Idaho Chapter 13 Form

What is the Idaho Chapter 13

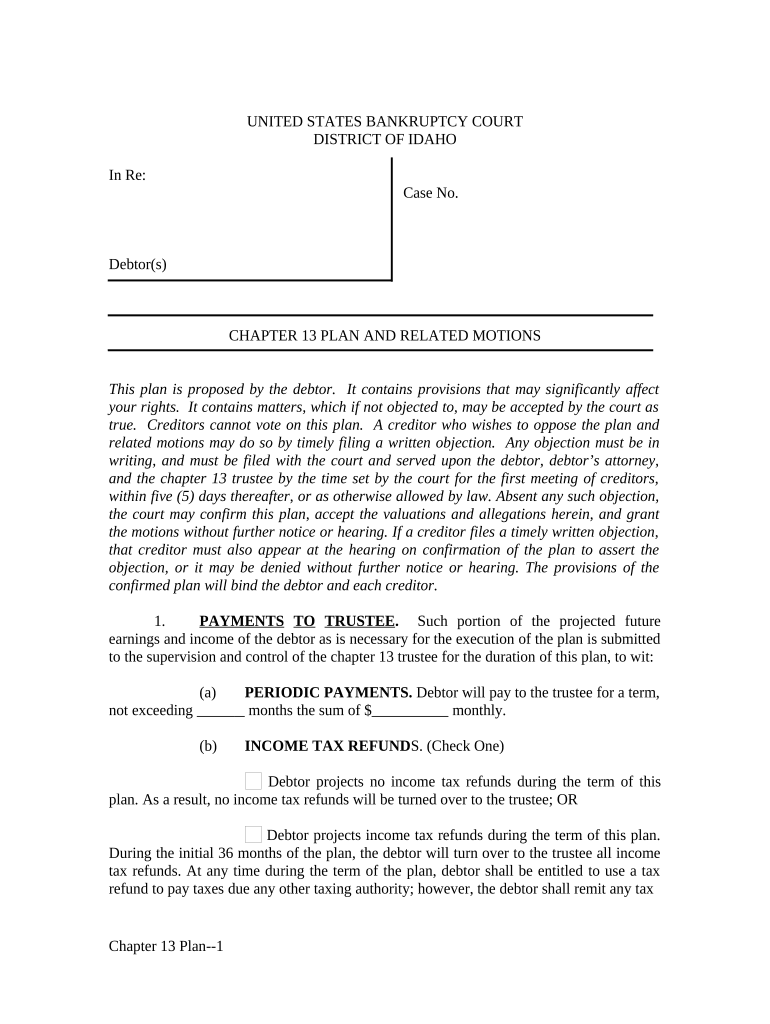

The Idaho Chapter 13 is a legal form used in the bankruptcy process, specifically designed for individuals seeking to reorganize their debts while maintaining their assets. Under Chapter 13 of the Bankruptcy Code, debtors propose a repayment plan to make installments to creditors over a specified period, typically three to five years. This form is crucial for those who have a regular income and want to avoid liquidation of their assets, allowing them to catch up on missed payments and manage their financial obligations more effectively.

Steps to complete the Idaho Chapter 13

Completing the Idaho Chapter 13 form involves several essential steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, tax returns, and a list of debts. Next, fill out the form, providing detailed information about your income, expenses, and debts. It is vital to accurately represent your financial situation to the court. After completing the form, review it carefully for any errors or omissions. Finally, submit the form along with any required supporting documents to the appropriate bankruptcy court in Idaho.

Legal use of the Idaho Chapter 13

The Idaho Chapter 13 form is legally binding if completed and submitted according to federal and state laws. It is essential to adhere to the guidelines set forth by the U.S. Bankruptcy Code, as well as any specific requirements from the Idaho bankruptcy court. This includes ensuring that the repayment plan proposed is feasible based on your income and expenses. Failure to comply with legal standards may result in dismissal of the case or other legal repercussions.

Eligibility Criteria

To qualify for filing under the Idaho Chapter 13, certain eligibility criteria must be met. Individuals must have a regular income to support the repayment plan. Additionally, there are limits on the amount of secured and unsecured debt that can be included in the Chapter 13 filing. As of the latest updates, the total secured debts must not exceed a specific threshold, and unsecured debts must also fall within defined limits. It is advisable to consult with a legal professional to determine eligibility based on current financial circumstances.

Required Documents

Filing the Idaho Chapter 13 requires several key documents to support the bankruptcy petition. Essential documents include proof of income, such as pay stubs or tax returns, a list of all debts, and a detailed account of monthly expenses. Additionally, documentation related to any secured debts, such as mortgages or car loans, is necessary. Collecting these documents in advance can streamline the filing process and ensure that all required information is accurately presented to the court.

Form Submission Methods

The Idaho Chapter 13 form can be submitted through various methods, including online filing, mail, or in-person submission at the bankruptcy court. Electronic filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. If submitting by mail, it is recommended to send the documents via certified mail to ensure they are received by the court. In-person submissions allow for direct interaction with court staff, which can be beneficial for addressing any immediate questions or concerns.

Key elements of the Idaho Chapter 13

Understanding the key elements of the Idaho Chapter 13 form is essential for successful completion and submission. These elements include the debtor's personal information, a comprehensive list of debts, a proposed repayment plan detailing how creditors will be paid over time, and a declaration of the debtor's financial situation. Additionally, the form requires signatures from the debtor and, in some cases, a co-debtor, affirming the accuracy of the information provided and the intention to adhere to the proposed plan.

Quick guide on how to complete idaho chapter 13

Complete Idaho Chapter 13 effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Idaho Chapter 13 on any device using airSlate SignNow mobile applications for Android or iOS and simplify any document-related task today.

How to modify and eSign Idaho Chapter 13 with ease

- Locate Idaho Chapter 13 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight essential sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your requirements in document management within a few clicks from any device you prefer. Modify and eSign Idaho Chapter 13 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Idaho Chapter 13 and how does it work?

Idaho Chapter 13 is a legal process that allows individuals to reorganize their debts while keeping their assets. It involves creating a repayment plan that lasts three to five years, during which you make monthly payments to a trustee who distributes the funds to your creditors. This type of bankruptcy can help you avoid foreclosure and keep your property.

-

What are the benefits of filing for Idaho Chapter 13?

Filing for Idaho Chapter 13 provides several benefits, including the ability to keep your home and car while repaying your debts over time. It can also stop foreclosure proceedings and collection actions from creditors, giving you relief from financial stress. Additionally, it may discharge some unsecured debts once the repayment plan is completed.

-

How much does it cost to file an Idaho Chapter 13 bankruptcy?

The cost to file an Idaho Chapter 13 bankruptcy typically includes court fees and attorney fees, which can vary widely. On average, you can expect to pay between $2,500 and $4,000 for all associated costs. It’s important to consult with a bankruptcy attorney to understand the specific fees involved in your case.

-

What documents do I need to file for Idaho Chapter 13?

To file for Idaho Chapter 13, you will need various documents, such as your income statements, tax returns, a list of your debts, and a detailed budget of your monthly expenses. These documents help your attorney prepare your case and create an effective repayment plan. Accurate documentation is crucial for a successful filing process.

-

Can I use airSlate SignNow to eSign documents for my Idaho Chapter 13 filing?

Yes, airSlate SignNow allows you to easily eSign documents related to your Idaho Chapter 13 filing. The platform streamlines the document signing process, ensuring that all required paperwork is completed quickly and securely. This makes it easier for you to manage your bankruptcy case effectively.

-

What features does airSlate SignNow offer for bankruptcy filings?

airSlate SignNow offers features such as eSigning, document templates, and cloud storage, making it an ideal solution for managing Idaho Chapter 13 paperwork. You can automate reminders for document submission and collaborate with your attorney in real-time. These features enhance efficiency during your bankruptcy process.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents related to Idaho Chapter 13 bankruptcy. The platform employs advanced encryption standards and secure data storage solutions to protect your information. You can confidently eSign and share your documents, knowing they are safeguarded.

Get more for Idaho Chapter 13

- Herrs donation request form

- Superkids scope and sequence form

- Percent error worksheet form

- Pre referral intervention manual 5th edition pdf form

- Army nco creed pdf form

- Banner referral form 76464876

- For patients ampamp visitors request for medical report form

- Impaired behavior incident report form city of oak harbor

Find out other Idaho Chapter 13

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now