Legal Last Will and Testament Form for a Widow or Widower with Adult Children District of Columbia

What is the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

The Legal Last Will And Testament Form for a widow or widower with adult children in the District of Columbia is a crucial document that outlines how a person's assets and affairs will be managed after their passing. This form is specifically designed for individuals who have lost their spouse and have adult children, allowing them to specify their wishes regarding asset distribution, guardianship, and other important matters. It serves to ensure that the deceased's intentions are honored and can help prevent disputes among heirs.

How to Use the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

Using the Legal Last Will And Testament Form involves several steps to ensure that it meets legal requirements and accurately reflects the individual's wishes. Start by obtaining the form from a reliable source. Fill in personal information, including the names of beneficiaries and any specific bequests. It is essential to clearly state any preferences regarding the distribution of assets and appoint an executor to manage the estate. After completing the form, it must be signed in the presence of witnesses, as required by law, to ensure its validity.

Steps to Complete the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

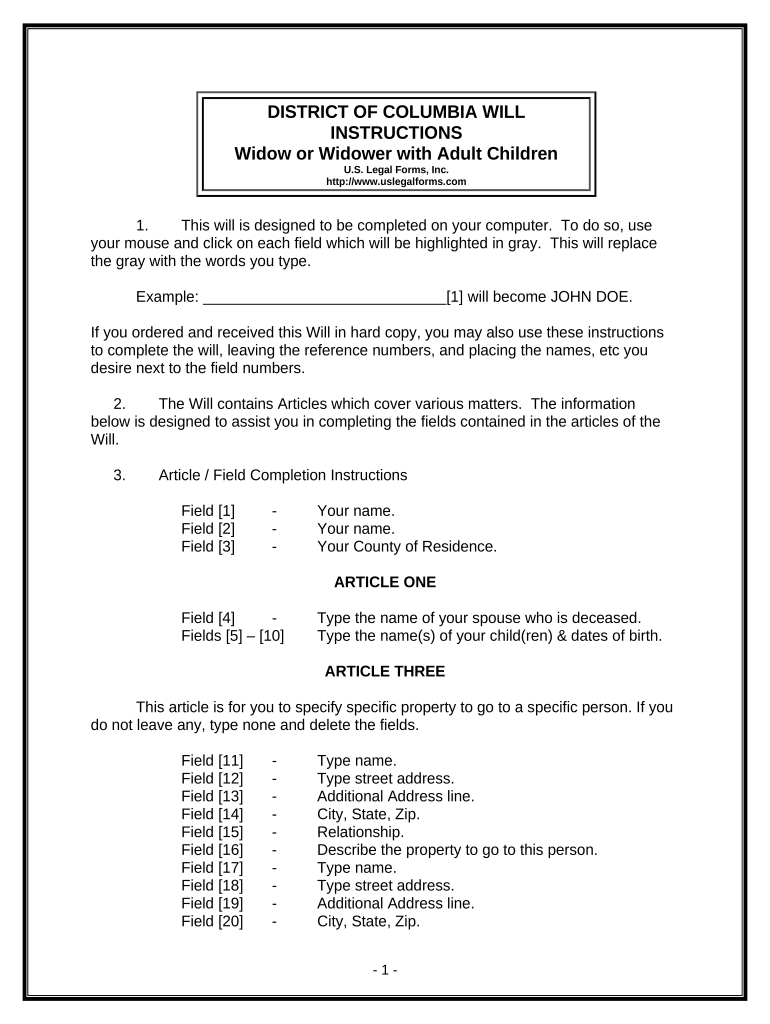

Completing the Legal Last Will And Testament Form involves a systematic approach:

- Gather necessary information, including details about assets, debts, and beneficiaries.

- Obtain the official form and read through all sections carefully.

- Fill in personal details, including your name, address, and the names of your adult children.

- Specify how you want your assets distributed among your beneficiaries.

- Choose an executor who will be responsible for managing your estate.

- Sign the document in front of at least two witnesses, who must also sign the form.

- Store the completed will in a safe place and inform your executor of its location.

Legal Use of the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

The Legal Last Will And Testament Form is legally binding when executed according to the laws of the District of Columbia. This means that it must be signed by the testator (the person making the will) and witnessed by at least two individuals who are not beneficiaries. The document should clearly express the testator's intentions regarding asset distribution and guardianship. Following proper legal procedures ensures that the will is enforceable and can be probated without complications.

State-Specific Rules for the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

In the District of Columbia, specific rules govern the execution of a last will and testament. The testator must be at least eighteen years old and of sound mind. The will must be written, and the signing must occur in the presence of two witnesses. Additionally, the witnesses cannot be beneficiaries of the will to avoid conflicts of interest. Understanding these state-specific rules is essential to ensure the validity of the will and to avoid potential legal challenges.

Key Elements of the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

Key elements of the Legal Last Will And Testament Form include:

- Identification of the Testator: Full name and address of the individual creating the will.

- Beneficiaries: Names and relationships of those who will inherit assets.

- Asset Distribution: Clear instructions on how assets should be divided among beneficiaries.

- Executor Appointment: Designation of an executor to manage the estate and ensure the will is executed.

- Witness Signatures: Signatures of at least two witnesses to validate the will.

Quick guide on how to complete legal last will and testament form for a widow or widower with adult children district of columbia

Complete Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia effortlessly

- Locate Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia and click Get Form to begin.

- Use the tools available to finish your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and eSign Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Legal Last Will And Testament Form For A Widow Or Widower With Adult Children in the District Of Columbia?

A Legal Last Will And Testament Form For A Widow Or Widower With Adult Children in the District Of Columbia is a legal document that ensures your wishes regarding asset distribution and guardianship are fulfilled upon your passing. This form is designed to cater specifically to widows and widowers with adult children, providing clarity and peace of mind.

-

How can I create a Legal Last Will And Testament Form For A Widow Or Widower With Adult Children in the District Of Columbia?

Creating a Legal Last Will And Testament Form For A Widow Or Widower With Adult Children in the District Of Columbia is simple with airSlate SignNow. Our platform allows you to easily customize the form, ensuring all necessary details are included. Once completed, you can eSign securely and store your document conveniently.

-

What are the costs associated with the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children?

The costs for the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children using airSlate SignNow are budget-friendly and tailored for individuals. We offer various pricing plans that accommodate different needs without compromising on features. You can access your form at a low monthly rate or annually.

-

Is the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children legally valid in the District Of Columbia?

Yes, the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children created via airSlate SignNow is legally valid in the District Of Columbia. Our templates are drafted in accordance with state laws, ensuring that they meet all legal requirements for execution and enforceability.

-

What features does the airSlate SignNow platform offer for creating a Legal Last Will And Testament Form?

The airSlate SignNow platform provides various features to assist in creating a Legal Last Will And Testament Form For A Widow Or Widower With Adult Children, including customizable templates, easy eSigning, and secure storage. Additionally, you can collaborate with family members or legal advisors to review the document before finalizing it.

-

Can the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children be updated?

Absolutely! The Legal Last Will And Testament Form For A Widow Or Widower With Adult Children can be easily updated through the airSlate SignNow platform. Life changes, such as marriage, divorce, or changes in asset distribution, may necessitate updates to your will, which can be done swiftly and efficiently.

-

Does airSlate SignNow offer integrations for the Legal Last Will And Testament Form?

Yes, airSlate SignNow provides robust integration options for the Legal Last Will And Testament Form For A Widow Or Widower With Adult Children. You can integrate with popular applications and services to streamline your document management process, ensuring a seamless experience.

Get more for Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

Find out other Legal Last Will And Testament Form For A Widow Or Widower With Adult Children District Of Columbia

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer