Texas Sales Tax Return Short Form 2019

What is the Texas Sales Tax Return Short Form

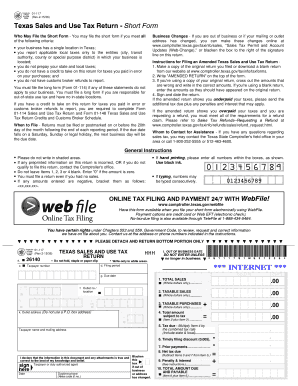

The Texas Sales Tax Return Short Form is a simplified document used by businesses in Texas to report their sales tax liabilities. This form is specifically designed for entities with straightforward sales tax situations, allowing for easier and quicker filing. It captures essential information such as total sales, taxable sales, and the amount of sales tax collected. Businesses that qualify can benefit from using this form to streamline their tax reporting process.

How to use the Texas Sales Tax Return Short Form

Using the Texas Sales Tax Return Short Form involves several steps. First, gather all necessary sales records, including total sales and taxable sales amounts. Next, accurately fill out the form, ensuring that each section is completed with the correct figures. After completing the form, review it for accuracy before submission. Businesses can file the form electronically or via mail, depending on their preference. Utilizing electronic filing can expedite the process and provide immediate confirmation of submission.

Steps to complete the Texas Sales Tax Return Short Form

Completing the Texas Sales Tax Return Short Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales data for the reporting period.

- Identify the total sales and the amount of taxable sales.

- Fill in the required fields on the form, including business information and sales figures.

- Calculate the total sales tax due based on the taxable sales amount.

- Review the completed form for accuracy.

- Submit the form electronically or mail it to the appropriate Texas tax authority.

Legal use of the Texas Sales Tax Return Short Form

The Texas Sales Tax Return Short Form is legally recognized for reporting sales tax obligations. To ensure its legal validity, it must be completed accurately and submitted on time. Compliance with Texas state tax laws is essential to avoid penalties. The form must also be signed and dated by an authorized representative of the business, which can be facilitated through electronic signature solutions that meet legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Sales Tax Return Short Form vary based on the reporting frequency assigned to the business. Typically, businesses must file monthly, quarterly, or annually. It is crucial for businesses to be aware of their specific deadlines to avoid late fees and penalties. Keeping a calendar of these important dates can help ensure timely submissions and compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Texas Sales Tax Return Short Form can be submitted through various methods. Businesses have the option to file online, which is often the most efficient way to ensure immediate processing. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own advantages, and businesses should choose the one that best fits their needs and capabilities.

Quick guide on how to complete texas sales tax return short form 2015

Complete Texas Sales Tax Return Short Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without any delays. Handle Texas Sales Tax Return Short Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Texas Sales Tax Return Short Form effortlessly

- Locate Texas Sales Tax Return Short Form and click on Get Form to commence.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive details using tools specially provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Texas Sales Tax Return Short Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas sales tax return short form 2015

Create this form in 5 minutes!

How to create an eSignature for the texas sales tax return short form 2015

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Texas Sales Tax Return Short Form?

The Texas Sales Tax Return Short Form is a simplified document designed for businesses with limited sales transactions, allowing for easy reporting of sales and use tax. This form streamlines the filing process, making it efficient for small to medium-sized businesses. Using airSlate SignNow, you can easily eSign and send your Texas Sales Tax Return Short Form, ensuring compliance with state regulations.

-

How does airSlate SignNow help with the Texas Sales Tax Return Short Form?

airSlate SignNow provides a platform that allows users to electronically sign and send their Texas Sales Tax Return Short Form quickly and securely. This tool minimizes paperwork and reduces the chance of errors, facilitating a smooth filing process. Additionally, it keeps your documents organized and accessible for future reference.

-

What are the costs associated with using airSlate SignNow for tax forms?

The pricing for airSlate SignNow varies based on your business needs and selected plan. Each plan includes features to assist in preparing and signing documents like the Texas Sales Tax Return Short Form. With competitive pricing and scalable options, businesses can easily find a solution that fits their budget and requirements.

-

Are there any integrations available with airSlate SignNow for managing my Texas Sales Tax Return Short Form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software tools, which can assist in managing your Texas Sales Tax Return Short Form. These integrations help streamline the entire tax filing process. By connecting your tools, you can automatically sync data and reduce manual entry, enhancing productivity.

-

What benefits does airSlate SignNow offer for submitting the Texas Sales Tax Return Short Form?

Using airSlate SignNow to submit your Texas Sales Tax Return Short Form offers multiple advantages, including time savings and increased accuracy. The platform facilitates easy eSigning and allows for quick sending directly to the appropriate tax authorities. Furthermore, document tracking ensures you're updated on your submission status.

-

Can I track my Texas Sales Tax Return Short Form after sending it with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Texas Sales Tax Return Short Form after submission. You'll receive notifications on document views and completions, keeping you informed throughout the process. This transparency helps you ensure that all your tax documents are handled timely.

-

Is airSlate SignNow secure for submitting sensitive documents like the Texas Sales Tax Return Short Form?

Yes, airSlate SignNow employs robust security measures to protect sensitive information, including your Texas Sales Tax Return Short Form. Data encryption, secure cloud storage, and compliance with industry standards ensure that your documents are safe from unauthorized access. You can confidently manage your tax forms knowing your information is secure.

Get more for Texas Sales Tax Return Short Form

- We approved your form i 290b notice of appeal or motion

- Nyssma score sheet form

- Usda household member disclosure form

- Undertaking certificate 441617226 form

- Identity map template form

- Habitual traffic offender washington form

- Plantillas actas reunion directiva form

- Multi engine endorsement questionnaire form

Find out other Texas Sales Tax Return Short Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document