Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Connecticut Form

What is the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

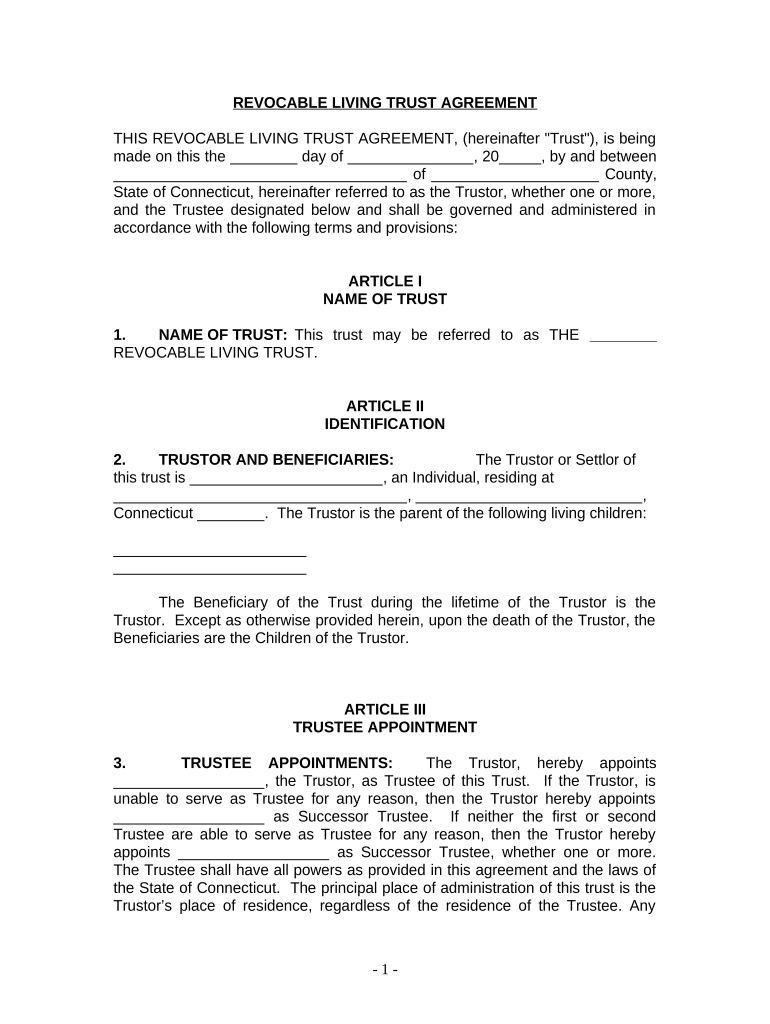

A living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Connecticut, a living trust can provide a structured way to protect their children's inheritance and ensure their wishes are followed. This type of trust can help avoid the probate process, which can be time-consuming and costly, allowing for a smoother transition of assets to beneficiaries.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

Several key elements define a living trust for individuals in this demographic. These include:

- Trustee Designation: The individual creating the trust (the grantor) can act as the trustee, managing the assets during their lifetime.

- Beneficiary Designation: The grantor can specify their children or other beneficiaries who will receive the assets upon their passing.

- Asset Management: The trust allows for the management of assets, including real estate and financial accounts, ensuring they are handled according to the grantor's wishes.

- Revocability: Most living trusts are revocable, meaning the grantor can alter or dissolve the trust at any point during their lifetime.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

Creating a living trust involves several essential steps:

- Determine Your Assets: Identify all assets you wish to include in the trust, such as property, bank accounts, and investments.

- Select a Trustee: Choose a trustworthy individual or institution to manage the trust.

- Draft the Trust Document: Create the trust document, outlining the terms, beneficiaries, and trustee responsibilities.

- Fund the Trust: Transfer ownership of the identified assets into the trust, ensuring they are legally part of the trust.

- Review and Update: Regularly review the trust to ensure it reflects your current wishes and circumstances, especially after major life changes.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

The legal use of a living trust in Connecticut is governed by state laws. It is essential to ensure that the trust complies with Connecticut statutes to be enforceable. This includes proper execution of the trust document, which typically requires the grantor's signature and may need to be notarized. Additionally, the trust must be funded correctly, with assets transferred into the trust to ensure they are managed according to the grantor's wishes.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

Connecticut has specific rules regarding living trusts that individuals should be aware of:

- Probate Avoidance: A properly funded living trust can help bypass the probate process in Connecticut, allowing for quicker distribution of assets.

- Tax Implications: Living trusts do not typically affect income tax, but it is advisable to consult a tax professional for specific guidance.

- Asset Protection: While living trusts offer some protection from probate, they do not provide protection from creditors unless structured as an irrevocable trust.

How to Obtain the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Connecticut

Obtaining a living trust can be accomplished through several avenues:

- Legal Assistance: Consulting with an estate planning attorney can ensure that the trust is tailored to your specific needs and complies with Connecticut laws.

- Online Resources: Various online platforms provide templates and guidance for creating a living trust, although professional legal advice is recommended for complex situations.

- Financial Institutions: Some banks and financial service providers offer trust services that can assist in setting up a living trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children connecticut

Easily Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents promptly without delays. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven operation today.

The Easiest Way to Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut Effortlessly

- Obtain Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to keep your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut is a legal document that allows individuals to manage their assets during their lifetime and outline their distributions after death. This type of trust is particularly useful for individuals with children, ensuring their assets are protected and passed on according to their wishes. It simplifies the legal process and can help avoid probate.

-

How can a Living Trust benefit single, divorced, or widowed individuals with children in Connecticut?

A Living Trust provides signNow benefits for single, divorced, or widowed individuals with children in Connecticut by ensuring that their assets are distributed according to their wishes. It helps to avoid the lengthy probate process, saving time and money, while also offering privacy since the trust does not go through public probate court. Additionally, it allows for seamless management of the estate in case of incapacity.

-

What is the cost of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut?

The cost of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut can vary based on the complexity of your estate and the services you choose. Typically, fees range from a few hundred to several thousand dollars if you hire a professional attorney. Using online platforms like airSlate SignNow can offer a more cost-effective solution for creating such trusts.

-

How does airSlate SignNow facilitate the creation of a Living Trust For Individuals in Connecticut?

airSlate SignNow offers user-friendly templates and eSigning capabilities that make creating a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut straightforward and efficient. Users can customize their trust documents with ease and securely sign them online, all while ensuring compliance with state laws. This accessibility can greatly benefit those unfamiliar with legal processes.

-

Are Living Trusts difficult to manage after they're created?

Managing a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut is generally not complicated, especially with the right tools. Once established, the trustee can manage the assets without court intervention, and airSlate SignNow provides ongoing support and resources for seamless management. Regular reviews are advisable to ensure that the trust remains aligned with your changing circumstances.

-

Can I change my Living Trust after it has been created?

Yes, you can change your Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut at any time while you are alive and competent. This flexibility allows you to adjust the terms, add or remove assets, or update beneficiaries as your life circumstances change. It is recommended to document any changes through a formal amendment to ensure clarity and legality.

-

What happens to a Living Trust in the event of the trustee's death?

In the event of the trustee's death, a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Connecticut can provide a clear succession plan. The trust documents typically outline who will take over as the successor trustee, ensuring that management of the trust is uninterrupted. This continuity helps protect the interests of your children and other beneficiaries during transitional periods.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Connecticut

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe