MS Employee's Withholding Exemption Certificate PDF 2022

What is the MS Employee's Withholding Exemption Certificate?

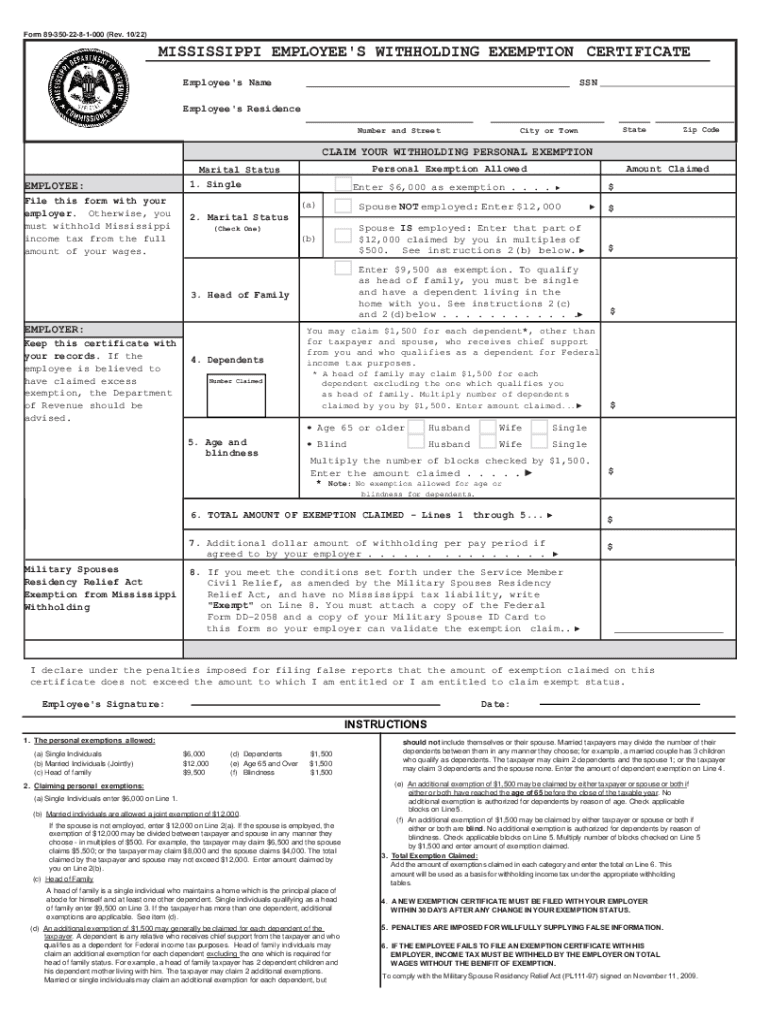

The MS Employee's Withholding Exemption Certificate, commonly referred to as the Mississippi withholding form, is a crucial document for employees in Mississippi. This form allows employees to claim exemptions from state income tax withholding. By completing this certificate, employees can adjust the amount of state taxes withheld from their paychecks, which can be particularly beneficial for those who qualify for exemptions based on their financial situation or personal circumstances.

How to Complete the MS Employee's Withholding Exemption Certificate

Filling out the Mississippi withholding form involves several straightforward steps. First, gather your personal information, including your name, address, and Social Security number. Next, indicate your filing status and any exemptions you are claiming. It is essential to accurately assess your eligibility for exemptions to avoid under-withholding, which could lead to tax liabilities later. Once completed, review the form for accuracy before submitting it to your employer.

Key Elements of the MS Employee's Withholding Exemption Certificate

Understanding the key elements of the Mississippi withholding form is vital for proper completion. The form typically includes sections for personal information, filing status, and the number of exemptions claimed. Additionally, it may require you to provide information regarding any additional amounts you wish to withhold. Familiarizing yourself with these elements can help ensure that you fill out the form correctly and in accordance with Mississippi tax regulations.

Eligibility Criteria for the MS Employee's Withholding Exemption Certificate

To qualify for exemptions on the Mississippi withholding form, employees must meet specific eligibility criteria. Generally, individuals who expect to owe no Mississippi income tax for the current year and had no tax liability in the previous year may qualify. Additionally, certain factors such as income level, filing status, and dependents can influence eligibility. It is advisable to review these criteria carefully to determine your qualification status.

Form Submission Methods for the MS Employee's Withholding Exemption Certificate

Once the Mississippi withholding form is completed, it must be submitted to your employer. This can typically be done in person or via email, depending on your employer's policies. Some employers may also allow submission through a secure online portal. It is important to check with your employer regarding their preferred submission method to ensure your form is processed correctly and in a timely manner.

Legal Use of the MS Employee's Withholding Exemption Certificate

The legal use of the Mississippi withholding form is essential for both employees and employers. This form must be completed accurately to comply with state tax laws. Misrepresentation or failure to submit the form can result in penalties for both parties. Therefore, understanding the legal implications of the form and ensuring that it is filled out correctly is crucial for maintaining compliance with Mississippi tax regulations.

Quick guide on how to complete ms employees withholding exemption certificatepdf

Easily prepare MS Employee's Withholding Exemption Certificate pdf on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage MS Employee's Withholding Exemption Certificate pdf on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to edit and electronically sign MS Employee's Withholding Exemption Certificate pdf effortlessly

- Find MS Employee's Withholding Exemption Certificate pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details with specific tools that airSlate SignNow supplies for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign MS Employee's Withholding Exemption Certificate pdf while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ms employees withholding exemption certificatepdf

Create this form in 5 minutes!

How to create an eSignature for the ms employees withholding exemption certificatepdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi withholding form 2023?

The Mississippi withholding form 2023 is a state-mandated document used by employers to report employee income tax withholdings. It's essential for compliance with state tax regulations and helps ensure that employees' taxes are appropriately deducted from their paychecks.

-

How can airSlate SignNow help with the Mississippi withholding form 2023?

airSlate SignNow allows businesses to easily send and eSign the Mississippi withholding form 2023, streamlining the document management process. With our solution, you can quickly prepare and send this form, ensuring that it's filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Mississippi withholding form 2023?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs. Our cost-effective solution provides access to essential features for managing the Mississippi withholding form 2023, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for managing the Mississippi withholding form 2023?

airSlate SignNow includes features like customizable templates, electronic signatures, and secure document storage, specifically designed to streamline the completion of the Mississippi withholding form 2023. These features enhance efficiency and ensure compliance with state taxation requirements.

-

Can airSlate SignNow integrate with other software for handling the Mississippi withholding form 2023?

Yes, airSlate SignNow offers integrations with various accounting and HR software, making it easier to manage the Mississippi withholding form 2023 alongside your regular payroll tasks. These integrations facilitate a seamless workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Mississippi withholding form 2023?

Using airSlate SignNow for the Mississippi withholding form 2023 simplifies your document management process and boosts compliance with tax regulations. Our platform ensures documents are sent, signed, and filed promptly, reducing administrative burdens and associated errors.

-

How do I get started with airSlate SignNow for the Mississippi withholding form 2023?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose a suitable pricing plan, and you can begin creating and sending the Mississippi withholding form 2023 immediately. Our user-friendly interface guides you through every step of the process.

Get more for MS Employee's Withholding Exemption Certificate pdf

Find out other MS Employee's Withholding Exemption Certificate pdf

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement