Oref Forms Oregon

What is the Oref Forms Oregon

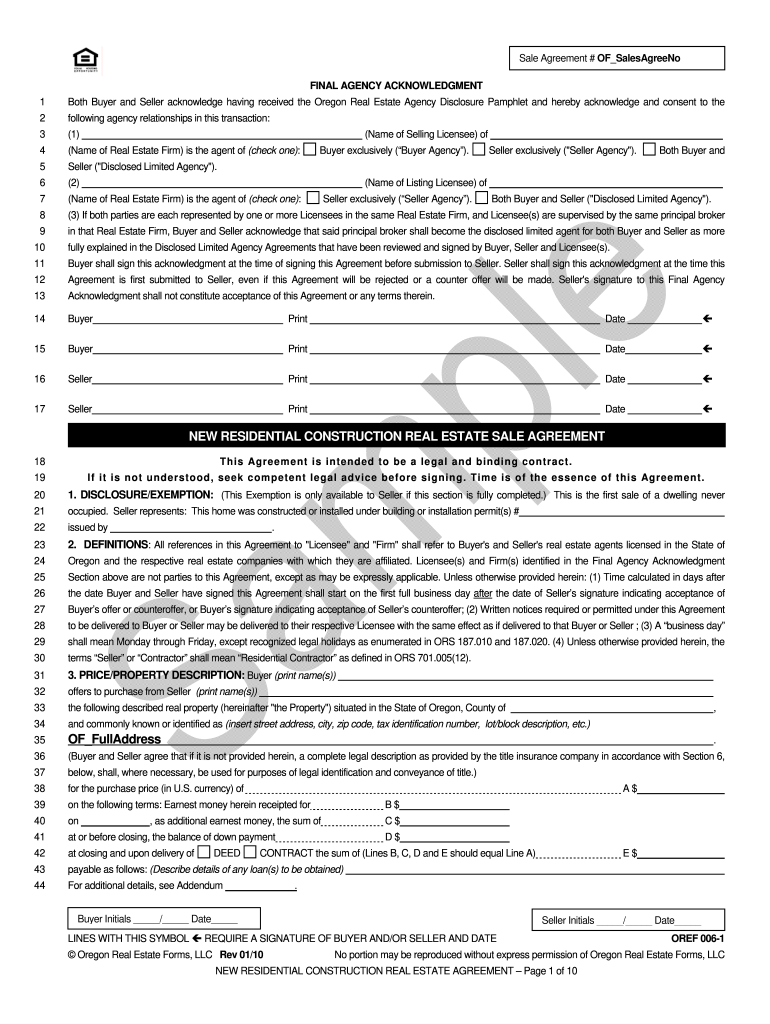

The Oref forms, or Oregon Real Estate Forms, are standardized documents used in real estate transactions within the state of Oregon. These forms are essential for various processes, including buying, selling, and leasing properties. They ensure that all parties involved have a clear understanding of their rights and obligations. The forms cover a range of transactions and include agreements such as purchase and sale agreements, lease agreements, and disclosures. Utilizing these forms helps to facilitate smooth real estate transactions while adhering to state regulations.

How to use the Oref Forms Oregon

Using the Oref forms effectively involves several steps. First, identify the specific form required for your transaction, such as the buyer acknowledgment form or the final agency acknowledgment. Next, carefully fill out the form with accurate information, ensuring that all required fields are completed. It is important to review the form for any errors or omissions before submission. Once completed, the form should be signed by all parties involved, either electronically or in print, to ensure its validity. Lastly, retain a copy for your records, as well as provide copies to all parties involved in the transaction.

Steps to complete the Oref Forms Oregon

Completing the Oref forms involves a straightforward process:

- Determine the specific form needed for your transaction.

- Gather all necessary information, including property details and party information.

- Fill out the form accurately, ensuring all required sections are completed.

- Review the form for accuracy and completeness.

- Obtain signatures from all parties involved.

- Submit the form as required, either electronically or in person.

Legal use of the Oref Forms Oregon

The legal use of Oref forms is governed by Oregon state laws and regulations. To be considered valid, these forms must be completed accurately and signed by all relevant parties. Electronic signatures are legally recognized in Oregon, provided that they comply with the state's eSignature laws. It is crucial to ensure that the forms are used in accordance with local regulations to avoid potential disputes or legal issues. Consulting with a real estate professional or attorney can provide additional guidance on the legal aspects of using Oref forms.

Key elements of the Oref Forms Oregon

Key elements of the Oref forms include:

- Identification of parties: Clearly state the names and contact information of all parties involved.

- Property description: Provide a detailed description of the property, including address and legal description.

- Terms of the agreement: Outline the specific terms, conditions, and obligations of each party.

- Signatures: Ensure that all parties sign the document to validate the agreement.

- Dates: Include dates of signing and any relevant deadlines for actions required by the parties.

Examples of using the Oref Forms Oregon

Examples of using the Oref forms include:

- When a buyer and seller enter into a purchase agreement for a residential property.

- When landlords and tenants complete a lease agreement for rental properties.

- When real estate agents provide disclosures regarding property conditions to potential buyers.

- When parties acknowledge their agency relationship in a final agency acknowledgment form.

Quick guide on how to complete final agency acknowledgment oregon real estate forms llc

Effortlessly prepare Oref Forms Oregon on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Oref Forms Oregon on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Oref Forms Oregon with ease

- Obtain Oref Forms Oregon and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature through the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Oref Forms Oregon and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Real Estate: How do I best structure a rental property if the bank refuses to title it to an LLC but I still want to operate it out of an LLC?

The bank doesn’t have anything to do with the title to the property.The bank makes loans.What you seem to be saying is that you are buying the property with a partner and you want the bank to loan money to an LLC.Why would the bank do that?The bank needs a first lien on the property to secure the loan. Only the owner of the property can give the bank a first lien. That is you and your partner.If you are saying that you want to create a Limited Liability Company (LLC) with you and your partner as the sole owners, and then have the LLC purchase the property, and you want the bank to loan the money to the LLC to purchase the property, then the answer is simple.The bank is the one who makes the decision about loaning money.If the bank is not comfortable loaning money to a company that, by its very nature and name, has no liability for paying it back, beyond foreclosure on the property, then the bank will not loan the money.The bank would prefer that you and your partner borrow the money.That way, if you do not pay it back, the bank will foreclose on the property and sell it at auction and apply the net proceeds to satisfy your loan.And then, the bank will sue you for the remaining balance and get a deficiency judgment against you for the unpaid part of the loan.And that’s why banks will not loan to an LLC, but will loan to the owner of the LLC.Plus, and I don’t want to scare you with this, if you try to pull some stunt to get around this, you are operating in the area that is called “fraud” and you really don’t want to go there.Accept the decision of the bank, and look for a commercial loan, or to private “hard money lenders” to provide the funds.I hope this helps.Good Luck.Michael Lantrip, Author “How To Do A Section 1031 Like Kind Exchange.”

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Is my real estate agent being honest? He said he has to pay $100 to Zillow each time someone fills out the contact listing agent form on my house. True?

Not to my knowledge. In my area, the way Zillow works is it pulls listings from the MLS (multiple listing service) unless I check a box that says the seller prohibits this. So it’s no more work for me to list your property on Zillow than in the MLS. Zillow sells real estate agents “leads” (queries about specific properties) or (in a new program) takes a % of the brokerage fee after a property has closed. Contacting agents online is free to both parties.

Create this form in 5 minutes!

How to create an eSignature for the final agency acknowledgment oregon real estate forms llc

How to make an electronic signature for your Final Agency Acknowledgment Oregon Real Estate Forms Llc in the online mode

How to make an eSignature for the Final Agency Acknowledgment Oregon Real Estate Forms Llc in Chrome

How to generate an eSignature for putting it on the Final Agency Acknowledgment Oregon Real Estate Forms Llc in Gmail

How to generate an electronic signature for the Final Agency Acknowledgment Oregon Real Estate Forms Llc right from your smartphone

How to make an electronic signature for the Final Agency Acknowledgment Oregon Real Estate Forms Llc on iOS devices

How to generate an electronic signature for the Final Agency Acknowledgment Oregon Real Estate Forms Llc on Android devices

People also ask

-

What are OREF forms, and how does airSlate SignNow facilitate their use?

OREF forms are standardized documents used for real estate transactions in Oregon. airSlate SignNow provides an efficient platform for creating, signing, and managing OREF forms electronically, ensuring compliance and ease of use for real estate professionals.

-

Can I customize OREF forms using airSlate SignNow?

Yes, airSlate SignNow allows users to customize OREF forms to meet their specific needs. You can add branding elements, modify fields, and set up workflows to streamline how these forms are used in your business.

-

How does pricing for airSlate SignNow compare when using OREF forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you're a small agency or a large firm, you can effectively manage costs while utilizing OREF forms without sacrificing features or efficiency.

-

What features of airSlate SignNow enhance the eSigning process for OREF forms?

airSlate SignNow includes features like remote signing, automatic reminders, and secure storage, which enhance the eSigning process for OREF forms. These tools ensure that your documents are signed quickly and securely without any unnecessary delays.

-

Is it possible to integrate airSlate SignNow with other software to manage OREF forms?

Absolutely! airSlate SignNow offers integrations with numerous software applications, allowing you to seamlessly manage OREF forms alongside your other business tools. This can streamline your workflow and improve overall productivity.

-

What benefits does airSlate SignNow provide for businesses using OREF forms?

Using airSlate SignNow for OREF forms offers businesses benefits such as improved efficiency, reduced paperwork, and enhanced security. With a user-friendly interface, teams can focus on closing deals rather than getting bogged down in administrative tasks.

-

Are there any mobile capabilities for managing OREF forms with airSlate SignNow?

Yes, airSlate SignNow provides robust mobile capabilities, allowing you to manage OREF forms from anywhere. This flexibility ensures that you can stay productive while on the go, making it easier to complete transactions efficiently.

Get more for Oref Forms Oregon

- List of medical expenses form

- Now that your client has filed her final accounting i would be most appreciative that you form

- 31746 automated non master file accountinginternal irs form

- My client has requested that i contact you regarding a couple of matters form

- Enclosed are the documents which your spouse needs to sign form

- Petition requesting colorado to accept guardianship form

- Gc 361 notice of intent to register conservatorship superior form

- Ex 1015 blocked account agreement secgov form

Find out other Oref Forms Oregon

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word