Business Credit Application District of Columbia Form

What is the Business Credit Application District Of Columbia

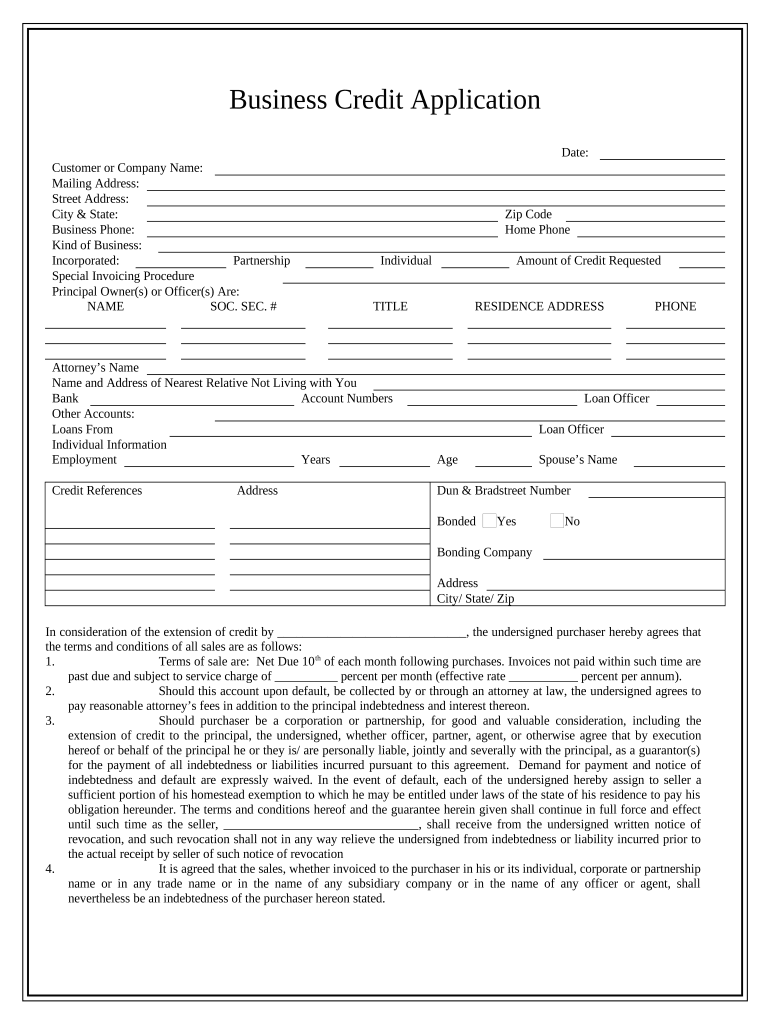

The Business Credit Application for the District of Columbia is a formal document that enables businesses to request credit from lenders or financial institutions. This application typically includes essential information about the business, such as its legal structure, financial history, and creditworthiness. By providing this information, businesses can facilitate the evaluation process for credit approval, which is crucial for managing cash flow and financing operations.

Steps to complete the Business Credit Application District Of Columbia

Completing the Business Credit Application involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including tax returns, bank statements, and profit and loss statements. Next, fill out the application form with detailed information about your business, including its name, address, and ownership structure. It is important to provide accurate financial data and any additional information requested by the lender. Finally, review the application for completeness and accuracy before submitting it digitally or via mail.

Legal use of the Business Credit Application District Of Columbia

The legal use of the Business Credit Application in the District of Columbia requires adherence to specific regulations governing financial transactions and credit applications. The application must be signed by authorized representatives of the business, and the information provided must be truthful and complete to avoid legal repercussions. Additionally, businesses should ensure compliance with federal and state laws regarding consumer protection and fair lending practices when submitting their applications.

Key elements of the Business Credit Application District Of Columbia

Key elements of the Business Credit Application include the business's legal name, contact information, and type of entity (such as LLC or corporation). Financial details such as revenue, expenses, and existing debts are crucial for assessing creditworthiness. The application may also require personal information from business owners, including Social Security numbers and personal credit history, to evaluate the overall risk associated with extending credit to the business.

Eligibility Criteria

Eligibility criteria for the Business Credit Application in the District of Columbia typically include factors such as the age of the business, revenue thresholds, and credit history. Lenders often look for businesses that have been operational for a minimum period, usually at least one year, and demonstrate consistent revenue streams. Additionally, a positive personal credit score of the business owners may also influence eligibility and approval rates.

Form Submission Methods

The Business Credit Application can be submitted through various methods, including online submissions via secure portals, mail, or in-person at designated financial institutions. Online submissions are often preferred due to their speed and convenience, allowing businesses to track the status of their applications in real-time. It is essential to follow the specific submission guidelines provided by the lender to ensure that the application is processed efficiently.

Quick guide on how to complete business credit application district of columbia

Effortlessly Prepare Business Credit Application District Of Columbia on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any holdups. Manage Business Credit Application District Of Columbia on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Business Credit Application District Of Columbia with Ease

- Locate Business Credit Application District Of Columbia and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require reprinting copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Business Credit Application District Of Columbia while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application District Of Columbia?

A Business Credit Application District Of Columbia is a formal document that businesses use to apply for credit from lenders. It typically requires information about the business's financial health, ownership structure, and credit history. Having this application prepared accurately can signNowly enhance your chances of securing credit.

-

How does airSlate SignNow facilitate the Business Credit Application District Of Columbia process?

airSlate SignNow simplifies the Business Credit Application District Of Columbia process by providing an efficient platform for document preparation and e-signatures. With its user-friendly interface, businesses can quickly create and send applications for credit, ensuring fast turnaround times and reducing paperwork. This streamlines the entire application process.

-

Are there any fees associated with the Business Credit Application District Of Columbia on airSlate SignNow?

While airSlate SignNow offers a free trial, pricing for the Business Credit Application District Of Columbia process depends on the selected subscription plan. These plans are designed to accommodate different business needs, ensuring cost-effectiveness while facilitating seamless document management. For detailed pricing, it's best to check our website.

-

What features does airSlate SignNow offer for the Business Credit Application District Of Columbia?

Key features of airSlate SignNow for the Business Credit Application District Of Columbia include customizable templates, secure e-signature capabilities, and document tracking. Additionally, users can collaborate in real-time and store all applications securely in the cloud. These features enhance efficiency and security throughout the application process.

-

What are the benefits of using airSlate SignNow for Business Credit Application District Of Columbia?

Using airSlate SignNow for your Business Credit Application District Of Columbia offers several benefits, including expedited processing times and reduced administrative burdens. The platform ensures that your documents are compliant and professionally presented. Furthermore, the ease of use helps businesses focus more on their core operations rather than paperwork.

-

Can airSlate SignNow integrate with other software for managing a Business Credit Application District Of Columbia?

Yes, airSlate SignNow offers integrations with various business applications to support the Business Credit Application District Of Columbia process. These integrations allow for seamless data transfer and enhance overall efficiency. Popular integrations include CRM systems, payment processors, and accounting software.

-

Is airSlate SignNow secure for handling sensitive Business Credit Applications District Of Columbia?

Absolutely! airSlate SignNow prioritizes security for all documents, including the Business Credit Application District Of Columbia. The platform utilizes encryption, secure servers, and access controls to ensure that your sensitive information remains protected throughout the application process. You can trust that your data is safe.

Get more for Business Credit Application District Of Columbia

Find out other Business Credit Application District Of Columbia

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now