Debt Form PDF

What is the Debt Form PDF

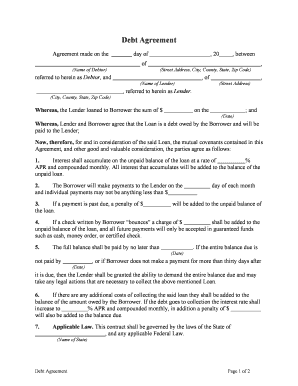

The debt form PDF is a standardized document used to outline the terms of a debt agreement between parties. This form serves as a written record of the obligations and rights of both the debtor and the creditor. It typically includes details such as the amount owed, repayment terms, interest rates, and any collateral involved. By formalizing the agreement in a PDF format, it ensures that all parties have a clear understanding of their responsibilities and provides a reference point in case of disputes.

Key Elements of the Debt Form PDF

When creating or reviewing a debt agreement form, several key elements should be included to ensure its effectiveness and legality:

- Parties Involved: Clearly identify the debtor and creditor, including their full names and contact information.

- Debt Amount: Specify the total amount of debt being acknowledged.

- Payment Terms: Outline the repayment schedule, including due dates and acceptable payment methods.

- Interest Rate: Include any applicable interest rates and how they will be calculated.

- Default Conditions: Define what constitutes a default and the consequences that follow.

- Signatures: Ensure that both parties sign the document to validate the agreement.

Steps to Complete the Debt Form PDF

Completing a debt agreement form involves several straightforward steps:

- Download the Form: Obtain a blank debt agreement form PDF from a reliable source.

- Fill in the Details: Enter the required information, including names, amounts, and terms.

- Review the Agreement: Both parties should carefully read the document to ensure all terms are accurate and understood.

- Sign the Document: Each party should sign the form, either digitally or in print, to signify their agreement.

- Distribute Copies: Provide each party with a signed copy for their records.

Legal Use of the Debt Form PDF

The debt form PDF can be legally binding if it meets specific criteria. To ensure its validity, the document must be signed by both parties and include all essential elements. Additionally, compliance with relevant laws, such as the Uniform Commercial Code (UCC), is crucial. This ensures that the agreement is enforceable in a court of law, protecting the rights of both the debtor and the creditor.

How to Obtain the Debt Form PDF

Obtaining a debt agreement form PDF can be done through various channels:

- Online Resources: Many legal websites and document preparation services offer downloadable templates for debt agreements.

- Legal Professionals: Consulting with an attorney can provide access to customized forms tailored to specific needs.

- Financial Institutions: Banks and credit unions may provide standard forms for their clients.

Digital vs. Paper Version

Choosing between a digital and paper version of the debt agreement form has its advantages. A digital version allows for easy editing, sharing, and storage, while a paper version may be preferred for traditional transactions or when physical signatures are required. Both formats can be legally binding if executed properly, but the digital version often offers enhanced security features, such as encryption and audit trails, which can further protect the agreement.

Quick guide on how to complete debt form pdf

Effortlessly Prepare Debt Form Pdf on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any holdups. Manage Debt Form Pdf on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest method to modify and eSign Debt Form Pdf seamlessly

- Locate Debt Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Debt Form Pdf and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a debt agreement form example?

A debt agreement form example is a template that helps you outline the terms and conditions of a debt repayment arrangement. This form can include details such as the payment amount, due dates, and any additional fees. Utilizing a debt agreement form example ensures clarity and mutual understanding between both parties involved.

-

How can I create a debt agreement form example using airSlate SignNow?

Creating a debt agreement form example with airSlate SignNow is simple and user-friendly. You can start by selecting a customizable template or uploading your own document. Then, fill in the necessary details, and our platform will guide you through the eSigning process with ease.

-

Is there a cost associated with using a debt agreement form example with airSlate SignNow?

Yes, while using a debt agreement form example on airSlate SignNow is cost-effective, there may be subscription fees depending on your chosen plan. Our pricing is transparent, and various tiers are available to meet different needs. Investigate the options to find the best fit for your business.

-

What features does airSlate SignNow offer for debt agreement forms?

airSlate SignNow offers several features for creating and managing debt agreement forms, including customizable templates, unlimited eSigning, and secure cloud storage. Additionally, you can add fields for signatures, initials, and other important information, ensuring your agreement is comprehensive and tailored to your needs.

-

Can I integrate airSlate SignNow with other applications for my debt agreement form example?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to streamline your workflows. Whether you need to connect with CRM systems, cloud storage services, or project management tools, you can easily do so when using a debt agreement form example on our platform.

-

How can utilizing a debt agreement form example improve my document management process?

Using a debt agreement form example can greatly enhance your document management process by ensuring that all agreements are standardized and easily accessible. airSlate SignNow provides an efficient solution to track changes, monitor signatures, and store documents securely, reducing the risk of errors.

-

What are the benefits of signing a debt agreement form example electronically?

The benefits of signing a debt agreement form example electronically include faster turnaround times, improved convenience, and reduced paper usage. With airSlate SignNow, you can sign documents from anywhere, ensuring quicker negotiations and transactions, ultimately enhancing productivity.

Get more for Debt Form Pdf

- Sc poa form

- Sc file form

- South carolina subcontractors form

- South dakota south dakota relative caretaker legal documents package form

- South dakota residential landlord tenant rental lease forms and agreements package

- South dakota premarital agreements package form

- Tennessee no fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without form

- Tn legal documents form

Find out other Debt Form Pdf

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe