Independent Contractor Work Form

What is the Independent Contractor Work

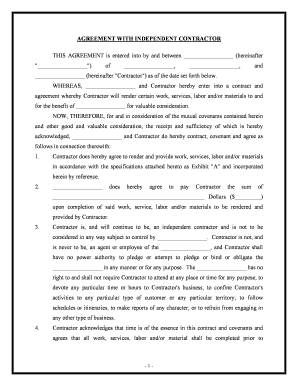

The independent contractor work form is a critical document that outlines the terms and conditions of the working relationship between a business and an independent contractor. This form typically includes details such as the scope of work, payment terms, and deadlines. It serves as a legal agreement that clarifies the expectations of both parties and helps prevent misunderstandings. Understanding this form is essential for both businesses hiring contractors and individuals seeking independent contractor employment.

Steps to complete the Independent Contractor Work

Completing the independent contractor work form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details, the nature of the work, and payment terms. Next, fill out the form carefully, ensuring that all sections are completed. It is important to review the document for any errors or omissions before submission. Finally, sign the form electronically using a secure eSignature solution to ensure its legality and authenticity.

Legal use of the Independent Contractor Work

To ensure the independent contractor work form is legally binding, it must comply with applicable laws and regulations. In the United States, the form should adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and ensure that eDocuments hold the same legal weight as their paper counterparts. Using a reliable eSignature platform can help maintain compliance and provide a secure method for signing.

Key elements of the Independent Contractor Work

Several key elements must be included in the independent contractor work form to make it effective. These elements typically consist of:

- Scope of Work: A detailed description of the tasks to be performed.

- Payment Terms: Information on compensation, including rates and payment schedules.

- Duration: The timeline for the project or the period of engagement.

- Confidentiality Clauses: Provisions to protect sensitive information.

- Termination Conditions: Guidelines on how either party can end the agreement.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding independent contractor employment, particularly concerning tax obligations. Independent contractors are responsible for reporting their income and paying self-employment taxes. It is essential to understand the IRS classification of independent contractors versus employees, as this affects tax filings and eligibility for certain benefits. Familiarizing oneself with IRS guidelines can help avoid potential penalties and ensure compliance.

Eligibility Criteria

To qualify as an independent contractor, individuals must meet specific eligibility criteria. Generally, they should have control over how and when they perform their work, provide their own tools and resources, and work for multiple clients. Additionally, independent contractors are typically responsible for their own taxes and do not receive employee benefits. Understanding these criteria is crucial for both contractors and businesses to ensure proper classification and compliance with labor laws.

Quick guide on how to complete independent contractor work

Effortlessly Create Independent Contractor Work on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed paperwork, enabling you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents swiftly without any holdups. Manage Independent Contractor Work on any platform with airSlate SignNow's Android or iOS applications and ease any document-related tasks today.

The most efficient method to edit and electronically sign Independent Contractor Work effortlessly

- Obtain Independent Contractor Work and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools available from airSlate SignNow specifically designed for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or errors requiring you to print new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Independent Contractor Work and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is independent contractor employment?

Independent contractor employment refers to a contractual relationship where individuals provide services to a business without being classified as employees. This type of employment offers flexibility for both contractors and employers, allowing for project-based work that matches individual skills with business needs.

-

How can airSlate SignNow streamline independent contractor employment processes?

airSlate SignNow simplifies the workflow for independent contractor employment by enabling businesses to send, sign, and manage documents electronically. This tool reduces the time spent on paperwork, ensuring that agreements are processed efficiently and securely.

-

What features does airSlate SignNow offer for managing contracts with independent contractors?

airSlate SignNow includes features like customizable templates, document tracking, and integrated storage solutions that are essential for managing contracts related to independent contractor employment. These features help keep all parties informed and improve compliance with contractual obligations.

-

Is airSlate SignNow cost-effective for managing independent contractor employment?

Yes, airSlate SignNow provides a cost-effective solution for managing independent contractor employment. With flexible pricing plans designed for businesses of all sizes, companies can choose the plan that best fits their needs without incurring unnecessary costs.

-

Can I integrate airSlate SignNow with other tools I use for independent contractor employment?

Absolutely! airSlate SignNow integrates seamlessly with various platforms and tools commonly used for independent contractor employment, such as project management software and accounting systems. This integration helps streamline workflows and ensures that all relevant information is easily accessible.

-

What benefits does electronic signature provide for independent contractor employment?

Using electronic signatures through airSlate SignNow offers signNow benefits for independent contractor employment, including faster signing processes and enhanced security. This technology ensures that documents are securely signed and stored, reducing the risk of fraud and simplifying record-keeping.

-

How does airSlate SignNow help with compliance in independent contractor employment?

airSlate SignNow assists in maintaining compliance for independent contractor employment by providing legally binding electronic signatures and audit trails. This guarantees that all signed documents are verifiable and compliant with industry regulations, which is vital for business operations.

Get more for Independent Contractor Work

- Simplified accounting forms superior court of california

- Gc 400e2 gc 405e2 non cash assets on hand at form

- Gc 400f gc 405f schedule f changes in form of

- Gc 400g gc 405g schedule g liabilities at end of form

- Net income from trade or businessstandard account form

- Net loss from trade or businessstandard account form

- Other chargesstandard and simplified accounts form

- Other credits not shown on another schedule describe form

Find out other Independent Contractor Work

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document