Tax Table Form 2013

What is the Tax Table Form

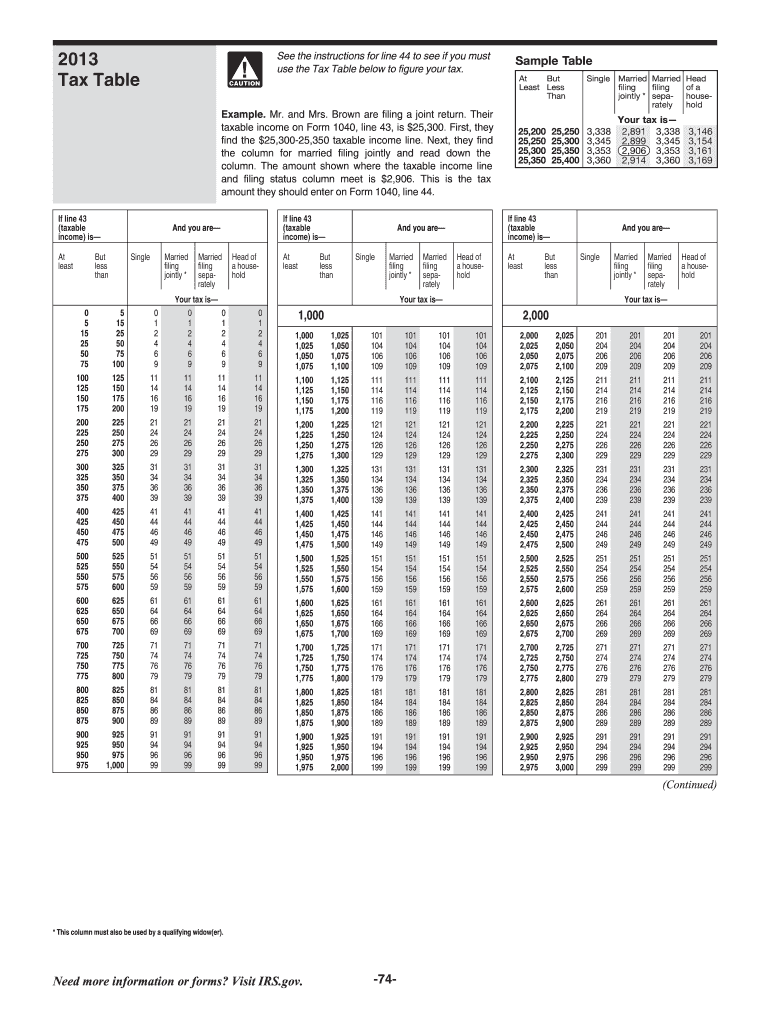

The Tax Table Form is a crucial document used by taxpayers in the United States to determine their tax liability based on their income level. This form provides a structured table that outlines the tax rates applicable to various income brackets, helping individuals and businesses accurately calculate their tax obligations. Understanding the Tax Table Form is essential for ensuring compliance with federal tax regulations and for effective financial planning.

How to use the Tax Table Form

Using the Tax Table Form involves a few straightforward steps. First, identify your taxable income for the year, which is your total income minus any deductions. Next, locate the appropriate tax table for your filing status, such as single, married filing jointly, or head of household. Once you find your income range in the table, you can determine the corresponding tax amount. This process simplifies tax calculations and helps ensure accuracy in reporting.

Steps to complete the Tax Table Form

Completing the Tax Table Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather your financial documents, including W-2s, 1099s, and any relevant deductions.

- Calculate your total taxable income by summing all sources of income and subtracting applicable deductions.

- Refer to the Tax Table Form and find your income range based on your filing status.

- Record the corresponding tax amount as indicated in the table.

- Ensure all calculations are accurate to avoid discrepancies in your tax return.

Legal use of the Tax Table Form

The Tax Table Form is legally recognized by the Internal Revenue Service (IRS) as an official document for tax reporting. To ensure its legal validity, taxpayers must complete the form accurately and submit it as part of their annual tax return. Compliance with IRS guidelines is essential, as errors or omissions can lead to penalties or audits. Using the form correctly helps maintain transparency and adherence to tax laws.

Filing Deadlines / Important Dates

Awareness of filing deadlines is vital for taxpayers using the Tax Table Form. Typically, the deadline for submitting individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any changes in filing dates announced by the IRS, especially in response to extraordinary circumstances, such as natural disasters or public health emergencies.

Examples of using the Tax Table Form

Examples of using the Tax Table Form can help clarify its practical application. For instance, a single taxpayer with a taxable income of $50,000 would locate the corresponding income bracket in the tax table for single filers. If the tax table indicates a tax liability of $7,500, this amount would be reported on their tax return. Similarly, a married couple filing jointly with a combined income of $100,000 would follow the same process, ensuring they reference the correct table for their filing status.

Who Issues the Form

The Tax Table Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS updates the tax tables annually to reflect changes in tax law, inflation adjustments, and other relevant factors. Taxpayers can access the most current version of the form through the IRS website or by requesting it directly from the agency.

Quick guide on how to complete 2013 tax table form

Easily prepare Tax Table Form on any device

Digital document management has gained traction among enterprises and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you need to generate, modify, and eSign your documents swiftly without delays. Manage Tax Table Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The simplest way to alter and eSign Tax Table Form effortlessly

- Find Tax Table Form and click Get Form to begin.

- Use the tools we provide to finish your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that task.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Table Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 tax table form

Create this form in 5 minutes!

How to create an eSignature for the 2013 tax table form

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a Tax Table Form?

A Tax Table Form is a vital document used to report income and calculate taxes owed. With airSlate SignNow, you can easily create, sign, and manage your Tax Table Form electronically, ensuring a smooth and efficient process for your tax reporting needs.

-

How can airSlate SignNow help me with my Tax Table Form?

airSlate SignNow provides a user-friendly platform to fill out and eSign your Tax Table Form securely. Our solution streamlines your document workflow, helping you to complete and submit your forms quickly, reducing the chance of errors.

-

Is there a cost associated with using airSlate SignNow for Tax Table Forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Our affordable rates ensure that you can access powerful features for managing your Tax Table Form without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing my Tax Table Form?

Absolutely! airSlate SignNow seamlessly integrates with various platforms such as Google Drive, Dropbox, and Salesforce. This capability enhances your document management process, making it easy to access and share your Tax Table Form across different applications.

-

What features are available for managing my Tax Table Form in airSlate SignNow?

With airSlate SignNow, you have access to features like customizable templates, secure eSigning, and real-time notifications. These features enable you to manage your Tax Table Form efficiently, ensuring that you can track progress and make necessary adjustments easily.

-

Is my information secure when using airSlate SignNow for my Tax Table Form?

Yes, airSlate SignNow prioritizes the security of your data. Our platform uses advanced encryption methods and complies with industry standards to protect your Tax Table Form and other sensitive documents.

-

Can airSlate SignNow help with the organization of multiple Tax Table Forms?

Definitely! airSlate SignNow includes tools for organizing and tracking multiple Tax Table Forms efficiently. This capability ensures you have streamlined access to your documents, helping you stay organized during tax season.

Get more for Tax Table Form

- 1099s 2012 form

- 2011 form 4972

- 1997 1040 ez form

- Irs form f656 2011

- Form 843 rev february 2008 claim for refund and request for abatement wings buffalo

- Ssa 2008 w3 forms

- Online copy of 2010 5500ez 2011 form

- Form w 7sp rev february 2007 application for irs individual taxpayer identification number spanish version

Find out other Tax Table Form

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document