Exhibit 10 3 Credit Agreement SEC Gov Form

What is the Exhibit 10 3 Credit Agreement SEC gov

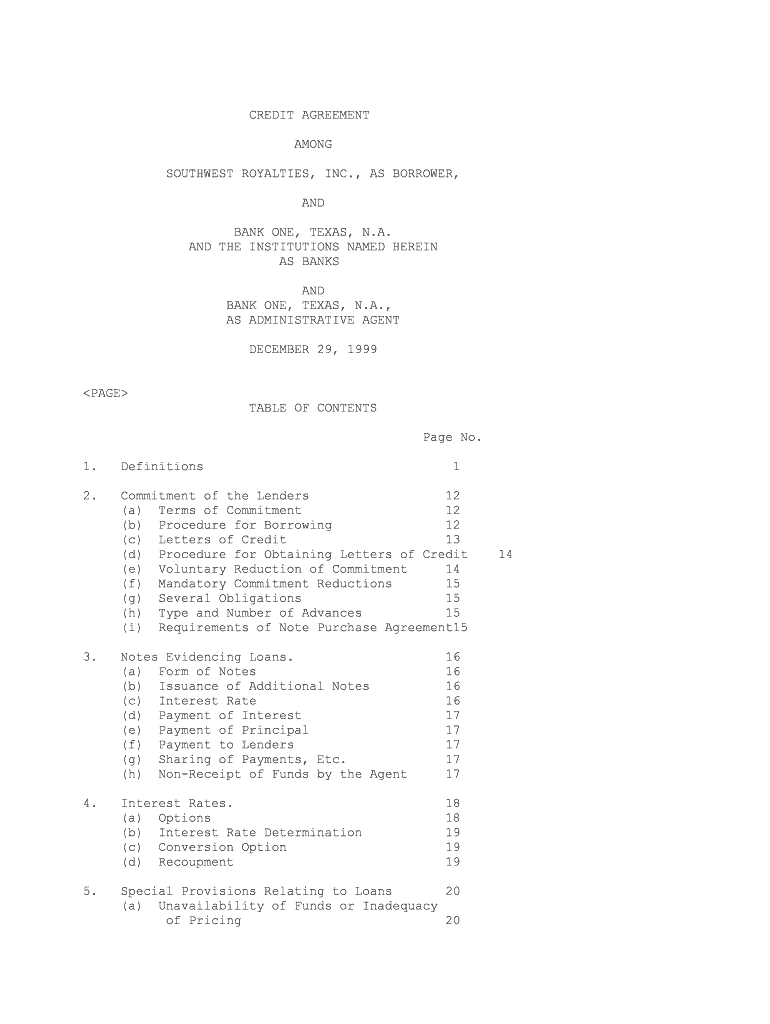

The Exhibit 10 3 Credit Agreement SEC gov is a formal document filed with the Securities and Exchange Commission (SEC) that outlines the terms and conditions of a credit agreement between a company and its creditors. This form is essential for public companies as it provides transparency regarding their financial obligations and credit arrangements. The document typically includes details such as loan amounts, interest rates, repayment schedules, and any covenants that the borrower must adhere to. Understanding this agreement is crucial for stakeholders, including investors and analysts, as it can impact a company's financial health and operational capabilities.

Key elements of the Exhibit 10 3 Credit Agreement SEC gov

The key elements of the Exhibit 10 3 Credit Agreement SEC gov include several critical components that define the relationship between the borrower and the lender. These elements typically encompass:

- Loan Amount: The total amount of credit extended to the borrower.

- Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment Terms: The schedule and method by which the borrower will repay the loan.

- Covenants: Specific conditions that the borrower must meet, which may include financial ratios or operational restrictions.

- Default Provisions: Circumstances under which the lender can declare the borrower in default and take action.

These elements are essential for both parties to understand their rights and obligations under the agreement.

Steps to complete the Exhibit 10 3 Credit Agreement SEC gov

Completing the Exhibit 10 3 Credit Agreement SEC gov involves several important steps to ensure accuracy and compliance with legal standards. The process typically includes:

- Gather Necessary Information: Collect all relevant financial data, including loan amounts, terms, and borrower details.

- Draft the Agreement: Create a draft that includes all key elements, ensuring clarity and precision in language.

- Review Legal Requirements: Ensure that the agreement complies with SEC regulations and any applicable state laws.

- Obtain Necessary Signatures: Have all parties sign the agreement, which may require electronic signatures for efficiency.

- File with the SEC: Submit the completed agreement to the SEC for public record and compliance verification.

Following these steps helps to create a legally binding document that protects the interests of both the borrower and the lender.

How to use the Exhibit 10 3 Credit Agreement SEC gov

The Exhibit 10 3 Credit Agreement SEC gov serves multiple purposes for companies and their stakeholders. To effectively use this document, consider the following:

- Investor Analysis: Investors can review the agreement to assess the financial commitments of the company and its ability to meet obligations.

- Credit Assessment: Lenders can evaluate the terms to determine the risk associated with extending credit to the borrower.

- Compliance Monitoring: Regulatory bodies can use the agreement to ensure that companies adhere to financial regulations and maintain transparency.

Using the Exhibit 10 3 Credit Agreement effectively involves understanding its implications for financial decision-making and corporate governance.

Legal use of the Exhibit 10 3 Credit Agreement SEC gov

The legal use of the Exhibit 10 3 Credit Agreement SEC gov is grounded in its role as a binding contract between parties. For the agreement to be legally enforceable, it must meet specific criteria, including:

- Clear Terms: All terms must be explicitly stated to avoid ambiguity.

- Mutual Consent: All parties involved must agree to the terms without coercion.

- Compliance with Laws: The agreement must adhere to federal and state laws governing credit agreements.

Ensuring these legal aspects are addressed helps protect the interests of all parties and facilitates smoother transactions.

How to obtain the Exhibit 10 3 Credit Agreement SEC gov

Obtaining the Exhibit 10 3 Credit Agreement SEC gov involves accessing publicly available documents filed with the SEC. To find this agreement, follow these steps:

- Visit the SEC's EDGAR Database: Use the SEC's Electronic Data Gathering, Analysis, and Retrieval system to search for filings.

- Search by Company Name: Enter the name of the company to locate its filings, including the Exhibit 10 3 Credit Agreement.

- Review the Filing: Click on the relevant document to view its contents, ensuring it is the correct agreement.

This process allows stakeholders to access vital financial information that can influence investment and lending decisions.

Quick guide on how to complete exhibit 103 credit agreement secgov

Complete Exhibit 10 3 Credit Agreement SEC gov seamlessly on any gadget

Digital document management has become increasingly popular among institutions and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Exhibit 10 3 Credit Agreement SEC gov on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Exhibit 10 3 Credit Agreement SEC gov with ease

- Locate Exhibit 10 3 Credit Agreement SEC gov and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your alterations.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Exhibit 10 3 Credit Agreement SEC gov and guarantee remarkable communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Exhibit 10 3 Credit Agreement and how does it relate to SEC regulations?

An Exhibit 10 3 Credit Agreement is a contract filed with the SEC that outlines the terms of credit between parties. Understanding this document is crucial for compliance with SEC regulations, and airSlate SignNow ensures you can eSign such agreements quickly and efficiently.

-

How does airSlate SignNow help with managing Exhibit 10 3 Credit Agreements?

airSlate SignNow allows businesses to easily create, send, and eSign Exhibit 10 3 Credit Agreements securely. Our platform simplifies the process, ensuring that all necessary documentation is compliant with SEC requirements while being accessible from anywhere.

-

What are the pricing options for using airSlate SignNow for Exhibit 10 3 Credit Agreements?

Our pricing for airSlate SignNow is designed to fit various business needs, and we offer flexible plans to accommodate different volumes of Exhibit 10 3 Credit Agreements. You can choose from monthly or annual subscriptions, ensuring that the cost-effectiveness and usability match your requirements.

-

Can I integrate airSlate SignNow with my existing systems for handling Exhibit 10 3 Credit Agreements?

Absolutely! airSlate SignNow integrates seamlessly with various tools that businesses already use, allowing you to manage Exhibit 10 3 Credit Agreements alongside your other workflows. This integration helps streamline document handling and improves operational efficiency.

-

What security measures does airSlate SignNow provide for eSigning Exhibit 10 3 Credit Agreements?

Security is a priority for us at airSlate SignNow, especially when dealing with sensitive documents like Exhibit 10 3 Credit Agreements. Our platform employs encryption, secure access controls, and audit trails to ensure that your documents are protected every step of the way.

-

Is there customer support available for questions about Exhibit 10 3 Credit Agreements?

Yes, airSlate SignNow offers comprehensive customer support for all your inquiries related to Exhibit 10 3 Credit Agreements. Whether you have questions about the eSigning process or need assistance with features, our support team is here to help you.

-

What features does airSlate SignNow offer for customizing Exhibit 10 3 Credit Agreements?

Our platform provides various features that allow you to customize Exhibit 10 3 Credit Agreements to meet your specific needs. You can easily add fields, templates, and branding to ensure that your documents are tailored to your brand while remaining compliant with SEC standards.

Get more for Exhibit 10 3 Credit Agreement SEC gov

Find out other Exhibit 10 3 Credit Agreement SEC gov

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF