Business Sole Proprietor Form

What is the Business Sole Proprietor

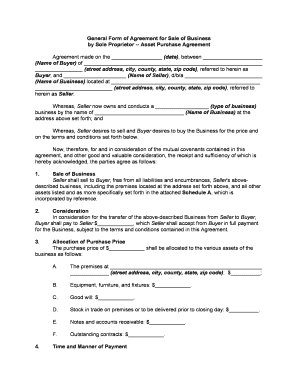

A business sole proprietor is an individual who owns and operates a business independently. This structure is the simplest form of business organization, where the owner is personally responsible for all aspects of the business, including debts and liabilities. It is important to understand that as a sole proprietor, there is no legal distinction between the owner and the business entity. This means that any profits or losses from the business are reported on the owner's personal tax return, making tax filing straightforward.

Key Elements of the Business Sole Proprietor

Several key elements define a business sole proprietor. These include:

- Ownership: The business is owned by a single individual who has complete control over decision-making.

- Liability: The owner assumes full responsibility for all business debts and obligations.

- Taxation: Income generated by the business is reported on the owner's personal tax return, simplifying tax processes.

- Regulatory Requirements: Minimal formalities are required to establish a sole proprietorship, often only a business license or permit.

Steps to Complete the Business Sole Proprietor

Completing the process to establish a business sole proprietor involves several steps:

- Choose a Business Name: Select a name that reflects your business and check its availability.

- Register Your Business: Depending on your state, you may need to register your business name or obtain a DBA (Doing Business As).

- Obtain Necessary Licenses and Permits: Research and apply for any local, state, or federal licenses required for your business type.

- Open a Business Bank Account: Keeping personal and business finances separate is crucial for accounting and tax purposes.

Legal Use of the Business Sole Proprietor

Understanding the legal implications of operating as a business sole proprietor is essential. The owner must comply with local, state, and federal regulations. This includes obtaining the necessary licenses and permits to operate legally. Additionally, the owner should be aware of their personal liability, as any legal actions against the business can affect personal assets. It is advisable to consult with a legal professional to ensure compliance with all applicable laws.

IRS Guidelines

The IRS provides specific guidelines for sole proprietors regarding tax obligations. Sole proprietors must report their business income and expenses on Schedule C of Form 1040. This form allows the owner to detail profits and losses, which are then included in their personal income tax return. It is important to maintain accurate records of all business transactions to support the information reported to the IRS.

Required Documents

To operate as a business sole proprietor, certain documents may be necessary. These typically include:

- Business License: Required by local or state authorities to legally operate.

- Tax Identification Number (TIN): Needed for tax reporting purposes, although sole proprietors can use their Social Security number.

- DBA Registration: If operating under a business name different from the owner's legal name.

Quick guide on how to complete business sole proprietor

Effortlessly Prepare Business Sole Proprietor on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Handle Business Sole Proprietor on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Business Sole Proprietor with Ease

- Locate Business Sole Proprietor and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or erase sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign Business Sole Proprietor and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a general agreement form contract?

A general agreement form contract is a legal document that outlines the terms and conditions of an agreement between parties. This contract ensures that both parties understand their obligations, rights, and the scope of the agreement. Using a general agreement form contract simplifies negotiations and helps in avoiding misunderstandings.

-

How can airSlate SignNow help with general agreement form contracts?

airSlate SignNow provides an easy-to-use platform for creating, editing, and eSigning general agreement form contracts. The solution allows you to streamline your document workflows, reducing the time spent on contract management. Additionally, its user-friendly interface ensures that even those unfamiliar with digital tools can create contracts efficiently.

-

What features does airSlate SignNow offer for managing general agreement form contracts?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSigning options for general agreement form contracts. Users can also automate reminders and notifications, ensuring that all parties stay updated throughout the contract process. This enhances efficiency and reduces the potential for delays.

-

Is airSlate SignNow cost-effective for creating general agreement form contracts?

Yes, airSlate SignNow offers a cost-effective solution for creating and managing general agreement form contracts. With competitive pricing plans tailored to fit various business sizes, it provides excellent value for features and functionalities. This makes it an ideal choice for businesses looking to manage their agreements without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing general agreement form contracts?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to manage your general agreement form contracts alongside other tools. Popular integrations include CRM systems, cloud storage services, and productivity tools, making it easier to streamline your workflows.

-

What are the benefits of using airSlate SignNow for general agreement form contracts?

Using airSlate SignNow for your general agreement form contracts provides numerous benefits, such as enhanced collaboration and improved efficiency. The platform simplifies the signing process, ensures compliance, and allows for easy document management. Additionally, you can track changes and access contracts anytime, anywhere.

-

How secure are the general agreement form contracts created with airSlate SignNow?

Security is a top priority at airSlate SignNow, ensuring that all general agreement form contracts are protected with robust encryption. The platform adheres to industry standards for data protection, giving users peace of mind when signing and sharing sensitive documents. This commitment to security helps maintain your contract's integrity.

Get more for Business Sole Proprietor

Find out other Business Sole Proprietor

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage