Claim Exemption Form

What is the Claim Exemption Form

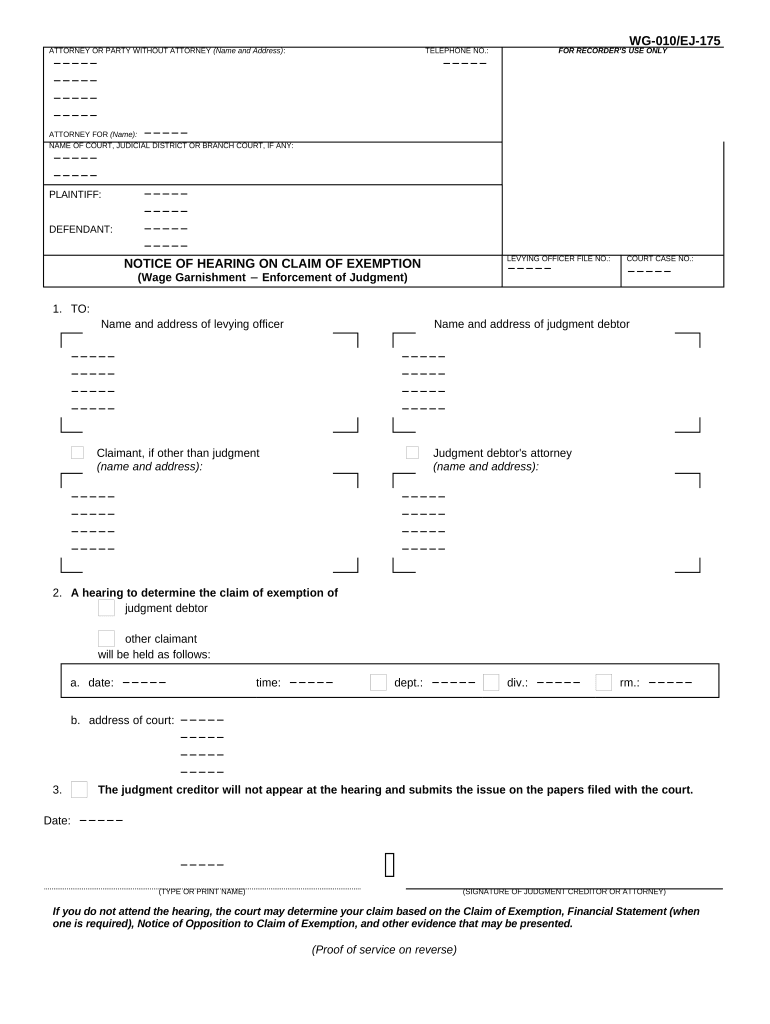

The California claim exemption form, often referred to as the California claim ej, is a legal document that allows individuals to assert their eligibility for certain exemptions from claims or liabilities. This form is particularly relevant in the context of hearings and legal proceedings, where individuals may seek to demonstrate that they qualify for specific exemptions based on their circumstances. Understanding the purpose and implications of this form is crucial for anyone navigating legal claims in California.

How to use the Claim Exemption Form

Using the California claim exemption form involves several key steps. First, individuals must accurately complete the form, providing necessary personal information and details regarding the claim. It is essential to review the instructions carefully to ensure all required fields are filled out correctly. Once completed, the form can be submitted to the appropriate court or agency as specified in the guidelines. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSigning and submission.

Steps to complete the Claim Exemption Form

Completing the California claim exemption form requires attention to detail. Here are the essential steps:

- Gather necessary information: Collect all relevant personal and claim-related details.

- Fill out the form: Input the required information in the designated sections, ensuring accuracy.

- Review the form: Double-check for any errors or omissions before submission.

- Sign the form: Use a reliable eSignature solution to sign the document electronically.

- Submit the form: Send the completed form to the appropriate authority, either electronically or via mail.

Legal use of the Claim Exemption Form

The legal use of the California claim exemption form is governed by specific regulations and requirements. This form must be filled out in compliance with California law to be considered valid. It is important to understand that submitting the form does not automatically guarantee the exemption; the court or agency will review the information provided and make a determination based on the merits of the claim. Adhering to legal guidelines ensures that the form is used appropriately within the legal framework.

Eligibility Criteria

To qualify for using the California claim exemption form, individuals must meet certain eligibility criteria. These criteria may include specific financial thresholds, types of claims, or personal circumstances that justify the exemption. It is vital for applicants to familiarize themselves with these requirements to ensure they are eligible before submitting the form. Consulting with a legal professional can provide clarity on individual eligibility and the implications of the claim exemption.

Form Submission Methods

The California claim exemption form can be submitted through various methods, facilitating accessibility for users. Common submission methods include:

- Online submission: Many courts allow for the electronic submission of forms, which can be done through secure platforms.

- Mail: Individuals can print the completed form and send it via postal service to the designated court or agency.

- In-person submission: Submitting the form in person at the appropriate office is also an option, providing immediate confirmation of receipt.

Quick guide on how to complete claim exemption form 497299620

Effortlessly Complete Claim Exemption Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and without delays. Manage Claim Exemption Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Claim Exemption Form with Ease

- Find Claim Exemption Form and click on Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Claim Exemption Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California claim ej?

A California claim ej is a specific document used to file claims in California's legal system. It serves as a formal request for compensation or resolution of a dispute. Understanding its components is crucial for anyone looking to navigate the claims process effectively.

-

How can airSlate SignNow help with California claim ej documents?

airSlate SignNow offers a user-friendly platform to create, send, and eSign California claim ej documents effortlessly. Its intuitive interface allows you to fill out forms, obtain signatures, and manage documents securely. This streamlines the claims process and enhances efficiency for businesses and individuals alike.

-

What are the pricing options for using airSlate SignNow for California claim ej?

airSlate SignNow provides flexible pricing plans suitable for diverse needs, whether you're an individual or a business. You can choose from monthly or annual subscriptions, which offer access to essential features for managing California claim ej documents. Visit our pricing page for detailed information on plans and benefits.

-

Are there any special features for managing California claim ej in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to handle California claim ej documents efficiently. These features include document templates, automated reminders for signers, and the ability to track document status in real-time, ensuring a smooth experience for all parties involved.

-

Can I integrate airSlate SignNow with other tools I use for California claims?

Absolutely! airSlate SignNow offers integrations with various business tools, enhancing your workflow when managing California claim ej documents. You can connect it with CRMs, cloud storage services, and productivity apps to centralize your document management and streamline the claims process.

-

What are the benefits of using airSlate SignNow for California claim ej?

Using airSlate SignNow for California claim ej provides numerous benefits, including increased efficiency, cost savings, and simplified document handling. By digitizing your claims process, you can save time on paperwork and reduce errors associated with manual processes. This leads to quicker resolutions and improved customer satisfaction.

-

Is airSlate SignNow secure for handling California claim ej documents?

Yes, airSlate SignNow prioritizes security when handling California claim ej documents. Our platform is built with advanced encryption and security features to protect sensitive information. You can rest assured that your documents are safe while you manage your claims online.

Get more for Claim Exemption Form

Find out other Claim Exemption Form

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast