Quitclaim Deed from Husband and Wife to LLC Connecticut Form

What is the Quitclaim Deed From Husband And Wife To LLC Connecticut

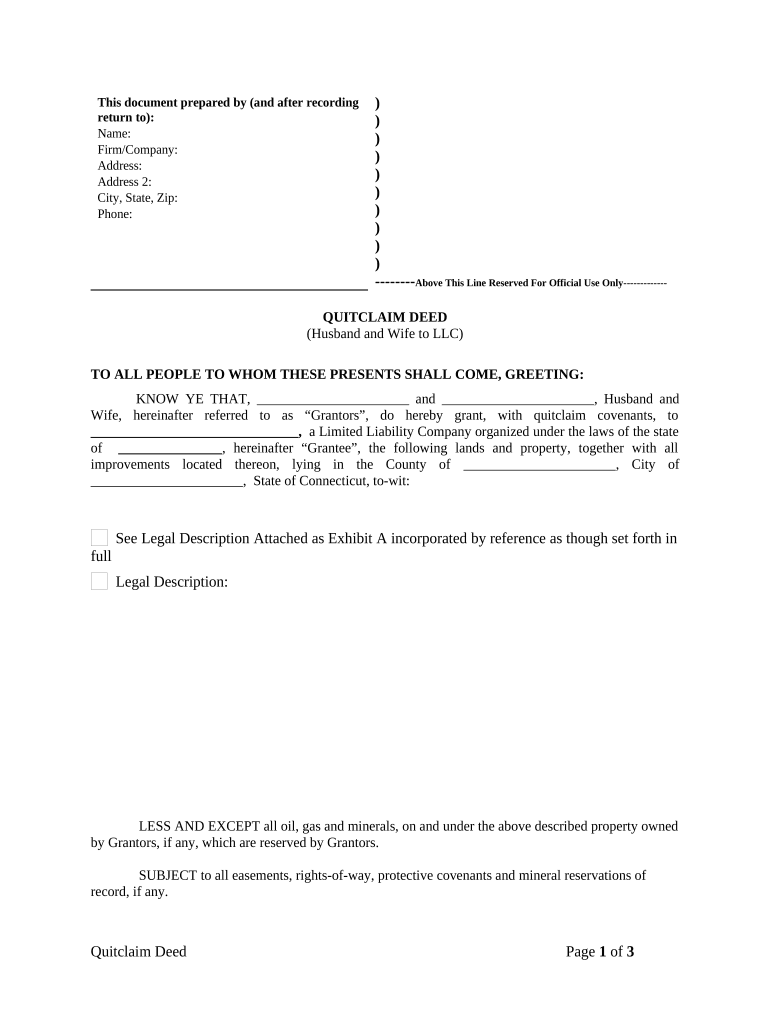

A quitclaim deed from husband and wife to an LLC in Connecticut is a legal document that transfers ownership of property from a married couple to a limited liability company. This type of deed is often used when couples want to transfer their real estate holdings into a business entity for liability protection or tax benefits. Unlike a warranty deed, a quitclaim deed does not guarantee that the property title is free of claims or encumbrances; it simply conveys whatever interest the grantors have in the property at the time of the transfer.

Key Elements of the Quitclaim Deed From Husband And Wife To LLC Connecticut

Several key elements must be included in the quitclaim deed to ensure its validity in Connecticut:

- Names of the Grantors: The full legal names of both husband and wife must be clearly stated.

- LLC Information: The name of the LLC receiving the property must be included, along with its business address.

- Property Description: A detailed description of the property being transferred, including its address and any legal descriptions.

- Consideration: The deed should specify the consideration, or payment, involved in the transfer, even if it is nominal.

- Signatures: Both spouses must sign the deed in the presence of a notary public to validate the transfer.

Steps to Complete the Quitclaim Deed From Husband And Wife To LLC Connecticut

Completing a quitclaim deed involves several steps to ensure that the transfer is legally binding:

- Gather Information: Collect all necessary information about the property, including the legal description and the names of the parties involved.

- Draft the Deed: Use a template or legal software to draft the quitclaim deed, ensuring all required elements are included.

- Review and Sign: Both spouses should review the document for accuracy and sign it in front of a notary public.

- File the Deed: Submit the signed quitclaim deed to the local land records office in Connecticut to officially record the transfer.

Legal Use of the Quitclaim Deed From Husband And Wife To LLC Connecticut

The quitclaim deed serves a specific legal purpose in Connecticut. It is primarily used to transfer property ownership without warranties, making it suitable for situations where the grantors may not have clear title or when transferring property between family members and business entities. It is important to note that while this deed is legally recognized, it does not protect the grantees against any claims or liens on the property.

State-Specific Rules for the Quitclaim Deed From Husband And Wife To LLC Connecticut

Connecticut has specific rules governing the execution and recording of quitclaim deeds. These include:

- Notarization: The signatures of both spouses must be notarized.

- Recording Requirements: The deed must be recorded in the town where the property is located to be enforceable against third parties.

- Transfer Tax: Depending on the value of the property, a transfer tax may apply, and the appropriate forms must be submitted with the deed.

How to Obtain the Quitclaim Deed From Husband And Wife To LLC Connecticut

Obtaining a quitclaim deed in Connecticut can be done through various means:

- Legal Templates: Many online legal services offer templates for quitclaim deeds that can be customized for your specific situation.

- Consulting an Attorney: For complex situations, it may be beneficial to consult a real estate attorney to ensure compliance with state laws.

- Local Land Records Office: You may also obtain forms directly from your local land records office, which often provides guidance on completing the deed correctly.

Quick guide on how to complete quitclaim deed from husband and wife to llc connecticut

Complete Quitclaim Deed From Husband And Wife To LLC Connecticut effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Quitclaim Deed From Husband And Wife To LLC Connecticut on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Quitclaim Deed From Husband And Wife To LLC Connecticut with ease

- Search for Quitclaim Deed From Husband And Wife To LLC Connecticut and click Get Form to begin.

- Take advantage of the provided tools to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign Quitclaim Deed From Husband And Wife To LLC Connecticut while ensuring exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To LLC in Connecticut?

A Quitclaim Deed From Husband And Wife To LLC in Connecticut is a legal document that allows a couple to transfer their property rights to a Limited Liability Company (LLC). This type of deed is often used when couples want to protect their assets within a business structure or to facilitate property management. Understanding this deed is crucial for property owners looking to make streamlined ownership transitions.

-

How can I create a Quitclaim Deed From Husband And Wife To LLC in Connecticut using airSlate SignNow?

With airSlate SignNow, creating a Quitclaim Deed From Husband And Wife To LLC in Connecticut is straightforward. Our platform offers customizable templates and an easy-to-use interface for drafting and signing your deed electronically. You can complete the process from anywhere, ensuring that you meet all legal requirements.

-

What are the benefits of using airSlate SignNow for my Quitclaim Deed From Husband And Wife To LLC in Connecticut?

Using airSlate SignNow for your Quitclaim Deed From Husband And Wife To LLC in Connecticut provides several benefits. It ensures secure, efficient, and legally binding document handling with electronic signatures. Additionally, the platform simplifies tracking and managing your document workflow, making the process smoother.

-

What is the cost to file a Quitclaim Deed From Husband And Wife To LLC in Connecticut via airSlate SignNow?

The cost of filing a Quitclaim Deed From Husband And Wife To LLC in Connecticut through airSlate SignNow varies based on the subscription plan you choose. We offer cost-effective options that cater to different usage needs, ensuring flexibility for individuals and businesses. Check our pricing page for detailed information about plans that include document preparation and filing.

-

Are electronic signatures valid for a Quitclaim Deed From Husband And Wife To LLC in Connecticut?

Yes, electronic signatures are valid for a Quitclaim Deed From Husband And Wife To LLC in Connecticut, provided they meet state-specific requirements. airSlate SignNow complies with legal standards to ensure that your electronic signatures hold up in court. Always confirm that your deed meets any additional local regulations.

-

Can I integrate airSlate SignNow with other software for managing my Quitclaim Deed From Husband And Wife To LLC in Connecticut?

Absolutely! airSlate SignNow offers integration with various software, including CRM systems and cloud storage solutions. This allows for seamless document management and easy access to your Quitclaim Deed From Husband And Wife To LLC in Connecticut whenever you need it, streamlining your workflow.

-

Is there customer support available for questions about the Quitclaim Deed From Husband And Wife To LLC in Connecticut?

Yes, airSlate SignNow provides robust customer support for all users including those preparing a Quitclaim Deed From Husband And Wife To LLC in Connecticut. Whether you have questions regarding the process, features, or pricing, our support team is ready to assist you through chat, email, or phone.

Get more for Quitclaim Deed From Husband And Wife To LLC Connecticut

- A musical story worksheet answer key form

- Arthur burke form

- Form f 39599249

- City of tshwane application for the expanded public works programme database form

- Afgis death claim form

- Medicaid renewal form nyc

- 10x10 coordinate plane pdf form

- Bitte ankreuzen welche aussagen auf das antrag stellende unternehmen zutrifftzutreffen form

Find out other Quitclaim Deed From Husband And Wife To LLC Connecticut

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now