Living Trust for Husband and Wife with No Children Delaware Form

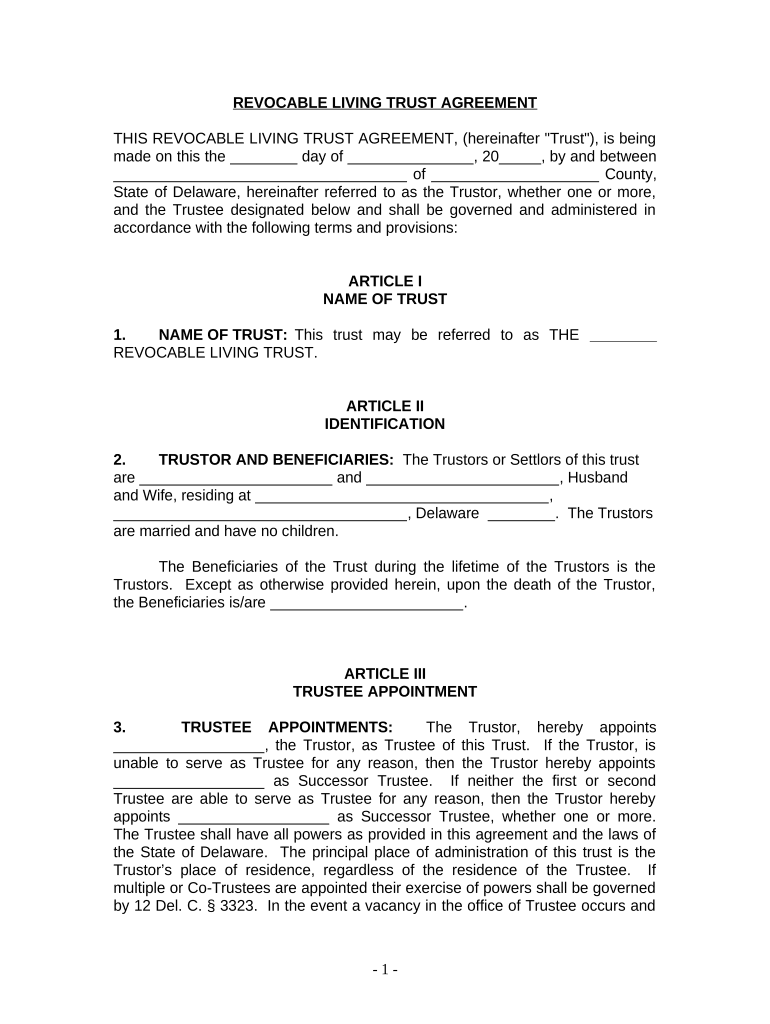

What is the Living Trust For Husband And Wife With No Children Delaware

A living trust for husband and wife with no children in Delaware is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust is particularly useful for couples without children, as it provides a straightforward way to transfer property and minimize probate complications. The trust can include various assets, such as real estate, bank accounts, and investments, ensuring that both spouses have access and control over their shared property.

Key Elements of the Living Trust For Husband And Wife With No Children Delaware

Several key elements define a living trust for husband and wife with no children in Delaware:

- Trustees: Typically, both spouses serve as trustees, allowing them to manage the trust's assets together.

- Beneficiaries: The couple can name each other as primary beneficiaries, with provisions for alternate beneficiaries, such as relatives or friends.

- Revocability: This type of trust is usually revocable, meaning the couple can modify or dissolve it at any time during their lifetimes.

- Asset Protection: A living trust can help protect assets from creditors and simplify the transfer of property upon death.

Steps to Complete the Living Trust For Husband And Wife With No Children Delaware

Completing a living trust for husband and wife with no children in Delaware involves several steps:

- Gather necessary information about all assets, including property titles and account statements.

- Choose a name for the trust and designate both spouses as trustees.

- Draft the trust document, outlining the terms, beneficiaries, and management instructions.

- Sign the trust document in the presence of a notary public to ensure its legal validity.

- Transfer ownership of assets into the trust, which may require updating titles and account registrations.

Legal Use of the Living Trust For Husband And Wife With No Children Delaware

The legal use of a living trust for husband and wife with no children in Delaware is designed to facilitate asset management and distribution. It allows couples to avoid the lengthy probate process, ensuring a smoother transition of assets upon death. Additionally, the trust can include specific instructions for asset distribution, which can help prevent disputes among potential heirs. It is essential to ensure that the trust complies with Delaware state laws to maintain its legal standing.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Delaware

Delaware has specific rules governing living trusts that couples should be aware of:

- Trust Creation: The trust must be created in writing and signed by both spouses.

- Notarization: The signatures must be notarized to ensure the document's authenticity.

- Asset Transfer: Assets must be properly transferred into the trust to be protected under its terms.

- Trustee Powers: Trustees have broad powers to manage the trust, but they must act in the best interests of the beneficiaries.

How to Use the Living Trust For Husband And Wife With No Children Delaware

Using a living trust for husband and wife with no children in Delaware involves several practical steps:

- Access and manage assets as needed during both spouses' lifetimes.

- Make adjustments to the trust document if circumstances change, such as acquiring new assets or changing beneficiaries.

- Ensure that all assets are retitled in the name of the trust to maintain protection.

- Upon the death of one spouse, the surviving spouse continues to manage the trust without interruption.

Quick guide on how to complete living trust for husband and wife with no children delaware

Complete Living Trust For Husband And Wife With No Children Delaware effortlessly on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Living Trust For Husband And Wife With No Children Delaware on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Living Trust For Husband And Wife With No Children Delaware without hassle

- Locate Living Trust For Husband And Wife With No Children Delaware and click Get Form to begin.

- Make use of the tools we supply to finalize your form.

- Select the relevant parts of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust For Husband And Wife With No Children Delaware and ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children Delaware?

A Living Trust For Husband And Wife With No Children Delaware is a legal document that allows couples to manage their assets during their lifetime and distribute them after death without going through probate. This type of trust offers flexibility and control, making it suitable for couples who wish to safeguard their assets.

-

What are the benefits of creating a Living Trust For Husband And Wife With No Children Delaware?

Creating a Living Trust For Husband And Wife With No Children Delaware provides benefits like avoiding probate, maintaining privacy over asset distribution, and allowing for seamless management of assets should one spouse become incapacitated. It also helps ensure that your assets are handled according to your wishes.

-

How much does a Living Trust For Husband And Wife With No Children Delaware cost?

The cost of establishing a Living Trust For Husband And Wife With No Children Delaware varies based on legal fees and service providers. Generally, it is an affordable option compared to other estate planning methods, especially considering the long-term savings by avoiding probate.

-

Is it difficult to set up a Living Trust For Husband And Wife With No Children Delaware?

Setting up a Living Trust For Husband And Wife With No Children Delaware can be straightforward, especially when using airSlate SignNow’s user-friendly platform. With clear guidance and document templates, you can efficiently create a trust that meets your specific needs.

-

Can I modify my Living Trust For Husband And Wife With No Children Delaware after it's set up?

Yes, you can modify your Living Trust For Husband And Wife With No Children Delaware at any time during your lifetime. This flexibility allows you to adapt the trust's terms as your circumstances or wishes change over the years.

-

Does a Living Trust For Husband And Wife With No Children Delaware provide asset protection?

A Living Trust For Husband And Wife With No Children Delaware offers some level of asset protection, particularly from probate creditors. However, it may not fully shield assets from lawsuits or creditors; therefore, it's important to consider additional strategies for maximum protection.

-

What happens to a Living Trust For Husband And Wife With No Children Delaware if one spouse dies?

Upon the death of one spouse, a Living Trust For Husband And Wife With No Children Delaware allows the surviving spouse to retain full control of the trust assets. The trust’s terms will dictate the management and distribution of assets, ensuring a smooth transition without the need for probate.

Get more for Living Trust For Husband And Wife With No Children Delaware

Find out other Living Trust For Husband And Wife With No Children Delaware

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word