Schedule C 2017

What is the Schedule C

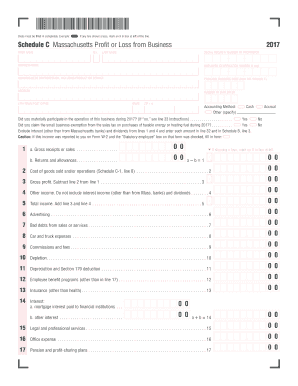

The Schedule C form, officially known as "Profit or Loss from Business," is a crucial document for self-employed individuals and sole proprietors in the United States. It is used to report income or loss from a business operated as a sole proprietorship. This form allows individuals to detail their business earnings, expenses, and net profit or loss, which is then transferred to their personal income tax return. Understanding the Schedule C is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule C

To effectively use the Schedule C form, individuals should first gather all relevant financial information regarding their business activities. This includes income received, business expenses, and any other deductions that may apply. The form consists of various sections, including income, expenses, and cost of goods sold, which need to be filled out accurately. After completing the form, it should be attached to the individual's Form 1040 when filing taxes. Properly using the Schedule C can help maximize deductions and minimize tax liability.

Steps to complete the Schedule C

Completing the Schedule C involves several key steps:

- Gather financial records: Collect all income statements, receipts, and documentation of business expenses.

- Fill out the income section: Report total income earned from the business during the tax year.

- Detail expenses: List all allowable business expenses, such as supplies, utilities, and travel costs.

- Calculate net profit or loss: Subtract total expenses from total income to determine the net profit or loss.

- Review and verify: Ensure all information is accurate and complete before submission.

Legal use of the Schedule C

The Schedule C form is legally binding when filled out correctly and submitted as part of the individual's tax return. To ensure legal compliance, it must adhere to IRS guidelines, including accurate reporting of income and expenses. Additionally, the form must be signed and dated to validate the information provided. Utilizing electronic signature solutions can enhance the legal standing of the document, as they comply with regulations such as the ESIGN Act and UETA.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C. These include instructions on what constitutes allowable business expenses, how to report income, and the importance of maintaining accurate records. Taxpayers should refer to the IRS instructions for Schedule C to understand the requirements fully and avoid potential penalties. Familiarity with these guidelines helps ensure compliance and can aid in maximizing deductions.

Filing Deadlines / Important Dates

Filing the Schedule C is typically due on April 15 each year, coinciding with the individual income tax return deadline. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time to submit their returns. Staying informed about these important dates helps avoid late fees and penalties.

Quick guide on how to complete schedule c

Prepare Schedule C effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Schedule C on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign Schedule C with ease

- Obtain Schedule C and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Modify and eSign Schedule C and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c

Create this form in 5 minutes!

How to create an eSignature for the schedule c

How to generate an electronic signature for the Schedule C online

How to create an eSignature for your Schedule C in Google Chrome

How to make an eSignature for signing the Schedule C in Gmail

How to generate an eSignature for the Schedule C straight from your mobile device

How to make an electronic signature for the Schedule C on iOS devices

How to generate an electronic signature for the Schedule C on Android devices

People also ask

-

What is Schedule C and how can airSlate SignNow help with it?

Schedule C is a tax form used by sole proprietors to report income or loss from their business. airSlate SignNow simplifies the process of completing and eSigning your Schedule C by allowing you to fill out the form digitally, ensuring accuracy and compliance. With our platform, you can efficiently manage your business documents and keep track of your financial records.

-

How does airSlate SignNow support small business owners filing Schedule C?

airSlate SignNow provides small business owners with an intuitive platform to eSign and manage their Schedule C forms seamlessly. Our solution offers templates specifically designed for tax documents, helping you save time while ensuring all necessary information is included. This means less stress during tax season and more focus on growing your business.

-

Is airSlate SignNow cost-effective for managing Schedule C and other tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your Schedule C and other tax documents. With flexible pricing plans, you can choose the option that best fits your business needs without overspending. This allows you to access essential features that enhance your document management process while staying within budget.

-

What features does airSlate SignNow offer for eSigning Schedule C forms?

airSlate SignNow features a user-friendly interface that allows you to eSign Schedule C forms quickly and securely. You can add signatures, initials, and even comments directly on the document, streamlining the review and approval process. Additionally, our platform ensures that all signed documents are stored securely in the cloud for easy access and reference.

-

Can I integrate airSlate SignNow with other accounting software for Schedule C filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your Schedule C filings. This integration ensures that your financial data is synchronized across platforms, reducing the risk of errors and improving efficiency in your tax preparation process.

-

How secure is my information when using airSlate SignNow for Schedule C?

Security is a top priority at airSlate SignNow. When you use our platform to manage your Schedule C forms, your information is protected with advanced encryption and secure access protocols. This ensures that your sensitive financial data remains confidential and safe from unauthorized access.

-

What benefits do I gain by using airSlate SignNow for my Schedule C documentation?

Using airSlate SignNow for your Schedule C documentation offers numerous benefits, including time savings, increased accuracy, and improved organization. With digital eSigning and easy access to your documents, you can streamline your tax preparation process and reduce the stress associated with filing. Additionally, our platform helps you stay compliant with tax regulations.

Get more for Schedule C

Find out other Schedule C

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation