About Form 4506 T, Request for Transcript of Tax Return IRS

What is the About Form 4506 T, Request For Transcript Of Tax Return IRS

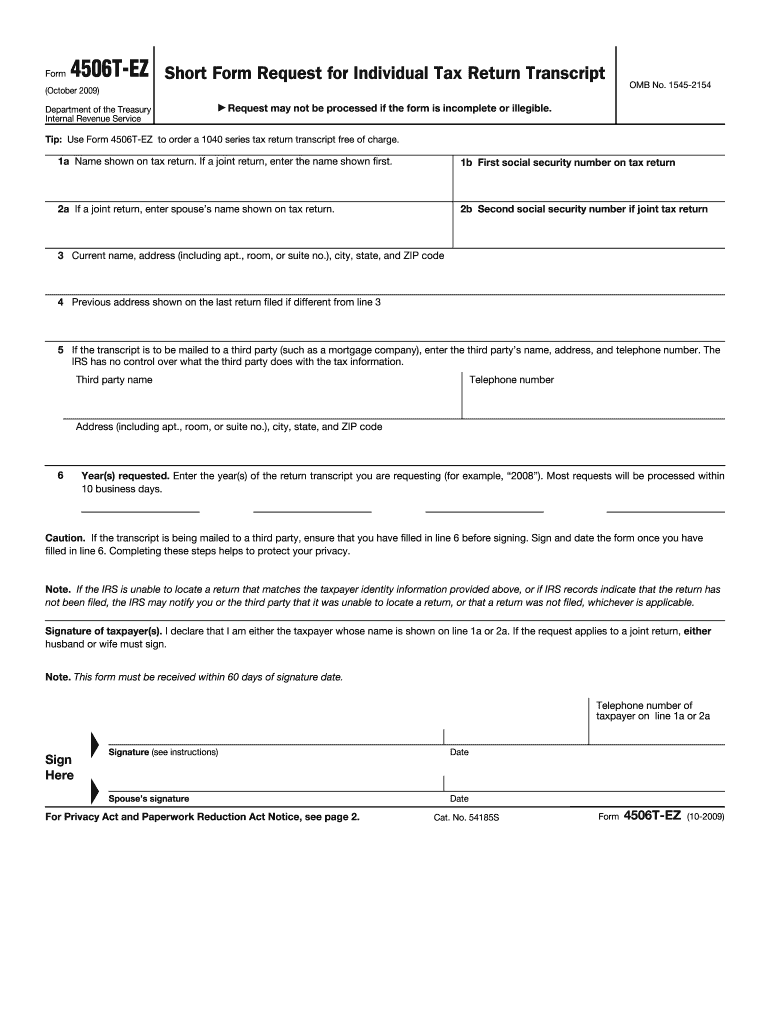

The About Form 4506 T, Request For Transcript Of Tax Return IRS, is a document used by taxpayers to request a transcript of their tax return from the Internal Revenue Service (IRS). This form allows individuals and businesses to obtain copies of their tax information for various purposes, including applying for loans, verifying income, and preparing tax returns. The transcript provides a summary of the taxpayer's return, including key financial data, which can be essential for financial institutions or other entities requiring proof of income.

Steps to complete the About Form 4506 T, Request For Transcript Of Tax Return IRS

Completing the About Form 4506 T involves several straightforward steps:

- Download the Form: Obtain the form from the IRS website or a trusted source.

- Fill in Personal Information: Provide your name, Social Security number, and address. If applicable, include your spouse's information.

- Select the Type of Transcript: Indicate whether you need a tax return transcript, account transcript, or other specific documents.

- Specify the Years: Clearly state the tax years for which you are requesting transcripts.

- Sign and Date the Form: Ensure you sign the form to validate your request.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

How to obtain the About Form 4506 T, Request For Transcript Of Tax Return IRS

To obtain the About Form 4506 T, you can visit the IRS website, where the form is available for download in PDF format. Alternatively, you can request a physical copy by calling the IRS directly. It is important to ensure you have the latest version of the form to avoid any processing delays. Once you have the form, follow the completion steps carefully to ensure your request is processed smoothly.

Legal use of the About Form 4506 T, Request For Transcript Of Tax Return IRS

The About Form 4506 T is legally recognized by the IRS as a valid request for tax information. When completed correctly, it serves as an official document that allows taxpayers to access their tax records. This form is particularly useful for individuals needing to provide proof of income for loans or financial aid. It is crucial to understand that the information obtained through this form must be used in compliance with applicable laws and regulations, particularly regarding privacy and data protection.

IRS Guidelines

The IRS has established guidelines for submitting the About Form 4506 T. These guidelines include ensuring that all information provided is accurate and up to date. The IRS recommends that taxpayers double-check their Social Security numbers and other identifying information to prevent delays. Additionally, the form should be submitted to the appropriate IRS address based on the taxpayer's location and the method of submission chosen. Following these guidelines helps ensure timely processing of the request.

Form Submission Methods (Online / Mail / In-Person)

The About Form 4506 T can be submitted through various methods:

- Online: Taxpayers can use the IRS online services to submit their request electronically.

- By Mail: Print the completed form and send it to the designated IRS address based on your state.

- In-Person: Some taxpayers may opt to deliver the form directly to their local IRS office, although this method may require an appointment.

Quick guide on how to complete about form 4506 t request for transcript of tax return irs

Effortlessly prepare About Form 4506 T, Request For Transcript Of Tax Return IRS on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the instruments required to create, modify, and electronically sign your documents swiftly without delays. Handle About Form 4506 T, Request For Transcript Of Tax Return IRS on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign About Form 4506 T, Request For Transcript Of Tax Return IRS without hassle

- Locate About Form 4506 T, Request For Transcript Of Tax Return IRS and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign About Form 4506 T, Request For Transcript Of Tax Return IRS and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 4506 T, and why do I need it?

Form 4506 T, Request For Transcript Of Tax Return IRS, is a document used to request a transcript of your tax return. It's essential for individuals or businesses that need to verify their income for loan applications, mortgage processes, or other financial matters. Understanding About Form 4506 T, Request For Transcript Of Tax Return IRS, helps ensure you have the documentation needed for accurate reporting and verification.

-

How much does it cost to use airSlate SignNow for eSigning Form 4506 T?

airSlate SignNow offers a range of pricing plans that are cost-effective, allowing users to easily eSign documents, including Form 4506 T, Request For Transcript Of Tax Return IRS. The pricing is competitive, and you can choose a plan that fits your business needs. With an easy-to-use interface, you can manage your documents efficiently at an affordable rate.

-

What are the key features of airSlate SignNow for handling Form 4506 T?

With airSlate SignNow, you can electronically sign Form 4506 T, Request For Transcript Of Tax Return IRS, securely and quickly. Key features include customizable templates, real-time tracking, and automated workflows. These tools enhance your efficiency in managing tax documents and streamline the signing process, making it simpler for all parties involved.

-

Is it safe to eSign Form 4506 T using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes your security and complies with industry-standard encryption protocols. eSigning Form 4506 T, Request For Transcript Of Tax Return IRS, ensures that your information is protected while allowing you to sign documents from anywhere. You can have peace of mind knowing that your data is handled securely.

-

Can I integrate airSlate SignNow with other software for processing Form 4506 T?

Yes, airSlate SignNow offers various integrations with popular software applications, enhancing your workflow when dealing with Form 4506 T, Request For Transcript Of Tax Return IRS. You can connect with CRM systems, cloud storage solutions, and other productivity tools to streamline your document management process. This flexibility allows you to create a customized setup that fits your business needs.

-

How long does it take to process Form 4506 T with the IRS?

The IRS typically takes around 5 to 10 business days to process Form 4506 T, Request For Transcript Of Tax Return IRS, after submission. However, processing times can vary depending on the volume of requests. Planning ahead and knowing the expected timeframe helps ensure you have the documentation you need when necessary.

-

What types of tax return transcripts can I request using Form 4506 T?

Using Form 4506 T, Request For Transcript Of Tax Return IRS, you can request various types of tax return transcripts, including tax return, account, and wage and income transcripts. Each type serves different purposes, such as verifying income for loans or audits. Ensure you select the appropriate type based on your specific needs.

Get more for About Form 4506 T, Request For Transcript Of Tax Return IRS

Find out other About Form 4506 T, Request For Transcript Of Tax Return IRS

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form