Uniform Sales & Use Tax Certificate Revenue Alabama 2020-2026

What is the Uniform Sales & Use Tax Certificate Revenue Alabama

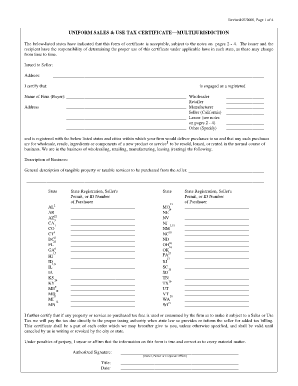

The Uniform Sales & Use Tax Certificate Revenue Alabama is a legal document that allows businesses to purchase goods without paying sales tax. This certificate is essential for retailers and wholesalers who buy products for resale. By using this certificate, businesses can avoid paying sales tax on items they intend to resell, thereby streamlining their purchasing process and improving cash flow.

How to use the Uniform Sales & Use Tax Certificate Revenue Alabama

To use the Alabama resale certificate, a buyer must present it to the seller at the time of purchase. This document should include the buyer's name, address, and sales tax identification number. The seller retains the certificate for their records to demonstrate that the sale was exempt from sales tax. It is important to ensure that the certificate is completed accurately to avoid any compliance issues.

Steps to complete the Uniform Sales & Use Tax Certificate Revenue Alabama

Completing the Alabama resale certificate involves several straightforward steps:

- Obtain the Alabama resale certificate form, which is available in PDF format.

- Fill in your business name, address, and sales tax identification number.

- Specify the type of property being purchased and the reason for the tax exemption.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the seller at the time of purchase.

Legal use of the Uniform Sales & Use Tax Certificate Revenue Alabama

The legal use of the Alabama resale certificate is governed by state regulations. It is crucial that the buyer only uses this certificate for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases, can lead to penalties and fines. Sellers should verify the validity of the certificate to ensure compliance with state tax laws.

Key elements of the Uniform Sales & Use Tax Certificate Revenue Alabama

Key elements that must be included in the Alabama resale certificate form are:

- Buyer’s name and address

- Sales tax identification number

- Description of the property being purchased

- Signature of the buyer

- Date of completion

Examples of using the Uniform Sales & Use Tax Certificate Revenue Alabama

Examples of when to use the Alabama resale certificate include:

- A retailer purchasing inventory from a wholesaler.

- A contractor buying materials for a project that will be billed to a client.

- A business acquiring equipment that will be resold to customers.

Required Documents

When filling out the Alabama resale certificate, the following documents may be required:

- Proof of business registration

- Sales tax identification number

- Any additional documentation that verifies the intent to resell the purchased items

Quick guide on how to complete uniform sales amp use tax certificate revenue alabama

Complete Uniform Sales & Use Tax Certificate Revenue Alabama seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to easily locate the right form and securely store it online. airSlate SignNow gives you all the features you need to create, modify, and electronically sign your documents rapidly without interruptions. Manage Uniform Sales & Use Tax Certificate Revenue Alabama on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Uniform Sales & Use Tax Certificate Revenue Alabama with ease

- Locate Uniform Sales & Use Tax Certificate Revenue Alabama and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Uniform Sales & Use Tax Certificate Revenue Alabama and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uniform sales amp use tax certificate revenue alabama

Create this form in 5 minutes!

How to create an eSignature for the uniform sales amp use tax certificate revenue alabama

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is an Alabama resale certificate PDF?

An Alabama resale certificate PDF is a legal document used by businesses in Alabama to purchase goods without paying sales tax. This certificate certifies that the buyer intends to resell the items purchased. Using the Alabama resale certificate PDF simplifies the sales tax process for both buyers and sellers.

-

How do I obtain an Alabama resale certificate PDF?

To obtain an Alabama resale certificate PDF, you need to fill out the official form provided by the Alabama Department of Revenue. Ensure that all required information is accurately entered to prevent delays. Once completed, you can print or save the Alabama resale certificate PDF for your records and use it for tax-exempt purchases.

-

Is there a cost associated with obtaining an Alabama resale certificate PDF?

There is no cost to obtain an Alabama resale certificate PDF from the Department of Revenue. However, businesses must ensure they meet the necessary qualifications to use the certificate correctly. Misuse of the Alabama resale certificate PDF may lead to penalties and tax liabilities.

-

Can I eSign my Alabama resale certificate PDF using airSlate SignNow?

Yes, you can easily eSign your Alabama resale certificate PDF using airSlate SignNow. Our platform allows you to upload the document and add electronic signatures, streamlining the process. This way, you can quickly send your signed Alabama resale certificate PDF to vendors or keep it for your records.

-

What features does airSlate SignNow offer for handling Alabama resale certificate PDFs?

airSlate SignNow offers various features to assist with Alabama resale certificate PDFs, including template creation and document sharing. With our user-friendly interface, you can easily customize your certificates and track their status. Additionally, we provide secure storage for all your documents, ensuring your sensitive information remains protected.

-

How does using airSlate SignNow benefit my business with Alabama resale certificate PDFs?

Using airSlate SignNow to manage your Alabama resale certificate PDFs can save your business time and reduce paperwork. Our solution streamlines the eSigning process, making it easier to handle multiple certificates. With enhanced accessibility and security, airSlate SignNow helps ensure compliance while minimizing the risk of errors.

-

Are there integrations available for managing Alabama resale certificate PDFs?

Yes, airSlate SignNow integrates with various applications to help you manage your Alabama resale certificate PDFs seamlessly. You can connect with popular tools like Google Drive, Dropbox, and CRM systems. These integrations simplify document management and enhance your workflow efficiency.

Get more for Uniform Sales & Use Tax Certificate Revenue Alabama

- Dexa bone density screening patient questionnaire form

- Cdc dash form

- Caloptima hospice notificationvalidation form caloptima hospice notificationvalidation form

- Ai 589 form

- Rapid ana ii report form remelcom

- Shalom square inc the columbia housing corporation columbiahousing form

- Installment private car sale contract template form

- Installment payment contract template form

Find out other Uniform Sales & Use Tax Certificate Revenue Alabama

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document