Instructions for Form 2210 Internal Revenue Service 2022

What is the Instructions for Form 2210?

The Instructions for Form 2210 provide essential guidance for taxpayers who need to determine whether they owe a penalty for underpayment of estimated tax. This form is particularly relevant for individuals who do not have sufficient withholding or estimated tax payments throughout the year. Understanding these instructions is crucial for accurate tax filing and compliance with Internal Revenue Service (IRS) requirements.

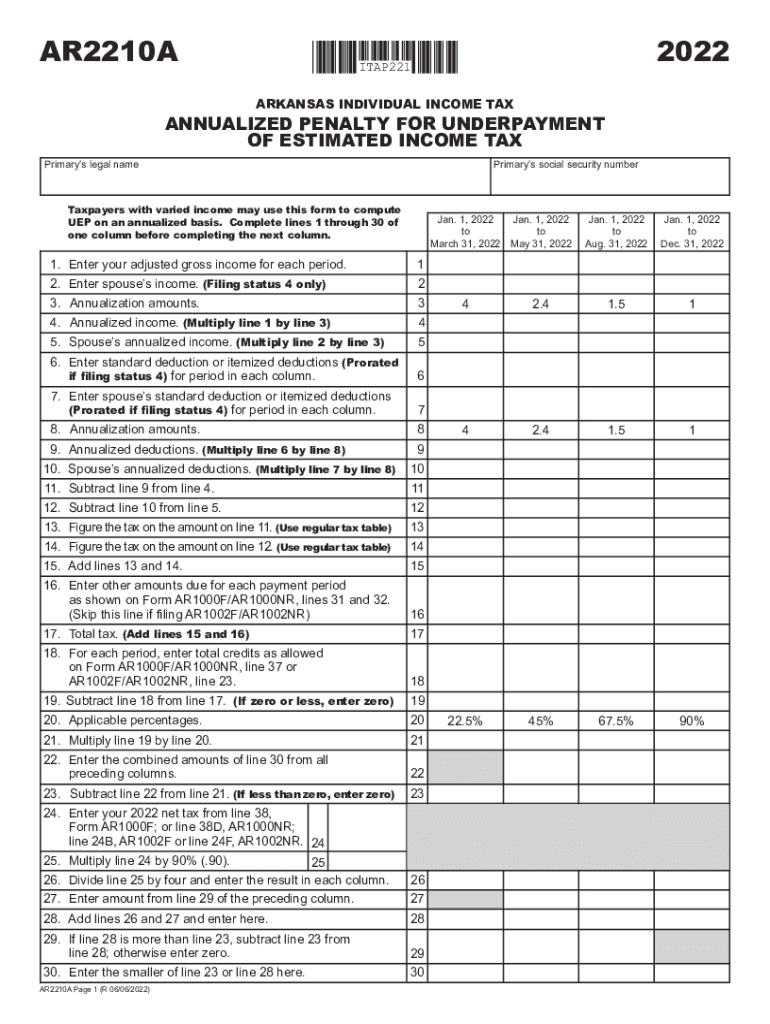

Form 2210 is used to calculate the penalty for underpayment of estimated tax, which may apply if a taxpayer owes more than a specific amount at the end of the tax year. The instructions outline the steps to determine if the penalty applies, how to compute it, and the exceptions that may exempt a taxpayer from owing this penalty.

Steps to Complete the Instructions for Form 2210

Completing the Instructions for Form 2210 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, follow these steps:

- Calculate your total tax liability: Determine the total amount of tax you owe for the year.

- Assess your withholding and estimated payments: Add up all the taxes withheld from your income and any estimated tax payments made throughout the year.

- Compare the amounts: If your total payments are less than your total tax liability, you may be subject to a penalty.

- Use the worksheet provided: The instructions include a worksheet to help you calculate the exact penalty amount.

- Complete the form: Fill out Form 2210 accurately, using the calculated figures from your assessment.

Legal Use of the Instructions for Form 2210

The Instructions for Form 2210 are legally binding guidelines provided by the IRS. They ensure that taxpayers understand their obligations regarding estimated tax payments and penalties for underpayment. Adhering to these instructions is essential for legal compliance and can help prevent unnecessary penalties or legal issues with the IRS.

Using these instructions correctly can also provide clarity on various exceptions and special circumstances that may apply, such as being a farmer or fisherman, which can alter the standard requirements for estimated tax payments.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 2210 is crucial for taxpayers. Generally, the deadline for filing your federal income tax return is April 15. If you are required to file Form 2210, it should be submitted along with your tax return by this date. However, if you file for an extension, you have until October 15 to submit your tax return and any accompanying forms, including Form 2210.

It is important to note that if you miss these deadlines, you may incur additional penalties and interest on any unpaid taxes. Staying informed about these dates can help you avoid unnecessary complications.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the Instructions for Form 2210 can result in penalties. If you underpay your estimated taxes, the IRS may impose a penalty based on the amount of underpayment and the duration of the underpayment period. This penalty is calculated using a specific interest rate set by the IRS, which can change quarterly.

Additionally, if you do not file Form 2210 when required, you may face further penalties, which can accumulate over time. It is essential to understand these consequences to maintain compliance and avoid financial repercussions.

Examples of Using the Instructions for Form 2210

Examples can help clarify how to apply the Instructions for Form 2210 in various scenarios. For instance, a self-employed individual who experiences fluctuating income may need to use this form to determine if they owe a penalty for underpayment. By following the steps outlined in the instructions, they can assess their estimated tax payments against their total tax liability.

Another example involves a taxpayer who had significant income from investments. If their withholding was insufficient to cover their tax liability, they would use Form 2210 to calculate any penalties and ensure they meet their tax obligations accurately.

Quick guide on how to complete instructions for form 2210 2022internal revenue service

Complete Instructions For Form 2210 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed files, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Handle Instructions For Form 2210 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Instructions For Form 2210 Internal Revenue Service effortlessly

- Find Instructions For Form 2210 Internal Revenue Service and click on Obtain Form to initiate.

- Utilize the tools we provide to finish your form.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finished button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Instructions For Form 2210 Internal Revenue Service and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 2210 2022internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2210 2022internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2210 and who needs it?

Form 2210 is a U.S. tax form used to determine if a taxpayer has underpaid their estimated tax for the year. Individuals who owe a penalty for underpayment of estimated taxes must file this form. Understanding what Form 2210 is can help taxpayers avoid unexpected penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with submitting Form 2210?

airSlate SignNow provides an efficient platform for signing and submitting important documents like Form 2210 electronically. With its easy-to-use interface, users can expedite the signing process, ensuring that Form 2210 is submitted on time and in compliance with IRS requirements. This helps in minimizing the risk of penalties associated with filing errors.

-

Is there a cost associated with using airSlate SignNow for Form 2210?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including the ability to manage Form 2210. By investing in a targeted solution like SignNow, users can save time and reduce errors associated with manual processing. The cost is often justified by the increased efficiency and compliance it provides.

-

What features does airSlate SignNow offer to help with tax forms like Form 2210?

airSlate SignNow includes features such as document templates, eSignature capabilities, and automated reminders that simplify the submission of tax forms like Form 2210. These features help streamline the process and ensure that all necessary signatures are obtained, reducing the likelihood of delays and penalties. Overall, SignNow enhances the user experience when handling important tax documents.

-

Can airSlate SignNow integrate with tax preparation software for Form 2210?

Absolutely! airSlate SignNow can integrate with various tax preparation software, allowing users to seamlessly manage Form 2210. This integration facilitates easy data transfer and ensures that all documents are synchronized, making the entire tax filing process more efficient. Users can streamline their work without having to toggle between multiple applications.

-

What benefits does using airSlate SignNow provide for businesses handling Form 2210?

Using airSlate SignNow offers businesses numerous benefits, including increased efficiency, compliance assurance, and reduced risk of errors when filing Form 2210. The platform allows teams to collaborate easily and securely, ensuring that tax documents are processed in a timely manner. The overall result is a more organized approach to tax compliance.

-

How secure is airSlate SignNow when handling sensitive documents like Form 2210?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to safeguard sensitive documents like Form 2210. By ensuring that all data is transmitted securely, users can confidently manage their tax documents without worrying about unauthorized access or data bsignNowes.

Get more for Instructions For Form 2210 Internal Revenue Service

- Warranty trust 497327963 form

- General warranty deed pdf form

- General warranty deed for two individuals to husband and wife with vendors lien texas form

- Gift deed form sample

- Tx warranty deed 497327967 form

- General warranty 497327968 form

- General warranty deed for individual to nonprofit corporation texas form

- Quitclaim deed husband form

Find out other Instructions For Form 2210 Internal Revenue Service

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF