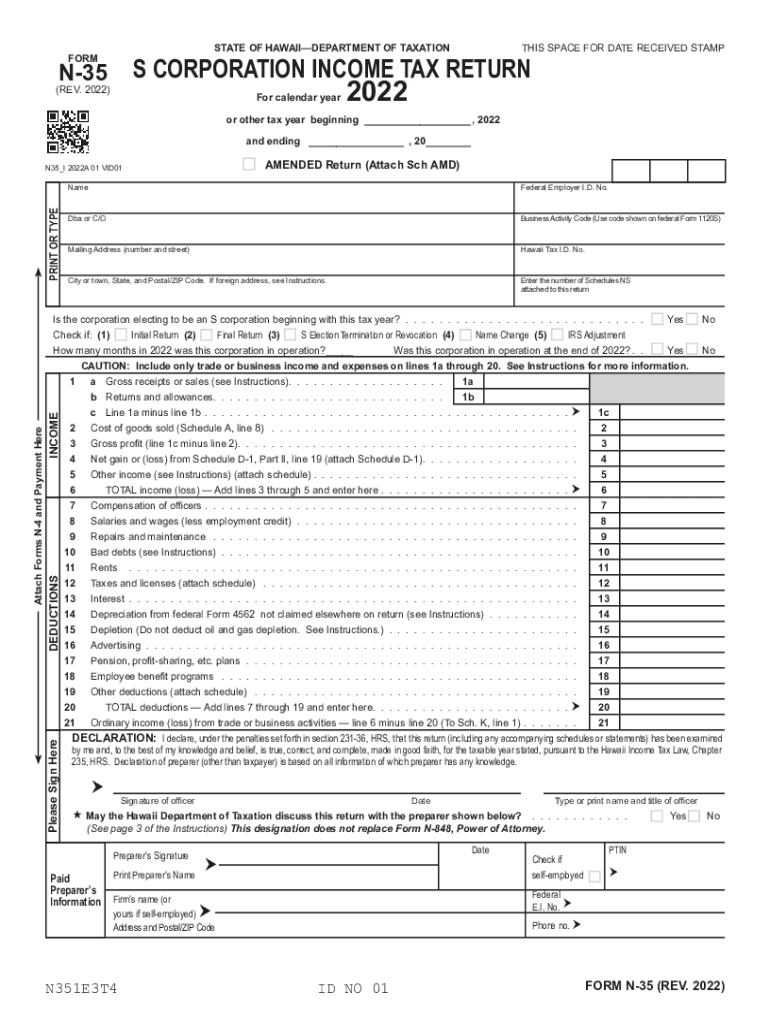

Hawaii Income Tax Forms by Tax Year E File Your Taxes 2022

What is the Hawaii Income Tax?

The Hawaii income tax is a tax levied on the income earned by individuals and businesses within the state. It is structured as a progressive tax, meaning that the rate increases as the income level rises. Hawaii has several tax brackets, which determine the percentage of income that must be paid in taxes. Understanding the specific rates and brackets is essential for accurate tax planning and compliance.

Key Elements of the Hawaii Income Tax Forms

The Hawaii income tax forms include essential information that taxpayers must provide to accurately report their income and calculate their tax liability. Key elements of these forms typically include:

- Personal identification information, such as name, address, and Social Security number.

- Income details, including wages, dividends, and interest.

- Deductions and credits that may apply to reduce taxable income.

- Signature and date to validate the submission.

Steps to Complete the Hawaii Income Tax Forms

Completing the Hawaii income tax forms involves several important steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and identify applicable deductions and credits.

- Fill out the appropriate tax form, ensuring all information is accurate and complete.

- Review the completed form for errors before submission.

- Submit the form electronically or via mail by the designated deadline.

Filing Deadlines / Important Dates

Taxpayers in Hawaii must be aware of specific deadlines for filing their income tax forms. Generally, the filing deadline for individual income tax returns is April 20. However, if the deadline falls on a weekend or holiday, it may be extended. It's crucial to stay informed about these dates to avoid penalties for late filing.

Form Submission Methods

Hawaii income tax forms can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online filing through the Hawaii Department of Taxation’s e-filing system.

- Mailing paper forms to the appropriate tax office.

- In-person submission at designated tax office locations.

Penalties for Non-Compliance

Failure to comply with Hawaii income tax regulations can result in penalties. Common penalties include:

- Late filing penalties, which may be assessed if the tax return is not submitted by the deadline.

- Late payment penalties for any unpaid taxes after the due date.

- Interest on overdue taxes, which accrues until the balance is paid in full.

Quick guide on how to complete hawaii income tax forms by tax year e file your taxes

Effortlessly Prepare Hawaii Income Tax Forms By Tax Year E File Your Taxes on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Hawaii Income Tax Forms By Tax Year E File Your Taxes on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Hawaii Income Tax Forms By Tax Year E File Your Taxes with Ease

- Obtain Hawaii Income Tax Forms By Tax Year E File Your Taxes and then click Get Form to begin.

- Make use of the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Hawaii Income Tax Forms By Tax Year E File Your Taxes to ensure clear communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii income tax forms by tax year e file your taxes

Create this form in 5 minutes!

How to create an eSignature for the hawaii income tax forms by tax year e file your taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current Hawaii income tax rate for businesses?

The Hawaii income tax rate for businesses varies based on the income level, with rates ranging from 4% to 6.4%. It's crucial for businesses operating in Hawaii to stay informed about these rates as they can signNowly affect profit margins. airSlate SignNow provides tools to streamline document workflows, ensuring that tax-related paperwork is efficiently managed.

-

How does the Hawaii income tax rate affect my eSigning process?

The Hawaii income tax rate can impact your eSigning process if you need to prepare documents related to tax obligations. By using airSlate SignNow, you can quickly create, send, and eSign critical documents, helping you meet compliance requirements more efficiently. This allows you to focus on your business rather than getting bogged down by paperwork.

-

Are there any discounts available for using airSlate SignNow in Hawaii?

While there are no specific discounts tied to the Hawaii income tax rate, airSlate SignNow offers competitive pricing that can help businesses save costs. Our affordable packages cater to various needs, making it easier for businesses in Hawaii to manage their document signing processes without excessive expense. Explore our options to see how we can fit your budget.

-

Can airSlate SignNow help with tax documentation related to Hawaii income tax?

Yes, airSlate SignNow is an excellent solution for managing tax documentation related to the Hawaii income tax rate. Our platform allows for secure eSigning of tax forms, ensuring that documents are legally binding and properly filed. This functionality simplifies the process and reduces the risk of errors in your tax documentation.

-

What features does airSlate SignNow offer that could aid in tax compliance in Hawaii?

airSlate SignNow provides features such as templates for common tax forms, automated reminders, and secure storage, which can greatly assist in maintaining compliance with the Hawaii income tax rate. These features ensure you always have the right documents ready for submission. By utilizing these tools, you can enhance your organization’s tax compliance efforts.

-

Is it easy to integrate airSlate SignNow with other accounting software used in Hawaii?

Absolutely! airSlate SignNow seamlessly integrates with many popular accounting and tax software solutions commonly used in Hawaii. These integrations help streamline your workflow related to the Hawaii income tax rate by allowing for smooth document sharing and management. You can connect your tools effortlessly and enhance overall productivity.

-

How does using airSlate SignNow improve efficiency for companies handling Hawaii income tax?

Using airSlate SignNow can drastically improve efficiency for companies handling the Hawaii income tax rate by reducing the time spent on paperwork. Our platform enables quick document preparation and eSigning, which speeds up the tax filing process. This means that businesses can complete their tax-related tasks more swiftly and reduce associated stress.

Get more for Hawaii Income Tax Forms By Tax Year E File Your Taxes

- South carolina divorce printable form

- Sc affidavit 497325970 form

- South carolina request hearing form

- Sc financial declaration form

- South carolina child support 497325973 form

- Family court form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy south carolina form

- Warranty deed for parents to child with reservation of life estate south carolina form

Find out other Hawaii Income Tax Forms By Tax Year E File Your Taxes

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online