Form N 35, Rev , S Corporation Income Tax Return Forms Fillable 2019

What is the Form N-35?

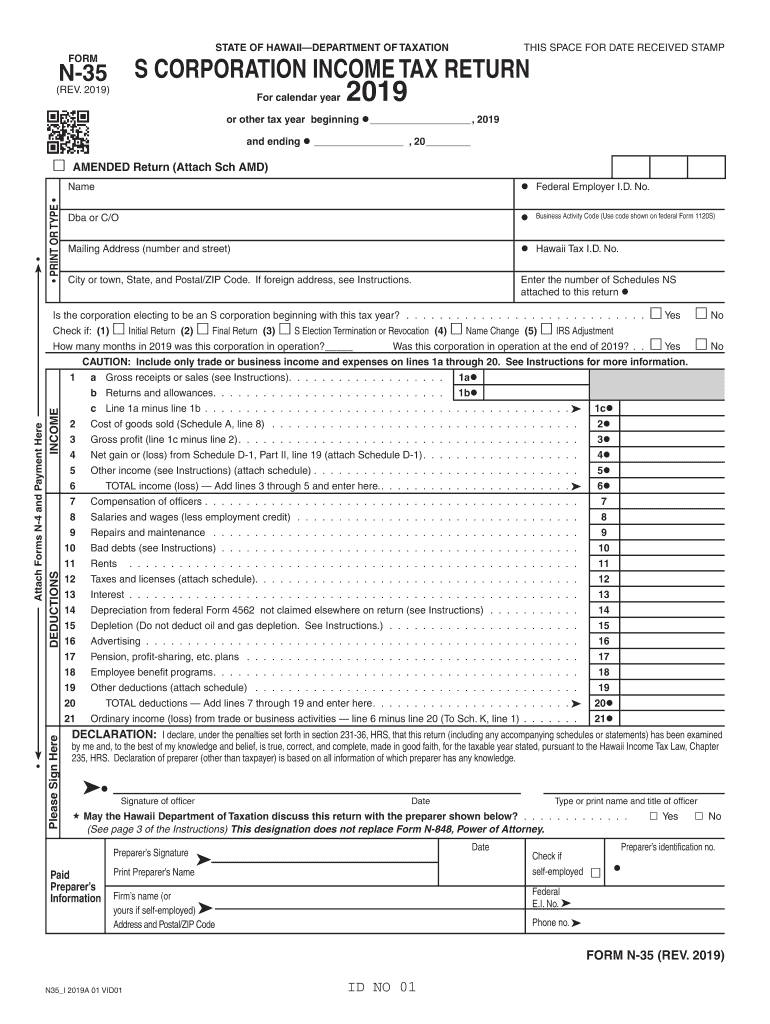

The Form N-35 is a tax document used by S corporations in Hawaii to report income, deductions, and credits. This form is essential for S corporations that have elected to be taxed as pass-through entities, meaning that the income is reported on the shareholders' personal tax returns rather than at the corporate level. The N-35 helps ensure compliance with state tax regulations and provides a clear overview of the corporation's financial activities during the tax year.

Steps to Complete the Form N-35

Completing the Form N-35 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and previous tax returns. Next, accurately fill out each section of the form, including details about the corporation's income, deductions, and credits. It's important to double-check calculations and ensure that all required signatures are included. Finally, make copies of the completed form for your records before submitting it to the appropriate tax authority.

Legal Use of the Form N-35

The Form N-35 is legally binding when completed and submitted according to Hawaii's tax regulations. To ensure its validity, it must be signed by an authorized officer of the corporation. Additionally, the form must be filed by the specified deadline to avoid penalties. Properly completing the N-35 helps maintain compliance with state tax laws and can prevent potential legal issues related to tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-35 are crucial for compliance. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. It's essential to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Form N-35, several documents are required. These include financial statements detailing income and expenses, previous tax returns, and any supporting documentation for deductions and credits claimed. Having these documents readily available can streamline the filing process and help ensure that all information reported is accurate and complete.

Form Submission Methods

The Form N-35 can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. If opting for paper submission, ensure that the form is mailed to the correct address and sent well before the deadline to avoid any delays.

Penalties for Non-Compliance

Failure to file the Form N-35 on time or submitting inaccurate information can result in significant penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal repercussions for continued non-compliance. It is essential for S corporations to adhere to filing requirements to avoid these consequences and maintain good standing with state tax authorities.

Quick guide on how to complete form n 35 rev 2019 s corporation income tax return forms 2019 fillable

Finish Form N 35, Rev , S Corporation Income Tax Return Forms Fillable effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Form N 35, Rev , S Corporation Income Tax Return Forms Fillable on any device with airSlate SignNow's Android or iOS applications and simplify your document-driven tasks today.

The simplest way to edit and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable without hassle

- Find Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and guarantee smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 35 rev 2019 s corporation income tax return forms 2019 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 35 rev 2019 s corporation income tax return forms 2019 fillable

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the cost of using airSlate SignNow for 'hi n 35'?

airSlate SignNow offers competitive pricing plans for 'hi n 35' that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, making it a cost-effective solution. With transparent pricing, you can select a plan that meets your needs without unexpected fees.

-

What features does airSlate SignNow include for 'hi n 35' users?

For 'hi n 35' users, airSlate SignNow includes features such as document templates, in-person signing, and automated workflows. These features streamline the signing process, making it more efficient and user-friendly. The platform is designed to enhance productivity while keeping things simple.

-

How can airSlate SignNow benefit my business in 'hi n 35'?

Using airSlate SignNow in 'hi n 35' can signNowly improve your document workflow and accelerate your business process. It allows you to send and eSign documents quickly, reducing turnaround time and improving customer satisfaction. Ultimately, it empowers you to focus on what matters most for your business.

-

Is airSlate SignNow easy to integrate with other tools for 'hi n 35'?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by businesses engaged in 'hi n 35'. This includes popular platforms like Google Drive, Salesforce, and more. These integrations enhance your existing workflows, allowing for a more cohesive and efficient operation.

-

Are documents secure with airSlate SignNow for 'hi n 35'?

Absolutely, airSlate SignNow prioritizes security for 'hi n 35' users by employing industry-standard encryption and compliance with regulations. Your documents are protected, ensuring that sensitive information remains confidential. Trust is crucial in eSigning, and our solution is built to guarantee security.

-

Can I access airSlate SignNow on mobile devices for 'hi n 35'?

Yes, airSlate SignNow offers a mobile-friendly experience, allowing 'hi n 35' users to access their documents anytime, anywhere. This mobile accessibility ensures that you can manage your signing needs on the go, enhancing flexibility and convenience. The app is available for both iOS and Android devices.

-

What customer support options are available for 'hi n 35' users of airSlate SignNow?

airSlate SignNow provides comprehensive customer support for 'hi n 35' users, including live chat, email support, and a knowledge base. Whether you have questions or need assistance, our team is here to help. We prioritize customer satisfaction and strive to ensure you have a great experience.

Get more for Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

Find out other Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF