Hawaii Tax Forms Alphabetical Listing Department of 2021

Steps to complete the Hawaii Tax Form N-35

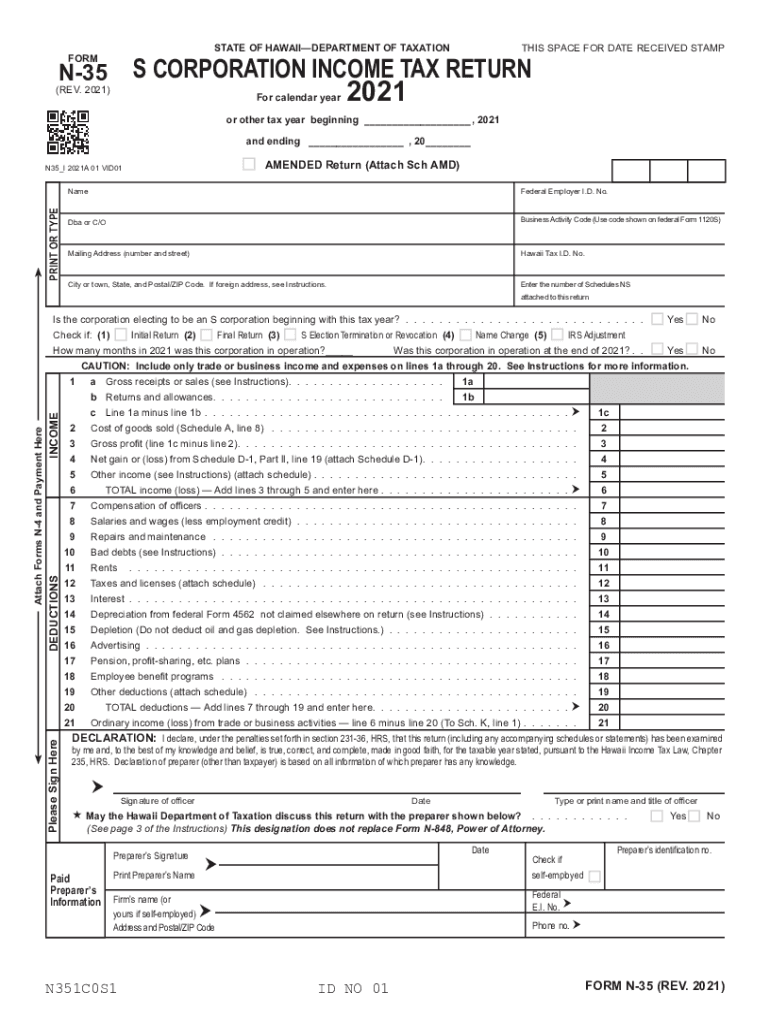

Completing the Hawaii Tax Form N-35, which is specifically designed for corporations, involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, balance sheets, and any relevant tax documents from previous years. This information will be crucial for accurately reporting your corporation's income and expenses.

Next, download the Hawaii Tax Form N-35 from the official Department of Taxation website or access it through a trusted digital platform. Carefully read the instructions provided with the form to understand the specific requirements for your corporation type. Fill out the form with precise information, ensuring that all figures are accurate and reflect your corporation's financial activities for the tax year.

Once the form is completed, review it thoroughly for any errors or omissions. It may be beneficial to have a tax professional review your form to ensure compliance with all state regulations. After finalizing the form, you can choose to submit it electronically or by mail, depending on your preference and the guidelines provided by the Hawaii Department of Taxation.

Required Documents for Hawaii Tax Form N-35

When preparing to file the Hawaii Tax Form N-35, several documents are required to support your submission. These documents include:

- Financial Statements: Include income statements and balance sheets that reflect your corporation's financial position.

- Previous Tax Returns: Having copies of prior year tax returns can help ensure consistency and accuracy in reporting.

- Supporting Schedules: Any additional schedules that detail specific income or deductions must be included.

- Proof of Payments: Documentation of any estimated tax payments made throughout the year should also be provided.

Gathering these documents ahead of time will streamline the process and reduce the likelihood of errors in your tax filing.

Form Submission Methods for Hawaii Tax Form N-35

The Hawaii Tax Form N-35 can be submitted through various methods, allowing flexibility for corporations. The primary submission methods include:

- Online Submission: Corporations can file electronically through the Hawaii Department of Taxation's online portal. This method is often faster and provides immediate confirmation of receipt.

- Mail Submission: If preferred, you can print the completed form and mail it to the designated address provided in the form instructions. Ensure that you send it well before the deadline to avoid any late penalties.

- In-Person Submission: Corporations may also choose to submit their forms in person at local tax offices. This option allows for direct interaction with tax officials if any questions arise.

Choosing the right submission method can enhance the efficiency of your filing process.

Filing Deadlines for Hawaii Tax Form N-35

Understanding the filing deadlines for the Hawaii Tax Form N-35 is crucial to avoid penalties. The standard deadline for filing this form is typically the fifteenth day of the fourth month following the end of your corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If your corporation has a different fiscal year, be sure to adjust the deadline accordingly.

It is also important to note that extensions may be available. Corporations can file for an automatic extension, which allows an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance with Hawaii Tax Form N-35

Failing to comply with the filing requirements for the Hawaii Tax Form N-35 can result in significant penalties. Common penalties include:

- Late Filing Penalty: If the form is filed after the deadline, a penalty may be assessed based on the amount of tax owed.

- Failure to Pay Penalty: If taxes owed are not paid by the due date, additional interest and penalties may accrue.

- Inaccurate Information Penalty: Providing false or misleading information on the form can lead to further legal implications and financial penalties.

To avoid these penalties, ensure timely and accurate filing of the Hawaii Tax Form N-35, and consider consulting with a tax professional if needed.

Quick guide on how to complete hawaii tax forms alphabetical listing department of

Complete Hawaii Tax Forms Alphabetical Listing Department Of effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Hawaii Tax Forms Alphabetical Listing Department Of on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Hawaii Tax Forms Alphabetical Listing Department Of effortlessly

- Obtain Hawaii Tax Forms Alphabetical Listing Department Of and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign functionality, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Hawaii Tax Forms Alphabetical Listing Department Of to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii tax forms alphabetical listing department of

Create this form in 5 minutes!

How to create an eSignature for the hawaii tax forms alphabetical listing department of

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the Hawaii tax form N 35?

The Hawaii tax form N 35 is an annual income tax return for corporations and partnerships operating in Hawaii. This form is essential for businesses to report their income and calculate the tax owed to the state. Understanding how to properly fill out and file the Hawaii tax form N 35 is crucial for compliance.

-

How can airSlate SignNow help with the Hawaii tax form N 35?

AirSlate SignNow streamlines the process of sending and signing documents, including the Hawaii tax form N 35. With its easy-to-use interface, you can securely send this tax form for eSignature, ensuring timely submission and compliance. Utilizing airSlate SignNow minimizes the hassle associated with paperwork, making tax season easier for businesses.

-

What are the pricing options for using airSlate SignNow for the Hawaii tax form N 35?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. You can choose from monthly or annual subscription models, with options that scale according to your usage needs. This allows you to efficiently manage the completion of the Hawaii tax form N 35 without incurring unnecessary costs.

-

Does airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing easy access to documents such as the Hawaii tax form N 35. These integrations foster a smooth workflow by enabling users to import and export necessary financial data efficiently. This ensures that your tax information is always up-to-date and operational.

-

Is eSigning the Hawaii tax form N 35 legally binding?

Yes, eSigning the Hawaii tax form N 35 through airSlate SignNow is considered legally binding. The platform adheres to eSignature laws, which recognize electronic signatures as valid as traditional handwritten signatures. This ensures that your submission is legally accepted by state authorities.

-

What security measures does airSlate SignNow implement for sensitive tax documents?

AirSlate SignNow prioritizes the security of your sensitive documents, including the Hawaii tax form N 35. The platform employs advanced encryption protocols and secure storage solutions to protect your data. Furthermore, user access controls and audit trails ensure that your information remains confidential and secure throughout the process.

-

How can I track the status of my Hawaii tax form N 35 submission through airSlate SignNow?

Once you send the Hawaii tax form N 35 for signing via airSlate SignNow, you can easily track its status in real-time. The platform offers notifications and tracking features that keep you updated on who has viewed and signed the document. This transparency helps ensure timely submissions without any delays.

Get more for Hawaii Tax Forms Alphabetical Listing Department Of

- Partial release of property from deed of trust for individual maryland form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy maryland form

- Warranty deed for parents to child with reservation of life estate maryland form

- Warranty deed for separate or joint property to joint tenancy maryland form

- Warranty deed to separate property of one spouse to both spouses as joint tenants maryland form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries maryland form

- Warranty deed from limited partnership or llc is the grantor or grantee maryland form

- Maryland trustee form

Find out other Hawaii Tax Forms Alphabetical Listing Department Of

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word