulations. With airSlate SignNow, you can streamline your tax documentation workflows and save time.

-

How can airSlate SignNow help with filing Minnesota Form Tax?

Using airSlate SignNow, you can easily prepare, send, and collect signatures for your Minnesota Form Tax documents. Our platform allows for quick turnaround times, reducing the hassle commonly associated with tax filing. By utilizing our solutions, you ensure submission deadlines are met and increase your chances of a smooth tax filing experience.

-

What are the pricing options for airSlate SignNow specifically for Minnesota Form Tax?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including features that enhance the management of Minnesota Form Tax. Our subscription plans provide excellent value, accommodating beginners to heavy users, ensuring you only pay for what you need. You can start with a free trial to see how our platform assists with tax-related documents.

-

Is airSlate SignNow compliant with Minnesota tax regulations?

Yes, airSlate SignNow adheres to all necessary compliance standards for electronic signatures required for Minnesota Form Tax. Our platform is built to meet local regulations, ensuring that your signed documents are valid and legally binding. Trust in our secure environment to handle your sensitive tax information with care.

-

What features does airSlate SignNow offer for managing Minnesota Form Tax?

airSlate SignNow offers a range of features tailored to managing Minnesota Form Tax, such as customizable templates, automated reminders, and integrations with popular applications. These features enhance efficiency by reducing manual errors and ensuring timely document management. Additionally, our platform provides a user-friendly interface making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with my accounting software for Minnesota Form Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Minnesota Form Tax documents. These integrations streamline the process by allowing you to transfer data directly and keep your documents organized in one place. Boost productivity and reduce errors with our effective integrations.

-

What are the benefits of using airSlate SignNow for Minnesota Form Tax?

Using airSlate SignNow for your Minnesota Form Tax offers many benefits, including improved efficiency, reduced turnaround time, and enhanced security for sensitive documents. Our solution automates the signing process, allowing you to focus on what matters - running your business. With comprehensive support and compliance assurance, you can confidently manage your tax documents.

Get more for Minnesota Form Tax

- Bank change order form 46547706

- Cash verification form 42776657

- Illness or misadventure claim form cronulla high school web1 cronulla h schools nsw edu

- Fort hare online application 48053484 form

- Lien waiver form pdf

- Planning department filing instructions form

- Implementation plan example form

- E bundesagentur fr arbeit zentrale auslands und fachvermittlung form

Find out other Minnesota Form Tax

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy