Estimated Income Tax Penalty E Form RS Login 2022

Understanding the AR2210 Form

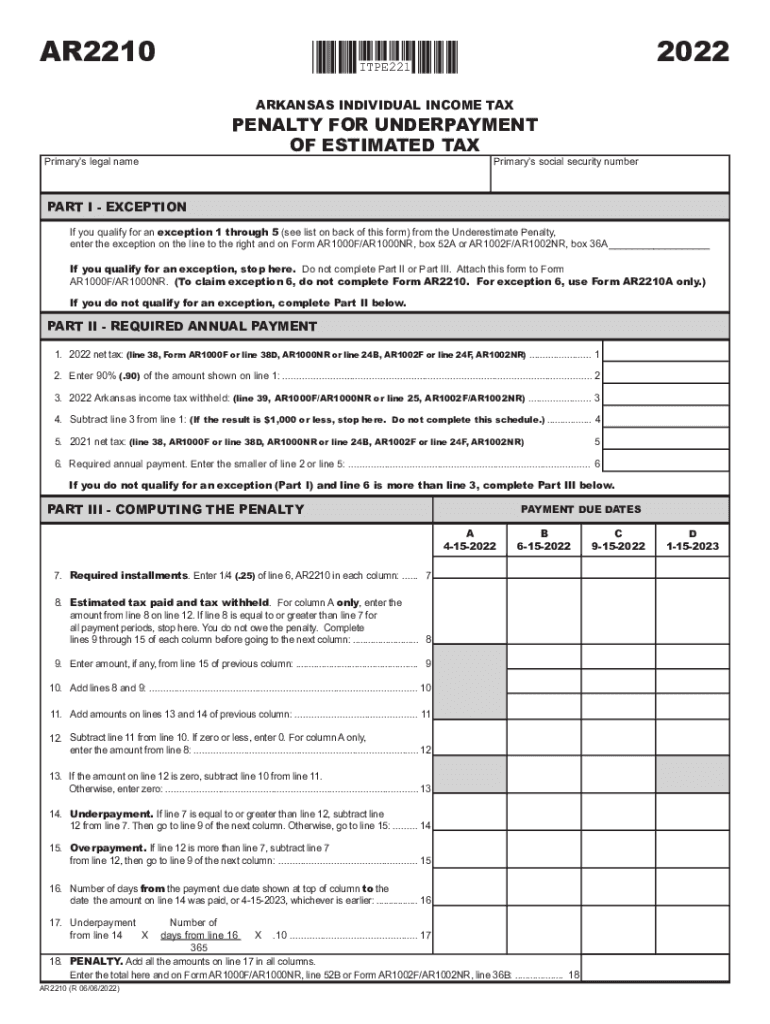

The AR2210 form is utilized by taxpayers in Arkansas to report and calculate underpayment of estimated income tax. This form is essential for individuals who may not have had sufficient tax withheld from their income throughout the year. By accurately completing the AR2210, taxpayers can determine if they owe a penalty for underpayment, ensuring compliance with state tax regulations.

Steps to Complete the AR2210 Form

Filling out the AR2210 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total income and the estimated tax owed for the year.

- Determine the amount of tax already paid through withholding or estimated payments.

- Use the AR2210 worksheet to calculate any potential underpayment penalty.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

Filing Deadlines for the AR2210 Form

Timely submission of the AR2210 form is crucial to avoid additional penalties. The form is typically due on the same date as your state income tax return. For most taxpayers, this means filing by April 15. However, if you file for an extension, ensure you submit the AR2210 by the extended deadline to remain compliant.

Legal Use of the AR2210 Form

The AR2210 form holds legal significance as it helps taxpayers report underpayment accurately. This form must be completed in accordance with Arkansas tax laws. Proper use of the AR2210 can protect taxpayers from penalties and interest charges associated with underpayment, provided that the form is submitted correctly and on time.

Required Documents for the AR2210 Form

To complete the AR2210 form, you will need several documents:

- Previous year’s tax return for reference.

- W-2 forms from employers to report income.

- 1099 forms for any additional income sources.

- Records of estimated tax payments made during the year.

- Any other documentation that supports income and deductions claimed.

Penalties for Non-Compliance with the AR2210 Form

Failing to file the AR2210 form or underreporting income can result in significant penalties. Arkansas imposes interest on unpaid taxes and may charge a penalty for underpayment. It is important to complete and submit the form to avoid these financial repercussions.

Quick guide on how to complete estimated income tax penalty e form rs login

Complete Estimated Income Tax Penalty E Form RS Login seamlessly on any device

Digital document management has become favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Estimated Income Tax Penalty E Form RS Login on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to amend and electronically sign Estimated Income Tax Penalty E Form RS Login with minimal effort

- Find Estimated Income Tax Penalty E Form RS Login and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Estimated Income Tax Penalty E Form RS Login to ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estimated income tax penalty e form rs login

Create this form in 5 minutes!

How to create an eSignature for the estimated income tax penalty e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar2210 feature in airSlate SignNow?

The ar2210 feature in airSlate SignNow enhances the document signing experience by streamlining the process. It allows users to easily manage and track document statuses, ensuring that every signature is captured efficiently. With ar2210, businesses can signNowly improve their workflow.

-

How does pricing work for airSlate SignNow's ar2210?

airSlate SignNow offers competitive pricing for the ar2210 feature, providing various plans to suit different business needs. Each plan includes access to essential tools for document management and eSigning, making it a cost-effective solution. You can choose a plan based on your budget and usage requirements.

-

What are the main benefits of using airSlate SignNow ar2210?

The primary benefits of using the ar2210 feature in airSlate SignNow include improved efficiency and reduced turnaround time for document signing. By leveraging intuitive tools for eSigning and document tracking, businesses can save time and minimize errors. Additionally, ar2210 enhances collaboration among team members.

-

Can I integrate airSlate SignNow's ar2210 with other applications?

Yes, airSlate SignNow's ar2210 feature supports integration with various applications, making it versatile for diverse business environments. You can easily connect it with popular tools like Google Drive, Salesforce, and more, streamlining your document workflow. This integration capability helps in maintaining a seamless operation.

-

Is there a mobile app for airSlate SignNow featuring ar2210?

Absolutely! airSlate SignNow provides a mobile app that includes the ar2210 feature for on-the-go document signing. This mobile functionality allows users to manage their documents efficiently, ensuring they can eSign and send files from anywhere. Its user-friendly interface makes mobile signing quick and hassle-free.

-

How secure is the ar2210 feature in airSlate SignNow?

The ar2210 feature in airSlate SignNow is designed with security in mind, employing advanced encryption and compliance standards to protect your documents. This gives users peace of mind when eSigning or sharing sensitive information. airSlate SignNow prioritizes data security, allowing businesses to conduct transactions confidently.

-

What types of documents can I sign using airSlate SignNow ar2210?

With the ar2210 feature in airSlate SignNow, you can sign various types of documents, including contracts, agreements, and forms. The flexibility allows you to handle legal, financial, and business documents efficiently. This versatility makes airSlate SignNow a valuable tool for any organization needing reliable eSignature solutions.

Get more for Estimated Income Tax Penalty E Form RS Login

Find out other Estimated Income Tax Penalty E Form RS Login

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors