Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Georgia Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

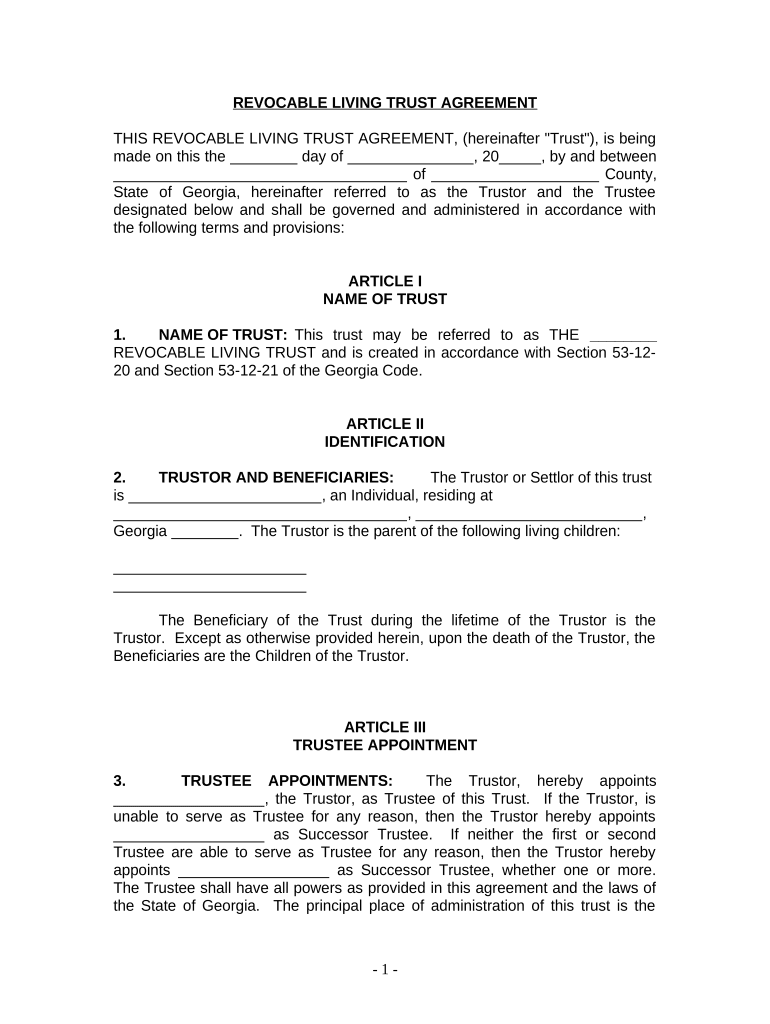

A living trust for individuals who are single, divorced, or widowed with children in Georgia is a legal document that allows you to manage your assets during your lifetime and specify how they will be distributed after your death. This type of trust is particularly beneficial for those with children, as it provides a clear plan for asset distribution, ensuring that your children are taken care of according to your wishes. Unlike a will, a living trust can help avoid probate, which can be a lengthy and costly process.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

Several key elements define a living trust for individuals in this category:

- Trustee: You can serve as your own trustee, retaining control over your assets while alive.

- Beneficiaries: You can designate your children as beneficiaries, ensuring they receive your assets upon your passing.

- Asset Management: The trust allows for the management of assets, including real estate, bank accounts, and investments, during your lifetime.

- Distribution Instructions: You can specify how and when your children will receive their inheritance, which can be particularly important if they are minors.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

Completing a living trust involves several important steps:

- Gather Information: Collect details about your assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide if you will be the trustee or appoint someone else to manage the trust.

- Draft the Trust Document: Create the trust document, outlining your wishes and designating beneficiaries.

- Transfer Assets: Legally transfer your assets into the trust to ensure they are managed according to your instructions.

- Sign the Document: Sign the trust document in accordance with Georgia laws, often requiring witnesses or notarization.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

The legal use of a living trust in Georgia is governed by state laws that recognize the validity of such documents. It is important to ensure that the trust is created in compliance with Georgia statutes, including proper execution and witnessing. A living trust can be used to manage assets during your lifetime and can outline specific instructions for distribution upon your death, making it a legally binding document that can help prevent disputes among heirs.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

Georgia has specific rules regarding living trusts that individuals should be aware of:

- Execution Requirements: The trust must be signed and, in some cases, notarized to be legally binding.

- Asset Title Transfer: Assets must be retitled in the name of the trust to ensure they are managed according to the trust's terms.

- Tax Implications: A living trust does not typically affect your income taxes, but it is advisable to consult a tax professional regarding any implications.

How to obtain the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

Obtaining a living trust can be accomplished through several avenues:

- Legal Assistance: Consulting with an attorney who specializes in estate planning can provide personalized guidance and ensure compliance with Georgia laws.

- Online Resources: There are various online platforms that offer templates and tools to create a living trust, but ensure they comply with state regulations.

- Financial Advisors: Many financial advisors can assist in creating a living trust as part of a broader estate planning strategy.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children georgia

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers since you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia with Ease

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your alterations.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require reprinting new copies. airSlate SignNow manages all your document administration needs with just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia is a legal document that helps manage your assets and ensures your children are taken care of after your passing. It provides a structured plan for asset distribution, avoiding probate and facilitating smoother transitions.

-

How does a Living Trust benefit me as a single parent in Georgia?

As a single parent, a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia protects your children’s inheritance, outlines guardianship, and ensures that your assets are managed according to your wishes, creating peace of mind.

-

What are the costs associated with setting up a Living Trust in Georgia?

The costs for setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia can vary based on complexity. Typically, you can expect to pay between $1,000 and $3,000 for lawyer fees, but using online services can reduce costs signNowly.

-

Are there any tax benefits associated with a Living Trust in Georgia?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia does not inherently provide tax benefits, but it can help with estate tax planning. Proper structuring can minimize potential estate taxes, allowing more of your assets to be passed on to your children.

-

Can I modify my Living Trust after it has been established?

Yes, one of the key features of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia is that it can be modified anytime. You have the flexibility to change beneficiaries, assets, or provisions as your situation evolves.

-

How does airSlate SignNow assist in creating a Living Trust in Georgia?

airSlate SignNow provides easy-to-use templates and eSigning solutions to streamline the creation of your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia. This makes the process convenient and cost-effective, ensuring your documents are securely signed and stored.

-

What happens to my Living Trust if I move to another state?

If you move to another state, your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia may still be valid, but it’s best to review and possibly update it according to the new state laws. This ensures your wishes regarding asset distribution remain enforceable.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Georgia

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now