Lansing Individual Income Tax Forms and City of 2017

What is the Lansing Individual Income Tax Forms And City Of

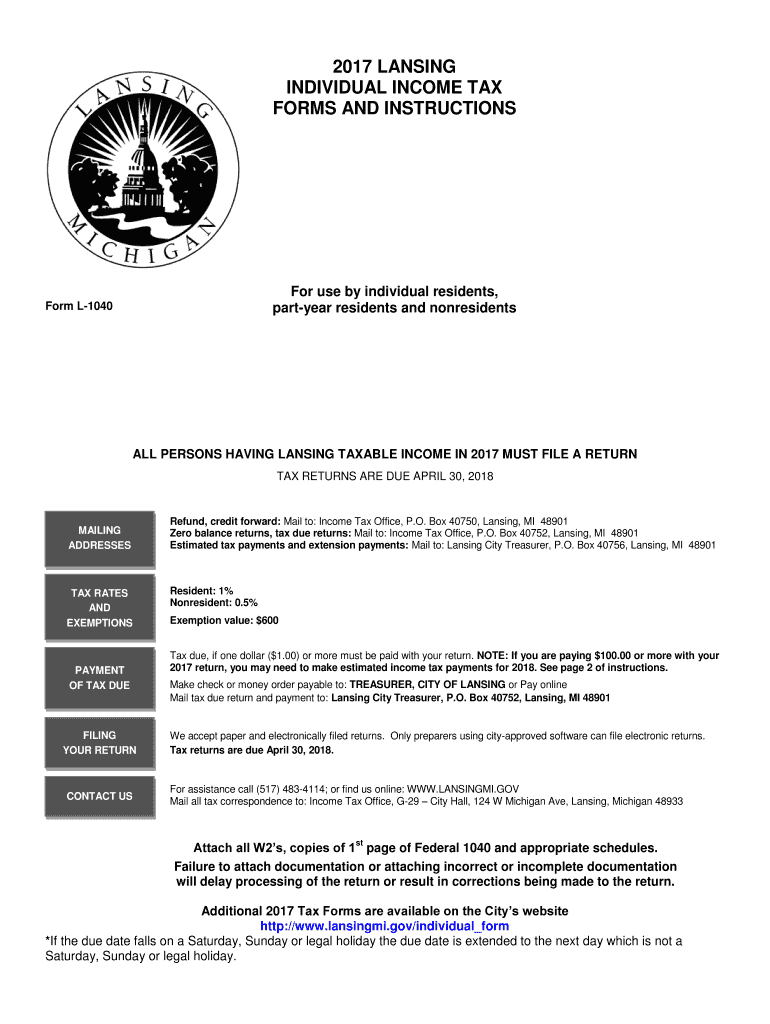

The Lansing Individual Income Tax Forms And City Of are essential documents used by residents of Lansing, Michigan, to report their income and calculate their tax obligations to the city. These forms are specifically designed to capture various income sources, deductions, and credits applicable to individual taxpayers. Understanding these forms is crucial for compliance with local tax laws and ensuring accurate tax reporting.

How to use the Lansing Individual Income Tax Forms And City Of

Using the Lansing Individual Income Tax Forms And City Of involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, download the appropriate forms from the official city website or obtain them from local tax offices. Fill out the forms carefully, ensuring all information is accurate. Once completed, review the forms for errors before submitting them to the city’s tax office.

Steps to complete the Lansing Individual Income Tax Forms And City Of

Completing the Lansing Individual Income Tax Forms And City Of requires a systematic approach:

- Collect all necessary income documentation, including W-2s and 1099s.

- Download the appropriate forms from the city’s official website.

- Fill out the forms, ensuring to include all required personal and financial information.

- Calculate your total income, deductions, and credits accurately.

- Review the forms for accuracy and completeness.

- Submit the forms by the designated deadline, either online or via mail.

Legal use of the Lansing Individual Income Tax Forms And City Of

The Lansing Individual Income Tax Forms And City Of are legally binding documents once properly filled out and submitted. To ensure their legal standing, taxpayers must comply with local tax laws and regulations. This includes providing truthful information and maintaining records that support the claims made on the forms. Non-compliance can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Lansing Individual Income Tax Forms And City Of. Typically, the deadline for filing these forms coincides with the federal tax deadline, which is usually April 15. However, it is advisable to check the city’s official tax website for any updates or changes to these dates, as they may vary from year to year.

Required Documents

When preparing to fill out the Lansing Individual Income Tax Forms And City Of, several documents are required to ensure accuracy and completeness:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any other documentation that supports income or deductions claimed.

Quick guide on how to complete 2017 lansing individual income tax forms and city of

Complete Lansing Individual Income Tax Forms And City Of effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without hindrance. Manage Lansing Individual Income Tax Forms And City Of on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Lansing Individual Income Tax Forms And City Of with ease

- Locate Lansing Individual Income Tax Forms And City Of and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your files or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your document, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Lansing Individual Income Tax Forms And City Of and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 lansing individual income tax forms and city of

Create this form in 5 minutes!

How to create an eSignature for the 2017 lansing individual income tax forms and city of

How to generate an eSignature for your 2017 Lansing Individual Income Tax Forms And City Of in the online mode

How to generate an eSignature for the 2017 Lansing Individual Income Tax Forms And City Of in Chrome

How to make an eSignature for signing the 2017 Lansing Individual Income Tax Forms And City Of in Gmail

How to make an eSignature for the 2017 Lansing Individual Income Tax Forms And City Of straight from your smartphone

How to make an eSignature for the 2017 Lansing Individual Income Tax Forms And City Of on iOS

How to make an eSignature for the 2017 Lansing Individual Income Tax Forms And City Of on Android OS

People also ask

-

What are the key features of airSlate SignNow for managing Lansing Individual Income Tax Forms And City Of?

airSlate SignNow offers a user-friendly interface, secure eSigning, and document management capabilities specifically designed for Lansing Individual Income Tax Forms And City Of. You can easily import, edit, and send tax forms, ensuring compliance and accuracy in your submissions.

-

How does airSlate SignNow enhance the process of submitting Lansing Individual Income Tax Forms And City Of?

With airSlate SignNow, you can streamline the process of submitting Lansing Individual Income Tax Forms And City Of by automating workflows and minimizing paperwork. The platform allows for quick eSignature collection, reducing turnaround time and enhancing overall efficiency for individuals and businesses alike.

-

Is airSlate SignNow cost-effective for handling Lansing Individual Income Tax Forms And City Of?

Yes, airSlate SignNow provides a cost-effective solution for managing Lansing Individual Income Tax Forms And City Of. Our competitive pricing plans cater to both individuals and businesses, ensuring you only pay for the features you need while maximizing your budget.

-

Can airSlate SignNow integrate with other software for managing Lansing Individual Income Tax Forms And City Of?

Absolutely! airSlate SignNow offers integrations with popular software like Google Drive, Dropbox, and CRM systems. This makes it easy to import and export your Lansing Individual Income Tax Forms And City Of seamlessly, enhancing your overall productivity.

-

What benefits does airSlate SignNow provide for submitting Lansing Individual Income Tax Forms And City Of?

Using airSlate SignNow for submitting Lansing Individual Income Tax Forms And City Of provides numerous benefits, including increased security through encrypted signatures, faster processing times, and reduced paper usage. The platform’s compliance with legal standards ensures your forms are valid and reliable.

-

Is it easy to use airSlate SignNow for Lansing Individual Income Tax Forms And City Of?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, making it easy for anyone to send and eSign Lansing Individual Income Tax Forms And City Of. You’ll have access to tutorials and support to help you navigate the platform effortlessly.

-

What support options does airSlate SignNow offer for Lansing Individual Income Tax Forms And City Of users?

Customers using airSlate SignNow for Lansing Individual Income Tax Forms And City Of have access to multiple support options, including live chat, email support, and an extensive knowledge base. We are dedicated to helping you resolve any questions or issues promptly.

Get more for Lansing Individual Income Tax Forms And City Of

Find out other Lansing Individual Income Tax Forms And City Of

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed