Ca Income Form

What is the CA Income Form?

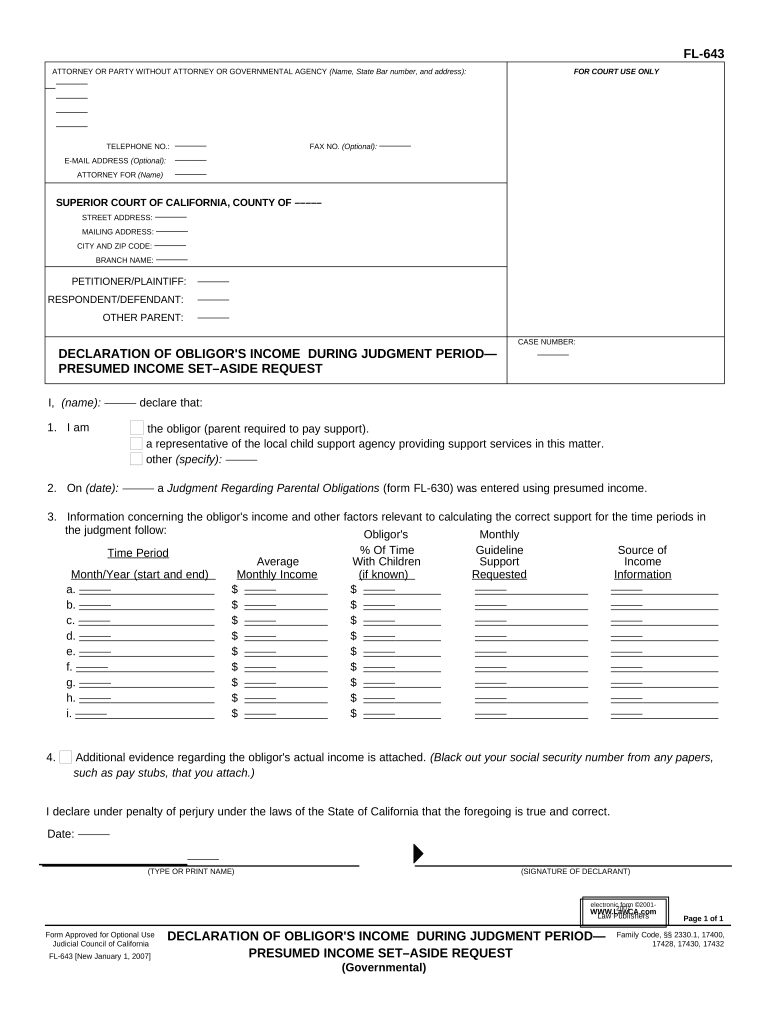

The CA income form is a crucial document used by residents of California to report their income for tax purposes. This form is essential for individuals and businesses alike, as it helps determine tax obligations based on income earned during the fiscal year. The form collects various types of income, including wages, dividends, and interest, ensuring that all sources of income are accounted for when filing taxes. Understanding the purpose of this form is vital for accurate tax reporting and compliance with state regulations.

How to Use the CA Income Form

Using the CA income form involves several steps to ensure that all information is accurately reported. First, gather all necessary documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Be sure to report all income sources in the appropriate sections. After completing the form, review it for accuracy and completeness before submitting it to the relevant tax authority.

Steps to Complete the CA Income Form

Completing the CA income form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income statements.

- Enter your personal information at the top of the form.

- Report your total income from all sources in the designated sections.

- Calculate any deductions or credits you may qualify for.

- Review the completed form for any errors or omissions.

- Sign and date the form before submitting it.

Legal Use of the CA Income Form

The CA income form serves a legal purpose in the context of tax compliance. It is recognized by the state as an official document for reporting income and calculating tax liabilities. When filled out correctly, the form can protect taxpayers from potential legal issues related to underreporting income. To ensure its legal standing, it is important to comply with all applicable tax laws and regulations when submitting the form.

Required Documents

To complete the CA income form accurately, several documents are required. These typically include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Bank statements showing interest income.

- Records of any other income sources, such as rental income or dividends.

Having these documents on hand will streamline the process of filling out the form and help ensure accuracy.

Form Submission Methods

The CA income form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission via the California Department of Tax and Fee Administration website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can depend on personal preference and the urgency of filing.

Quick guide on how to complete ca income form 497299002

Complete Ca Income Form seamlessly on any device

Online document management has gained signNow traction among organizations and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documentation, as you can acquire the correct form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Ca Income Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Ca Income Form effortlessly

- Find Ca Income Form and then click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign Ca Income Form and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA income form and why is it important?

A CA income form is a crucial document used for reporting income to the California tax authorities. It is essential for individuals and businesses to accurately report their earnings to ensure compliance with state tax laws. Properly completing the CA income form can help avoid penalties and ensure smooth processing of tax returns.

-

How can airSlate SignNow help with completing a CA income form?

airSlate SignNow offers a user-friendly platform to easily fill out and eSign your CA income form. With our templates and tools, you can streamline the process, ensuring that all necessary information is correctly entered. This simplifies the tax filing process and saves you time.

-

Is there a cost associated with using airSlate SignNow for CA income forms?

Yes, airSlate SignNow provides various pricing plans tailored for individuals and businesses. These plans include features to assist with the CA income form, ensuring you have access to all the tools needed for efficient document management. You can choose a plan that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software to assist with CA income forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including accounting and tax software. This allows you to import relevant data directly into your CA income form, enhancing accuracy and reducing manual entry errors. Integrations improve workflow efficiency.

-

What features does airSlate SignNow offer for managing CA income forms?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and real-time collaboration tools. These features make it easy to create, edit, and sign CA income forms from anywhere, ensuring that you can gather signatures quickly and securely.

-

Is airSlate SignNow secure for handling personal information on CA income forms?

Yes, airSlate SignNow prioritizes security and compliance. We utilize advanced encryption and secure storage practices to protect your personal information on CA income forms. You can trust that your data is safe with us while you focus on completing your tax documentation.

-

Can I access my CA income forms on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access your CA income forms anytime and anywhere. Whether you're on the go or working remotely, you can easily fill out, sign, and share your CA income form from your smartphone or tablet.

Get more for Ca Income Form

Find out other Ca Income Form

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed