Testamentary Trust Form

What is the testamentary trust?

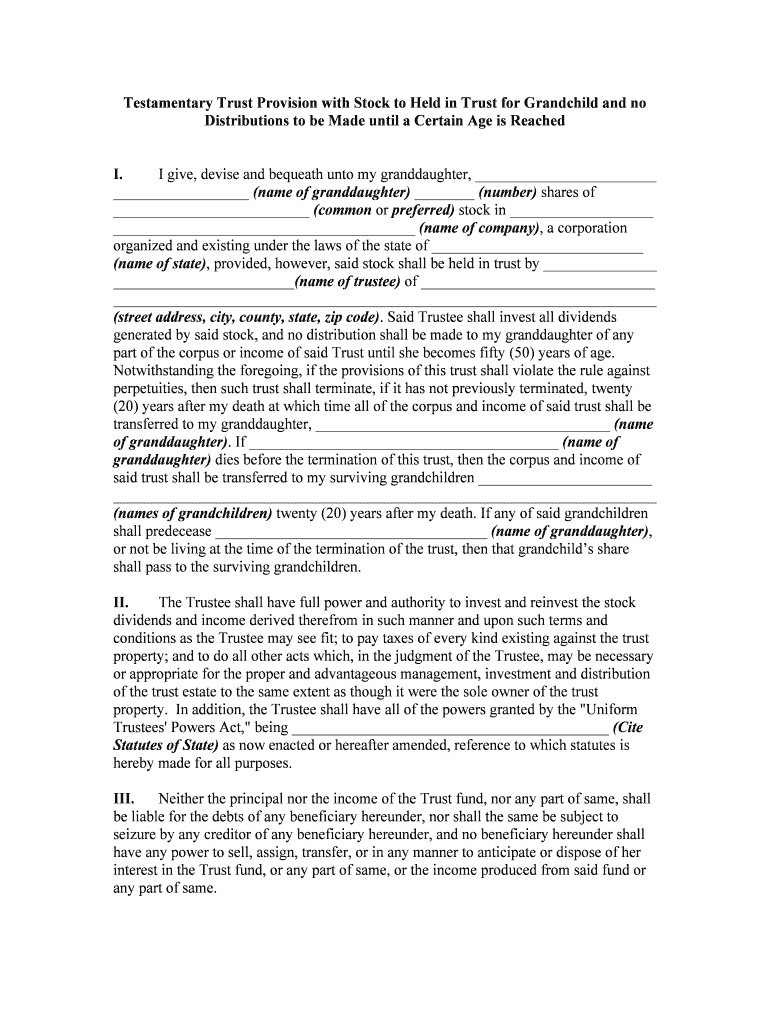

A testamentary trust is a legal arrangement created through a will that comes into effect upon the death of the individual who established it, known as the testator. This type of trust is designed to manage and distribute the deceased's assets according to specific instructions outlined in the will. Testamentary trusts can provide financial support to beneficiaries, such as children or grandchildren, and can also help manage the assets until beneficiaries reach a certain age or meet other conditions. This arrangement ensures that the testator's wishes are honored and can help protect the assets from mismanagement or creditors.

Key elements of the testamentary trust

Several critical components define a testamentary trust. These include:

- Trustee: The individual or institution responsible for managing the trust and ensuring that the assets are distributed according to the testator's wishes.

- Beneficiaries: The individuals or entities that will receive benefits from the trust, typically named in the will.

- Trust terms: Specific instructions regarding how and when the assets should be distributed to the beneficiaries, which may include conditions such as age restrictions or milestones.

- Assets: The property or funds placed into the trust, which can include real estate, investments, or cash.

Steps to complete the testamentary trust

Completing a testamentary trust involves several important steps:

- Draft the will: Work with an attorney to create a will that includes the testamentary trust provisions.

- Name the trustee: Select a trustworthy individual or institution to serve as the trustee.

- Identify beneficiaries: Clearly outline who will benefit from the trust and under what conditions.

- Detail trust terms: Specify how the assets should be managed and distributed, including any age or condition requirements.

- Sign and witness the will: Ensure that the will is signed in accordance with state laws, typically requiring witnesses.

- Store the will safely: Keep the will in a secure location and inform the trustee of its whereabouts.

Legal use of the testamentary trust

The legal use of a testamentary trust is governed by state laws, which can vary significantly. Generally, a testamentary trust must be established through a valid will, and its provisions must comply with state probate laws. The trust becomes effective only after the testator's death and must be administered according to the terms laid out in the will. It is essential to consult with a legal professional to ensure compliance with all applicable laws and to address any specific requirements that may arise in different jurisdictions.

Examples of using the testamentary trust

Testamentary trusts can serve various purposes, including:

- Providing for minor children: A testamentary trust can ensure that assets are managed for the benefit of minor children until they reach adulthood.

- Supporting a spouse: A trust can provide financial support to a surviving spouse while protecting the assets for future generations.

- Charitable giving: A testamentary trust can be established to support charitable organizations after the testator's death.

Required documents

To establish a testamentary trust, several documents are typically required:

- Last will and testament: The primary document outlining the creation of the testamentary trust.

- Trustee acceptance: A document confirming the trustee's willingness to serve in that capacity.

- Asset documentation: Records of the assets intended for the trust, such as property deeds or bank statements.

Quick guide on how to complete testamentary trust

Effortlessly Prepare Testamentary Trust on Any Device

The management of online documents has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Testamentary Trust on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric activity today.

How to Edit and eSign Testamentary Trust with Ease

- Obtain Testamentary Trust and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choosing. Edit and eSign Testamentary Trust to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a testamentary trust sample?

A testamentary trust sample is a legal document that outlines how assets should be managed and distributed after someone's death. It is established through a will and can provide guidance on important matters such as asset management for minors or beneficiaries with special needs.

-

How can I create a testamentary trust sample using airSlate SignNow?

Creating a testamentary trust sample with airSlate SignNow is simple. You can customize our templates to include specific terms and conditions that meet your unique needs, ensuring your testamentary trust sample reflects your intentions accurately and legally.

-

What features does airSlate SignNow offer for creating testamentary trust samples?

airSlate SignNow offers several features that facilitate the creation of testamentary trust samples, including document templates, seamless eSigning, and secure cloud storage. This allows users to develop and execute their trust documents efficiently while ensuring data security.

-

Is there a cost associated with using airSlate SignNow for testamentary trust samples?

Yes, airSlate SignNow provides various pricing plans to accommodate different user needs, including those needing testamentary trust samples. Our cost-effective solutions come with a range of features, making it easier for you to draft and manage important legal documents.

-

What are the benefits of using airSlate SignNow for testamentary trust samples?

Using airSlate SignNow for your testamentary trust samples helps ensure clarity and efficiency in the process. You can save time, minimize errors, and maintain the legality of your documents with our reliable platform, making it a smart choice for estate planning.

-

Can I integrate airSlate SignNow with other applications for managing testamentary trust samples?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when creating and managing testamentary trust samples. This connectivity enhances collaboration and ensures all related documents are easily accessible and organized.

-

How secure is airSlate SignNow when handling testamentary trust samples?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and complies with industry standards, ensuring that your testamentary trust samples and other sensitive documents are protected against unauthorized access and data bsignNowes.

Get more for Testamentary Trust

Find out other Testamentary Trust

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement