Primarys Legal Name 2022

Understanding the Arkansas Capital

The term "Arkansas capital" typically refers to the capital city of Arkansas, which is Little Rock. This city serves as the political and administrative center of the state. It is essential to understand the significance of the capital when dealing with state-specific forms, such as the Arkansas AR1000D form, which relates to capital gains. Knowing the capital's location can also help in understanding local regulations and procedures that may affect your documentation.

Legal Use of the Arkansas Capital in Documentation

When filling out forms related to capital gains in Arkansas, it is crucial to use the correct legal name of the capital. This ensures that documents are processed accurately. The Arkansas capital plays a role in various legal contexts, particularly in tax filings. For instance, the Arkansas Department of Finance and Administration oversees tax regulations, and referencing Little Rock correctly in your documents can help avoid complications.

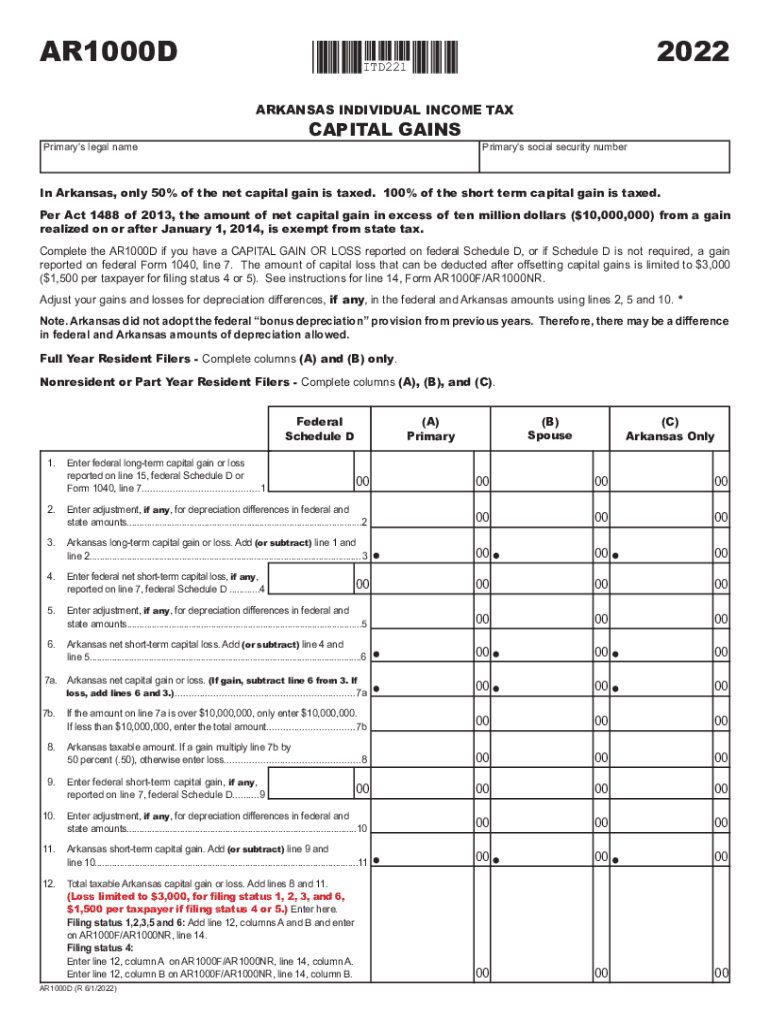

Steps to Complete the Arkansas AR1000D Form

Completing the Arkansas AR1000D form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including records of capital gains and losses. Next, accurately fill out the form, ensuring that you include your legal name and the correct details regarding your capital assets. After completing the form, review it for any errors before submission. This careful approach can help prevent issues with the Arkansas Department of Finance and Administration.

Required Documents for Arkansas Capital Gains Filing

To file for capital gains in Arkansas, specific documents are required. These typically include proof of the sale of assets, purchase receipts, and any relevant tax documents from previous years. Additionally, if applicable, you may need to provide documentation that supports claims of exemptions or deductions. Having these documents ready can facilitate a smoother filing process and ensure compliance with state regulations.

Filing Deadlines for Arkansas Capital Gains

Staying informed about filing deadlines is essential for compliance. For capital gains in Arkansas, the tax return is generally due on April 15 of the following year after the income was earned. If you need more time, you can file for an extension, but it is important to understand that this does not extend the payment deadline. Missing these deadlines can result in penalties, so keeping track of them is crucial.

IRS Guidelines for Reporting Capital Gains

When dealing with capital gains, it is important to adhere to IRS guidelines. The IRS requires taxpayers to report capital gains on their federal tax returns. This includes both short-term and long-term capital gains, which are taxed differently. Understanding these guidelines can help you accurately report your gains and comply with both federal and state tax regulations.

Quick guide on how to complete primarys legal name

Complete Primarys Legal Name effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it in the cloud. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without any delays. Handle Primarys Legal Name on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Primarys Legal Name with ease

- Obtain Primarys Legal Name and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your PC.

Forget about misplaced or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Primarys Legal Name to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct primarys legal name

Create this form in 5 minutes!

How to create an eSignature for the primarys legal name

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Arkansas capital?

airSlate SignNow is a powerful eSignature solution that allows businesses in the Arkansas capital, Little Rock, to send and sign documents efficiently. It streamlines the signing process, ensuring that companies can manage contracts and agreements with ease, ultimately benefiting operations and compliance.

-

What features does airSlate SignNow offer for businesses in Arkansas capital?

airSlate SignNow provides essential features like customizable templates, real-time tracking, and automated reminders, all tailored for users in Arkansas capital. These capabilities enhance workflow efficiency and ensure that important documents are completed promptly, reducing operational downtime.

-

How much does airSlate SignNow cost for businesses in Arkansas capital?

Pricing for airSlate SignNow is competitive and designed to fit the budgets of businesses in Arkansas capital, with various plans available to suit different needs. You can choose a pricing tier based on your document signing volume and requirements, allowing for flexibility as your business grows.

-

Can airSlate SignNow integrate with other software commonly used in Arkansas capital?

Yes, airSlate SignNow integrates seamlessly with popular software applications frequently used by businesses in Arkansas capital, such as CRM systems and project management tools. This ensures that users can adopt airSlate SignNow without disrupting existing workflows, enhancing productivity.

-

What are the benefits of using airSlate SignNow for companies in Arkansas capital?

Companies in the Arkansas capital can enjoy signNow benefits from using airSlate SignNow, including faster document turnaround times and improved security for electronic signatures. By adopting this solution, businesses can enhance their efficiency and ensure compliance with local regulations.

-

Is airSlate SignNow secure for eSignatures in Arkansas capital?

Absolutely, airSlate SignNow employs industry-leading security measures to protect electronic signatures, making it a safe choice for businesses in Arkansas capital. With encryption and secure storage, users can confidently manage their confidential documents without worrying about bsignNowes.

-

How user-friendly is airSlate SignNow for those in the Arkansas capital region?

airSlate SignNow is designed with user experience in mind, making it easy for businesses in the Arkansas capital to navigate the platform. Its intuitive interface allows users to send, sign, and manage documents quickly, minimizing the learning curve and maximizing efficiency.

Get more for Primarys Legal Name

- Harmless form

- Texas from form

- Warranty deed one individual to two individuals texas form

- Petition for release of excess proceeds and notice of hearing texas form

- Quitclaim deed from two 2 individuals to two 2 individuals texas form

- Lady bird deed sample 497327373 form

- Warranty deed grantee 497327374 form

- Texas deed royalty form

Find out other Primarys Legal Name

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free