05 158 Texas Franchise Tax Annual Report 2020

What is the 05 158 Texas Franchise Tax Annual Report

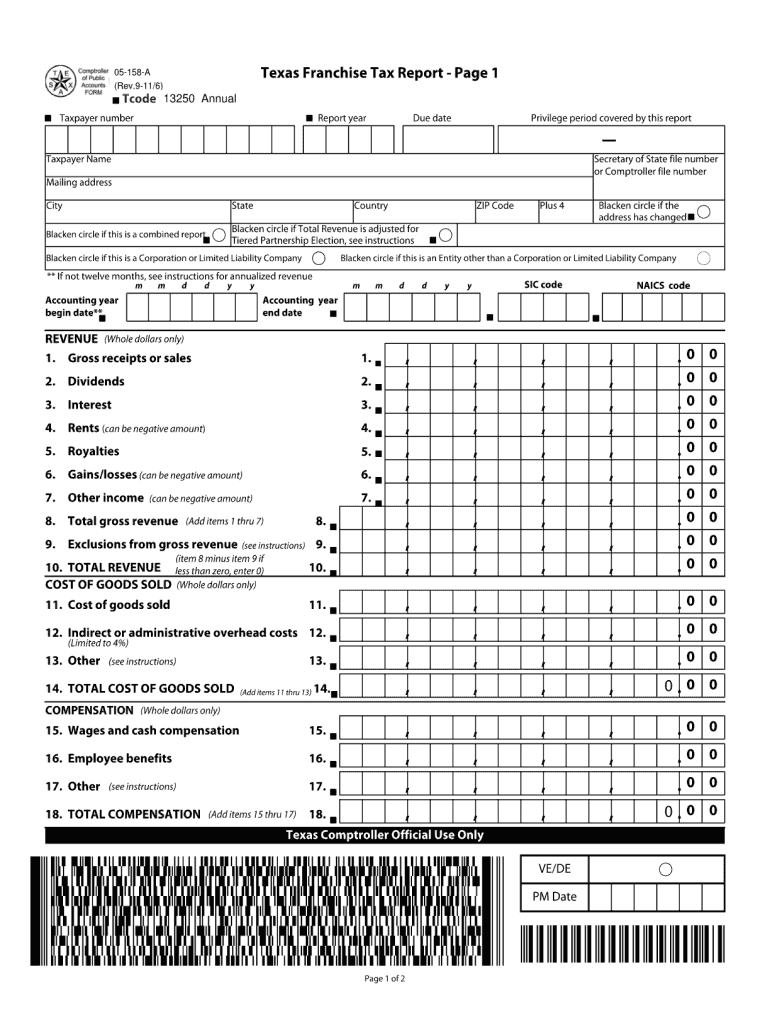

The 05 158 Texas Franchise Tax Annual Report is a mandatory document that businesses operating in Texas must file annually. This report provides the state with essential information regarding a company's financial performance and tax obligations. It is specifically designed for entities subject to the Texas franchise tax, including corporations, limited liability companies (LLCs), and partnerships. The report helps determine the amount of franchise tax owed based on a business's revenue and other financial metrics.

How to use the 05 158 Texas Franchise Tax Annual Report

Using the 05 158 Texas Franchise Tax Annual Report involves several key steps. First, businesses must gather relevant financial information, including revenue figures and expenses, for the reporting period. Next, the form should be accurately completed, ensuring all required fields are filled out correctly. Once the report is prepared, it can be submitted electronically through the Texas Comptroller's website or mailed directly to the appropriate office. Ensuring accuracy and compliance with state guidelines is crucial to avoid penalties.

Steps to complete the 05 158 Texas Franchise Tax Annual Report

Completing the 05 158 Texas Franchise Tax Annual Report requires a systematic approach:

- Gather financial documents, including income statements and balance sheets.

- Determine the applicable franchise tax rate based on your business's revenue.

- Fill out the form, ensuring all sections are completed accurately.

- Review the report for any errors or omissions.

- Submit the completed report electronically or by mail before the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the 05 158 Texas Franchise Tax Annual Report are crucial for compliance. Typically, the report is due on May 15 of each year for most businesses. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for businesses to mark their calendars and ensure timely submission to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to file the 05 158 Texas Franchise Tax Annual Report on time can result in significant penalties. Businesses may incur late fees, which can increase over time. Additionally, non-compliance may lead to the suspension of the business entity's right to operate in Texas. It is essential for businesses to understand these consequences and prioritize timely filing to maintain good standing with the state.

Form Submission Methods (Online / Mail / In-Person)

The 05 158 Texas Franchise Tax Annual Report can be submitted through various methods. The most efficient way is to file electronically via the Texas Comptroller's website, which allows for immediate processing. Alternatively, businesses can choose to mail the completed form to the designated office. In-person submissions are also accepted, although they are less common. Each method has its own processing times, so businesses should consider their needs when selecting a submission method.

Key elements of the 05 158 Texas Franchise Tax Annual Report

Several key elements must be included in the 05 158 Texas Franchise Tax Annual Report to ensure it is complete and compliant. These elements typically include:

- Business name and address

- Federal Employer Identification Number (EIN)

- Revenue figures for the reporting period

- Calculation of the franchise tax owed

- Signature of an authorized representative

Quick guide on how to complete 05 158 texas franchise tax annual report

Effortlessly Prepare 05 158 Texas Franchise Tax Annual Report on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle 05 158 Texas Franchise Tax Annual Report on any device with airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

The Easiest Way to Edit and eSign 05 158 Texas Franchise Tax Annual Report with Ease

- Locate 05 158 Texas Franchise Tax Annual Report and click Get Form to begin.

- Use the provided tools to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 05 158 Texas Franchise Tax Annual Report and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 158 texas franchise tax annual report

Create this form in 5 minutes!

How to create an eSignature for the 05 158 texas franchise tax annual report

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the 05 158 Texas Franchise Tax Annual Report?

The 05 158 Texas Franchise Tax Annual Report is a required document that Texas businesses must file each year to report their revenue and calculate franchise tax. It ensures compliance with state tax regulations and helps maintain good standing for your business.

-

How does airSlate SignNow facilitate the filing of the 05 158 Texas Franchise Tax Annual Report?

airSlate SignNow provides an intuitive platform that allows businesses to easily prepare and eSign the 05 158 Texas Franchise Tax Annual Report, streamlining the entire process. With customizable templates and secure storage, users can manage their documents efficiently.

-

What are the main features of airSlate SignNow for handling the 05 158 Texas Franchise Tax Annual Report?

Key features of airSlate SignNow for the 05 158 Texas Franchise Tax Annual Report include customizable templates, electronic signature capabilities, and automated reminders. These features simplify document management and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the 05 158 Texas Franchise Tax Annual Report?

Yes, airSlate SignNow offers affordable pricing plans tailored to different business needs, ensuring cost-effectiveness when filing the 05 158 Texas Franchise Tax Annual Report. The investment provides signNow time savings and enhanced compliance.

-

What are the benefits of using airSlate SignNow for the 05 158 Texas Franchise Tax Annual Report?

Using airSlate SignNow for the 05 158 Texas Franchise Tax Annual Report provides several benefits, such as increased efficiency, reduced paperwork, and improved security for sensitive documents. This helps businesses focus more on operations rather than compliance.

-

Can airSlate SignNow integrate with other accounting software for the 05 158 Texas Franchise Tax Annual Report?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to sync financial data required for completing the 05 158 Texas Franchise Tax Annual Report. This ensures accuracy and helps streamline the filing process.

-

How secure is airSlate SignNow when filing the 05 158 Texas Franchise Tax Annual Report?

airSlate SignNow prioritizes security, using encryption and secure cloud storage to protect documents related to the 05 158 Texas Franchise Tax Annual Report. These measures help ensure that your business information remains confidential and safe from unauthorized access.

Get more for 05 158 Texas Franchise Tax Annual Report

Find out other 05 158 Texas Franchise Tax Annual Report

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT