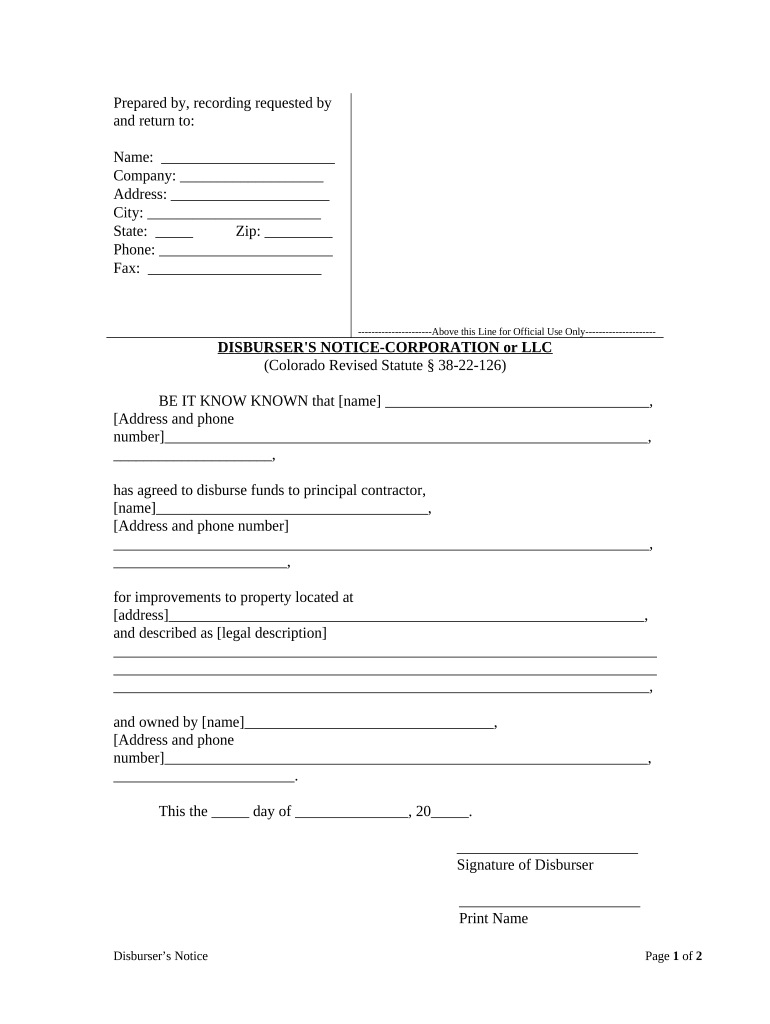

Colorado Corporation Llc Form

What is the Colorado Corporation LLC?

A Colorado Corporation LLC, or Limited Liability Company, is a specific type of business structure that combines the benefits of both a corporation and a partnership. This structure provides personal liability protection for its owners, known as members, while allowing for flexible management and tax benefits. In Colorado, forming an LLC is a popular choice for small business owners due to its simplicity and the legal protections it offers.

Key elements of the Colorado Corporation LLC

When forming a Colorado Corporation LLC, several key elements must be considered:

- Limited liability protection: Members are generally not personally liable for the debts and obligations of the LLC.

- Flexible management structure: LLCs can be managed by members or appointed managers, allowing for various management styles.

- Pass-through taxation: Income is typically taxed at the member level, avoiding double taxation that corporations face.

- Compliance requirements: LLCs must adhere to state regulations, including filing Articles of Organization and maintaining good standing.

Steps to complete the Colorado Corporation LLC

To successfully form a Colorado Corporation LLC, follow these steps:

- Choose a unique name: Ensure the name complies with Colorado naming requirements and is not already in use.

- Designate a registered agent: Appoint an individual or business entity to receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit the necessary paperwork to the Colorado Secretary of State, along with the required filing fee.

- Create an operating agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on the business type, additional local, state, or federal licenses may be required.

Required Documents

To form a Colorado Corporation LLC, the following documents are typically required:

- Articles of Organization: This document officially establishes the LLC with the state.

- Operating Agreement: While optional, this internal document details the management and operational guidelines.

- Registered Agent Consent: A statement from the registered agent agreeing to serve in that capacity.

Eligibility Criteria

To be eligible to form a Colorado Corporation LLC, the following criteria must be met:

- At least one member is required, who can be an individual or another business entity.

- The chosen name must include "Limited Liability Company," "LLC," or an abbreviation thereof.

- The LLC must have a registered agent with a physical address in Colorado.

Filing Deadlines / Important Dates

While there are no specific deadlines for forming an LLC in Colorado, it is essential to keep track of ongoing compliance requirements:

- Annual reports: LLCs must file periodic reports to maintain good standing with the state.

- Renewal of licenses: Ensure that any required business licenses are renewed according to local regulations.

Quick guide on how to complete colorado corporation llc

Finalize Colorado Corporation Llc effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Colorado Corporation Llc on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Colorado Corporation Llc without hassle

- Locate Colorado Corporation Llc and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Corporation Llc and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the steps to form a Colorado corporation using airSlate SignNow?

To form a Colorado corporation using airSlate SignNow, you first need to complete the necessary documents to officially register your corporation with the state. airSlate SignNow simplifies this by allowing you to easily fill, sign, and send your paperwork online. Once submitted, you will receive confirmation of your registration, and you can securely store all related documents in one place.

-

How much does it cost to form a Colorado corporation with airSlate SignNow?

The cost to form a Colorado corporation with airSlate SignNow varies depending on the services you choose. Our platform offers competitive pricing, ensuring you have access to essential tools for document preparation and signing. Additionally, you may incur state filing fees, which are separate from the costs of using our service.

-

What features does airSlate SignNow provide for forming a Colorado corporation?

airSlate SignNow provides a suite of features to help you effectively form a Colorado corporation, including customizable templates and a user-friendly interface. You can easily create, edit, and eSign documents, ensuring compliance with Colorado regulations. Integration with other software tools further streamlines your business processes.

-

What are the benefits of using airSlate SignNow to form a Colorado corporation?

Using airSlate SignNow to form a Colorado corporation offers numerous benefits, including time savings and increased efficiency. Our easy-to-use platform allows you to manage all your documents digitally, reducing paperwork and minimizing errors. Plus, you can track the status of your documents in real time.

-

Can I integrate airSlate SignNow with other tools while forming a Colorado corporation?

Yes, airSlate SignNow can be integrated with various business tools and software applications, making it easier for you to manage your entire document workflow as you form a Colorado corporation. Popular integrations include CRM systems and payment processors, ensuring you can operate seamlessly across your platforms.

-

Is it necessary to hire an attorney to form a Colorado corporation with airSlate SignNow?

While it’s not mandatory to hire an attorney to form a Colorado corporation using airSlate SignNow, consulting with a legal expert can provide personalized guidance. Our platform offers comprehensive resources to help you understand the formation process, but an attorney may help address specific legal concerns unique to your business.

-

How does airSlate SignNow ensure the security of my documents when forming a Colorado corporation?

airSlate SignNow prioritizes the security of your documents by utilizing advanced encryption protocols to protect sensitive information during the process of forming a Colorado corporation. Our platform also provides secure cloud storage, so you can rest assured that your important documents are safeguarded from unauthorized access.

Get more for Colorado Corporation Llc

Find out other Colorado Corporation Llc

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF