Gift Property Form

What is the gift property?

The term "gift property" refers to real estate or personal property that is transferred from one individual to another without any exchange of money or consideration. This transfer can occur for various reasons, including familial support, charitable donations, or simply as a gesture of goodwill. In the United States, the legal framework governing such transfers often requires specific documentation to ensure that the transaction is recognized as valid and binding. Understanding the implications of gifting property is crucial for both the giver and the recipient, as it can affect tax liabilities and ownership rights.

Steps to complete the gift property

Completing a gift property transfer involves several important steps to ensure that the process is legally sound and recognized by relevant authorities. Here are the key steps:

- Determine the value of the property being gifted, as this will be necessary for tax purposes.

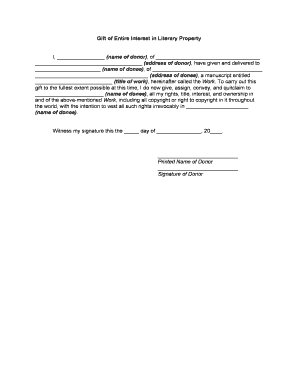

- Draft a gift property document, which outlines the details of the transfer, including the names of both parties, the description of the property, and any conditions attached to the gift.

- Have the document signed by both the giver and the recipient. Depending on state laws, notarization may also be required.

- File any necessary forms with local or state authorities, which may include a deed of gift with reservation of life estate if applicable.

- Consider consulting with a tax professional to understand any potential tax implications, including gift tax thresholds.

Legal use of the gift property

The legal use of gift property involves ensuring that the transfer complies with state and federal laws. In the U.S., certain regulations govern how property can be gifted, including tax considerations and the requirement for proper documentation. For instance, the IRS allows individuals to gift up to a specified amount each year without incurring gift taxes. However, exceeding this limit may necessitate the filing of a gift tax return. Additionally, it is important to ensure that the gift property is free from liens or other encumbrances that could complicate ownership.

Required documents

When completing a gift property transfer, several documents are typically required to validate the transaction. These may include:

- A gift property document that outlines the terms of the transfer.

- A property deed, which may need to be updated to reflect the new ownership.

- Any relevant tax forms, such as IRS Form 709, if the value of the gift exceeds the annual exclusion limit.

- Proof of identity for both the giver and the recipient, which may include government-issued identification.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding the gifting of property. Under current federal law, individuals can gift up to a certain amount each year without incurring gift taxes. This amount is adjusted periodically, so it is essential to check the current threshold. Additionally, gifts that exceed this limit may require the filing of Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Understanding these guidelines helps both givers and recipients navigate the tax implications of their transactions.

Examples of using the gift property

Gift property can be utilized in various scenarios, each with its unique considerations. Common examples include:

- A parent gifting a home to their child to assist with housing costs.

- Grandparents transferring ownership of a vacation property to their grandchildren.

- A charitable organization receiving property donations to support its mission.

Each example highlights the importance of proper documentation and understanding the legal and tax implications involved in the transfer of property.

Quick guide on how to complete gift property

Execute Gift Property effortlessly on any device

Online document management has become increasingly popular among enterprises and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Handle Gift Property on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Gift Property with ease

- Locate Gift Property and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Gift Property and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a gift property sample and how is it used?

A gift property sample is a template or example document that outlines the terms and conditions of transferring property as a gift. It serves as a legal framework to ensure that the gift is documented appropriately, protecting both the giver and the recipient in the process.

-

How can airSlate SignNow help me manage gift property samples?

airSlate SignNow provides an intuitive platform to create, edit, and sign gift property samples electronically. With features such as secure sharing and customizable templates, you can streamline the process of gifting property, making it simple and efficient for all parties involved.

-

Is there a cost associated with using gift property samples on airSlate SignNow?

While creating and managing gift property samples through airSlate SignNow may come with a subscription fee, the platform offers flexible pricing plans to fit any budget. Investing in this cost-effective solution can ultimately save you time and resources when handling property transfers.

-

Can multiple users collaborate on a gift property sample using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a gift property sample in real time. This feature ensures that all parties can review, edit, and sign the document, enhancing communication and reducing the possibility of misunderstandings during the gifting process.

-

What are the benefits of using airSlate SignNow for gift property samples?

Using airSlate SignNow for gift property samples offers several benefits, including easy document management and remote signing capabilities. Additionally, the platform's extensive security measures protect sensitive information, giving you peace of mind during property transactions.

-

Can I integrate airSlate SignNow with other applications for gift property samples?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, allowing you to easily manage your gift property samples alongside other business tools. This capability enhances productivity and keeps your workflow organized.

-

How do I create a gift property sample using airSlate SignNow?

Creating a gift property sample in airSlate SignNow is straightforward. Simply select a template or start from scratch, fill in the necessary details, and customize it to fit your needs. Once finalized, you can effortlessly send it out for signatures.

Get more for Gift Property

- Hawaii estate 497304583 form

- Hawaii eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497304585 form

- Hawaii annual file form

- Sample notices resolutions stock ledger and certificate hawaii form

- Minutes for organizational meeting hawaii hawaii form

- Hawaii sample letter form

- Js 44 civil cover sheet federal district court hawaii form

Find out other Gift Property

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney