Form N 35, Rev , S Corporation Income Tax Return Forms Fillable 2020

What is the Form N-35?

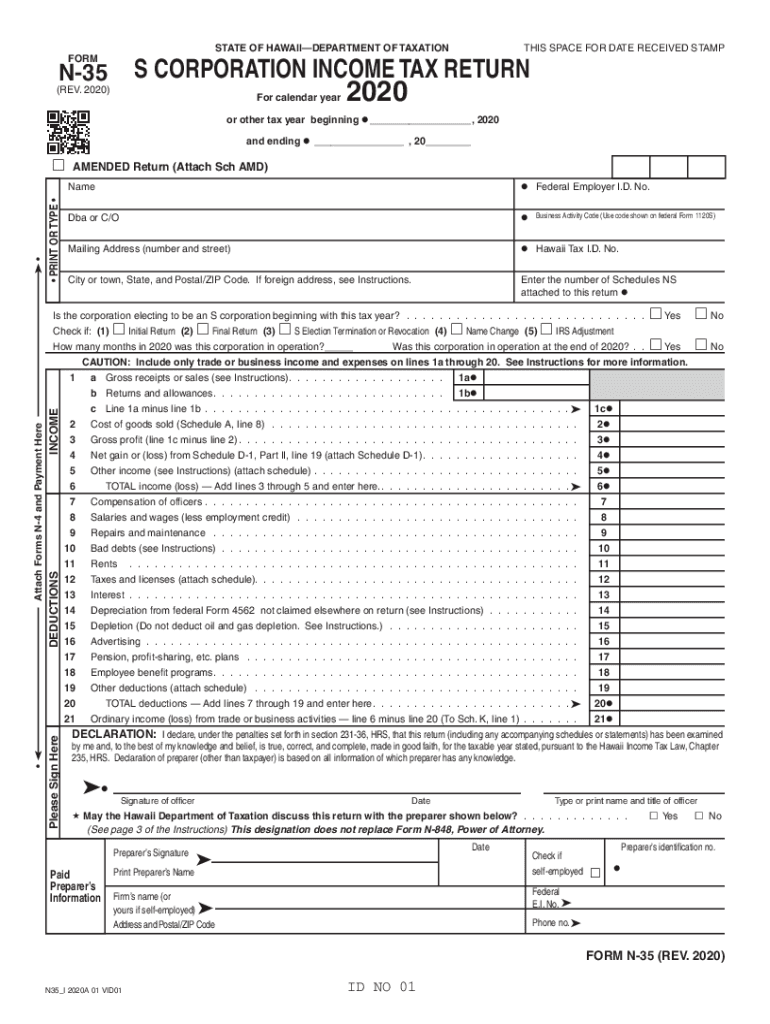

The Form N-35 is a tax document used by S corporations in Hawaii to report income, deductions, and credits. This form is essential for S corporations as it helps determine the tax liability of the business and its shareholders. The N-35 must be filed annually and includes detailed information about the corporation's financial activities. Understanding its components is crucial for accurate reporting and compliance with state tax laws.

Steps to Complete the Form N-35

Completing the Form N-35 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form by entering details about the corporation's income, deductions, and credits. It is important to review the form for any errors or omissions before submission. Finally, ensure that the form is signed by an authorized officer of the corporation to validate the information provided.

Legal Use of the Form N-35

The Form N-35 serves as a legally binding document when filed correctly. It must adhere to the guidelines set forth by the Hawaii Department of Taxation. Proper completion and timely submission of the form ensure that the corporation remains in good standing and avoids penalties. Additionally, the information reported on the N-35 is crucial for the shareholders, as it affects their individual tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-35 are critical for compliance. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes to deadlines or extensions that may apply to ensure timely filing.

Form Submission Methods

The Form N-35 can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. When submitting by mail, ensure that the form is sent to the correct address and consider using certified mail for tracking purposes. In-person submissions can be made at designated tax offices, providing an opportunity to ask questions if needed.

Required Documents

To complete the Form N-35, certain documents are required. These typically include financial statements, records of income and expenses, and any supporting documentation for deductions and credits claimed. Having these documents organized and readily available can streamline the completion process and reduce the likelihood of errors.

Key Elements of the Form N-35

The Form N-35 contains several key elements that must be accurately reported. These include the corporation's total income, allowable deductions, tax credits, and the calculation of the tax owed. Additionally, the form requires information about the shareholders and their respective shares of income and deductions. Understanding these elements is essential for ensuring compliance and accurate tax reporting.

Quick guide on how to complete form n 35 rev 2020 s corporation income tax return forms 2020 fillable

Complete Form N 35, Rev , S Corporation Income Tax Return Forms Fillable effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a flawless eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and smoothly. Manage Form N 35, Rev , S Corporation Income Tax Return Forms Fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable with ease

- Obtain Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Alter and eSign Form N 35, Rev , S Corporation Income Tax Return Forms Fillable and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 35 rev 2020 s corporation income tax return forms 2020 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 35 rev 2020 s corporation income tax return forms 2020 fillable

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow?

The pricing for airSlate SignNow is tailored to fit various business needs, ensuring a cost-effective solution. With packages designed to accommodate small teams to larger enterprises, you can choose the one that aligns with your budget and requirements, making it easy to manage your document eSigning in a hi n 35 manner.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a comprehensive set of features including document templates, custom branding, and team collaboration tools. These features ensure that businesses can streamline their eSigning processes efficiently, making it a robust choice for anyone looking for a hi n 35 solution.

-

How easy is it to integrate airSlate SignNow with other applications?

Integrating airSlate SignNow with your existing business applications is seamless and efficient. We offer integrations with popular CRM platforms, productivity tools, and cloud storage services, allowing you to work in a hi n 35 environment without disruption.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning brings numerous benefits, including enhanced security, quicker turnaround times, and reduced paperwork. This powerful tool helps businesses save time and resources, making it an attractive option for those seeking a hi n 35 approach to electronic document management.

-

Is airSlate SignNow compliant with eSignature laws?

Yes, airSlate SignNow is fully compliant with eSignature laws such as ESIGN and UETA. This adherence ensures that your documents eSigned through our platform are legally binding, providing peace of mind for users who prioritize lawful and credible hi n 35 transaction processes.

-

Can I customize the documents I send with airSlate SignNow?

Absolutely! airSlate SignNow allows for extensive document customization, enabling you to create personalized templates that fit your branding and business needs. This aspect of customization makes it a preferred choice for companies looking to maintain a professional image while utilizing a hi n 35 solution.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and stringent access controls. This dedication to safeguarding your information ensures a trustworthy environment for your eSigning needs, matching the high standards expected from a hi n 35 solution.

Get more for Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

- Dme face to face form

- Emblemhealth dependent student certification form 24667052

- Ghana resident permit sample form

- Maryland elevator inspection form

- Kotak bank rtgs form pdf editable 558320475

- Pef protest of assignment form

- Quit claim deed form alabama

- Motor vehicle dealer surety bond application allstar form

Find out other Form N 35, Rev , S Corporation Income Tax Return Forms Fillable

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF