UBIT Minnesota Department of Revenue 2020

What is the UBIT Minnesota Department Of Revenue

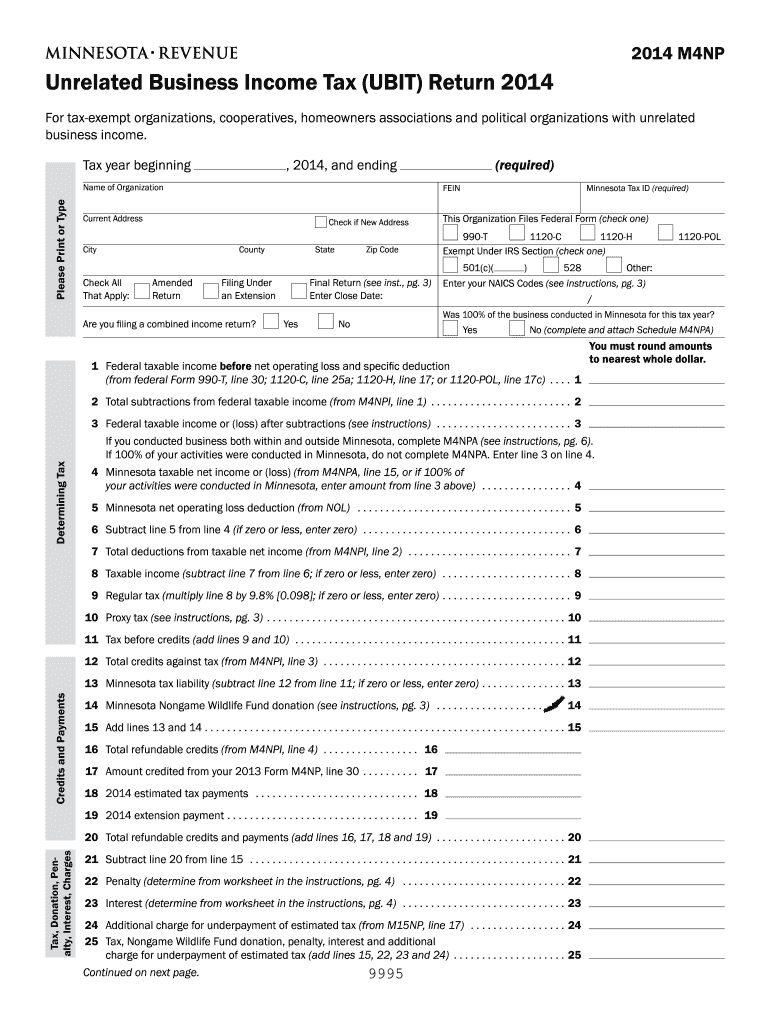

The UBIT Minnesota Department of Revenue form is designed for organizations that are subject to Unrelated Business Income Tax (UBIT). This tax applies to income generated from activities that are not substantially related to the organization's exempt purpose. Nonprofits and tax-exempt entities must file this form to report any unrelated business income to the state of Minnesota. Understanding the nuances of this form is essential for compliance and to avoid potential penalties.

How to use the UBIT Minnesota Department Of Revenue

Using the UBIT Minnesota Department of Revenue form involves several steps to ensure accurate reporting of unrelated business income. First, gather all relevant financial information regarding your organization's income-generating activities. Next, complete the form by providing details about the income earned, expenses incurred, and any applicable deductions. It’s important to review the instructions provided with the form to ensure all sections are filled out correctly. Once completed, submit the form by the designated deadline to avoid any late fees.

Steps to complete the UBIT Minnesota Department Of Revenue

Completing the UBIT Minnesota Department of Revenue form requires careful attention to detail. Follow these steps:

- Collect financial records related to unrelated business activities.

- Fill out the form, ensuring that all income and expenses are accurately reported.

- Include any necessary supporting documentation, such as financial statements.

- Review the completed form for accuracy and completeness.

- Submit the form by mail or electronically, depending on your preference.

Legal use of the UBIT Minnesota Department Of Revenue

The legal use of the UBIT Minnesota Department of Revenue form is governed by state tax laws. Organizations must comply with these regulations to maintain their tax-exempt status. Properly reporting unrelated business income is crucial, as failure to do so can result in penalties or loss of tax-exempt status. It is advisable for organizations to consult with a tax professional to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the UBIT Minnesota Department of Revenue form are critical for compliance. Typically, the form must be submitted by the due date of the organization's federal tax return. Organizations should mark their calendars for these important dates to avoid late filing penalties. Staying informed about any changes in deadlines is also essential, as state regulations may evolve.

Required Documents

To complete the UBIT Minnesota Department of Revenue form, certain documents are required. These may include:

- Financial statements detailing unrelated business income and expenses.

- Records of any deductions claimed.

- Documentation supporting the nature of the income-generating activities.

Having these documents ready will facilitate a smooth filing process and help ensure accuracy in reporting.

Quick guide on how to complete ubit minnesota department of revenue

Accomplish UBIT Minnesota Department Of Revenue effortlessly on any platform

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage UBIT Minnesota Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign UBIT Minnesota Department Of Revenue with ease

- Obtain UBIT Minnesota Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign UBIT Minnesota Department Of Revenue and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ubit minnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the ubit minnesota department of revenue

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is UBIT in relation to the Minnesota Department of Revenue?

UBIT, or Unrelated Business Income Tax, is a tax imposed on income derived from business activities that are not substantially related to a nonprofit's exempt purpose. The Minnesota Department of Revenue enforces UBIT regulations to ensure compliance among nonprofits. Understanding UBIT is crucial for organizations to avoid penalties and maintain their tax-exempt status.

-

How can airSlate SignNow help with UBIT compliance for the Minnesota Department of Revenue?

airSlate SignNow provides businesses with a streamlined solution for sending and eSigning essential documents related to UBIT compliance. By facilitating secure and efficient document management, organizations can easily gather necessary signatures and maintain accurate records for submission to the Minnesota Department of Revenue. This reduces the risk of non-compliance and saves time.

-

What features does airSlate SignNow offer for managing UBIT-related documents?

AirSlate SignNow offers a wide range of features ideal for managing UBIT-related documentation, including customizable templates, automated workflows, and secure eSigning capabilities. These tools help businesses efficiently prepare and distribute documents needed for filing with the Minnesota Department of Revenue. Enhanced security measures also ensure sensitive information remains protected.

-

Is airSlate SignNow affordable for small organizations dealing with UBIT?

Yes, airSlate SignNow is designed to be a cost-effective solution suitable for businesses of all sizes, including small organizations that need to navigate UBIT requirements. Competitive pricing plans enable budget-conscious entities to access powerful eSigning and document management features. Investing in this tool can save time and reduce the risk of UBIT-related penalties.

-

How does airSlate SignNow integrate with existing systems for UBIT documentation?

AirSlate SignNow seamlessly integrates with various applications commonly used for financial and tax management, enhancing its utility for handling UBIT documentation. These integrations ensure that data flows smoothly between systems, which is essential for accurate reporting to the Minnesota Department of Revenue. Users can leverage this connectivity to streamline their workflows.

-

Can airSlate SignNow enhance collaboration while preparing UBIT reports?

Absolutely! AirSlate SignNow enables team collaboration through shared access to documents and real-time commenting features. This is particularly beneficial when preparing UBIT reports and compliance documentation for the Minnesota Department of Revenue, as team members can easily communicate and make adjustments before finalizing any submissions. Enhanced collaboration leads to more accurate filings.

-

What are the security features in airSlate SignNow that support UBIT document management?

AirSlate SignNow prioritizes security with features like advanced encryption, secure cloud storage, and user authentication options. These measures ensure that all UBIT-related documents are safeguarded, facilitating compliance with the Minnesota Department of Revenue's requirements. Organizations can trust that their sensitive information is kept confidential and secure.

Get more for UBIT Minnesota Department Of Revenue

- Wax try in consent form

- Photosynthesis worksheet answer key pdf form

- Editable bank statement form

- Delivery certificate pdf form

- Delivery acceptance form

- Information collection request direct loan servicing

- Mckinney vento eligibility student residency questionnaire form

- Nomination for the district award of merit note the nomination is confidential bsaseabase form

Find out other UBIT Minnesota Department Of Revenue

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation