Marital Trust Form

What is the marital trust?

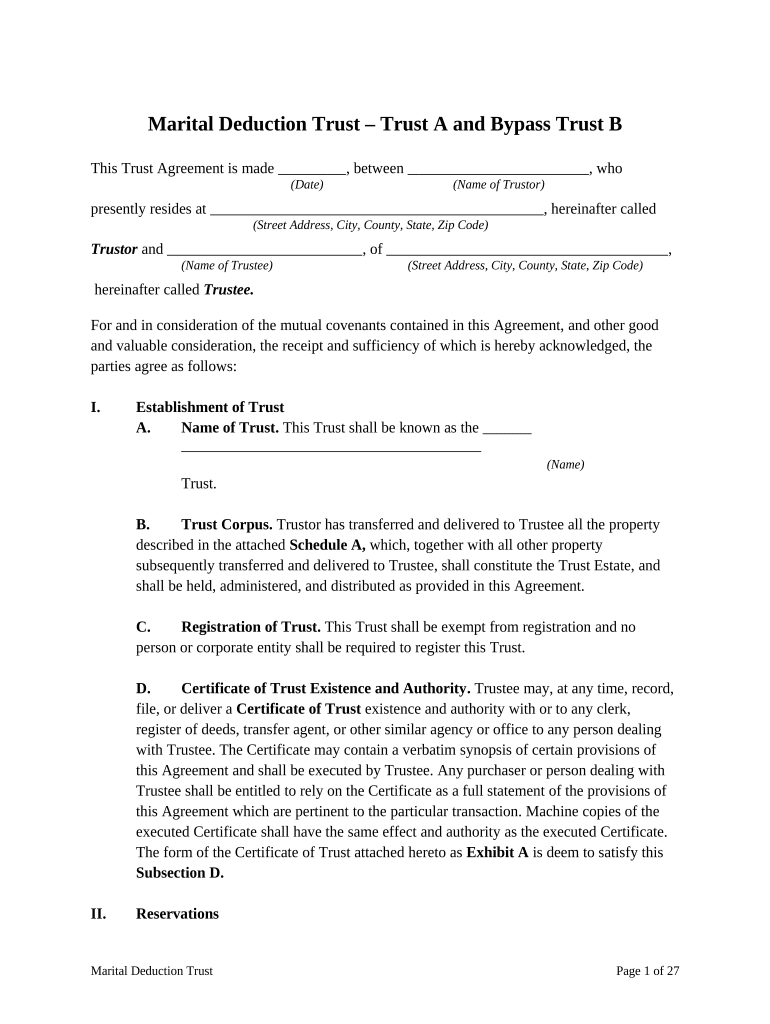

A marital trust is a legal arrangement designed to manage and distribute assets for the benefit of a surviving spouse. This type of trust allows one spouse to transfer assets into the trust, which are then held for the surviving spouse's benefit during their lifetime. Upon the death of the surviving spouse, the remaining assets are distributed according to the terms set forth in the trust document. The primary goal of a marital trust is to provide financial security for the surviving spouse while also minimizing estate taxes for the heirs.

Key elements of the marital trust

Understanding the key elements of a marital trust is essential for effective estate planning. Important components include:

- Trustee: The individual or institution responsible for managing the trust assets and ensuring compliance with the trust terms.

- Beneficiary: The surviving spouse is typically the primary beneficiary, receiving income or principal from the trust as needed.

- Distribution terms: Specific guidelines on how and when assets are distributed after the death of the surviving spouse.

- Tax considerations: Marital trusts can provide tax benefits, allowing for a deferral of estate taxes until the death of the surviving spouse.

Steps to complete the marital trust

Completing a marital trust involves several steps to ensure it is legally binding and effective. Here are the key steps:

- Consult an attorney: Seek professional legal advice to understand the implications and requirements of establishing a marital trust.

- Draft the trust document: Work with your attorney to create a comprehensive trust document that outlines the terms and conditions.

- Fund the trust: Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Sign the document: Ensure that all parties involved, including witnesses, sign the trust document to validate it.

Legal use of the marital trust

The legal use of a marital trust is governed by state-specific laws and regulations. In Florida, for example, the marital trust must comply with the Florida Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries. It is important to ensure that the trust is properly established and maintained to avoid legal disputes or complications during the distribution of assets.

State-specific rules for the marital trust

Each state has its own rules regarding marital trusts. In Florida, key considerations include:

- Trust registration: Florida does not require trusts to be registered, but it is advisable to keep a record of the trust document and any amendments.

- Tax implications: Understanding Florida's estate tax laws is crucial, as marital trusts can help minimize tax burdens.

- Trustee requirements: Florida law stipulates that trustees must act in the best interests of the beneficiaries, adhering to fiduciary duties.

How to obtain the marital trust

Obtaining a marital trust typically involves working with a qualified estate planning attorney. They can guide you through the process, which generally includes:

- Initial consultation: Discuss your financial situation and estate planning goals with your attorney.

- Drafting the trust: Collaborate with your attorney to create a trust document tailored to your needs.

- Finalizing the trust: Review and sign the final document, ensuring all legal requirements are met.

Quick guide on how to complete marital trust

Manage Marital Trust seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your paperwork quickly without delays. Handle Marital Trust on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Marital Trust with ease

- Obtain Marital Trust and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Modify and eSign Marital Trust and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Florida trust and how does it work?

A Florida trust is a legal arrangement that allows you to manage your assets and protect them for your beneficiaries. When set up correctly, a Florida trust can help avoid probate, reduce estate taxes, and ensure that your wishes are carried out after your passing. With airSlate SignNow, you can securely sign and manage your trust documents digitally.

-

How can airSlate SignNow help with creating a Florida trust?

airSlate SignNow provides an efficient platform for creating and managing your Florida trust documents. Our user-friendly interface allows you to customize your trust agreements easily and ensures that all signatures are legally binding. Plus, our integration capabilities help you store and share your documents securely.

-

What are the benefits of using a Florida trust?

Using a Florida trust offers several benefits including asset protection, privacy, and guidance in the distribution of your assets. It can help minimize your estate taxes and avoid the costly probate process. Additionally, airSlate SignNow’s electronic signature feature simplifies the signing process for all parties involved.

-

Is there a cost associated with setting up a Florida trust using airSlate SignNow?

The cost of setting up a Florida trust with airSlate SignNow can vary depending on your specific needs and the complexity of your trust. However, airSlate SignNow offers cost-effective plans that include features tailored to seamlessly manage your trust documents. You can choose a plan that fits your budget and ensures all your eSigning needs are met.

-

Can I integrate airSlate SignNow with other tools for my Florida trust?

Yes, airSlate SignNow offers integrations with various tools that can enhance your Florida trust management experience. Whether you use accounting software, cloud storage services, or CRM platforms, you can streamline your workflow and keep all your essential documents organized. Our integrations facilitate easy access and collaboration on trust-related documents.

-

How secure is my Florida trust information with airSlate SignNow?

airSlate SignNow prioritizes the security of your Florida trust information with advanced encryption and compliance with industry standards. We utilize secure servers and offer options for two-factor authentication to protect your sensitive data. You can rest assured that your documents are safe while you eSign and manage your trust.

-

What types of documents can I sign related to my Florida trust?

With airSlate SignNow, you can sign various documents related to your Florida trust, such as trust agreements, amendments, and revocation forms. Our platform enables you to create, send, and sign these documents quickly and efficiently. This ensures that all necessary paperwork is completed and legally binding without the hassle of physical signatures.

Get more for Marital Trust

Find out other Marital Trust

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity