Installments Fixed Rate Promissory Note Secured by Personal Property for Idaho Idaho Form

What is the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

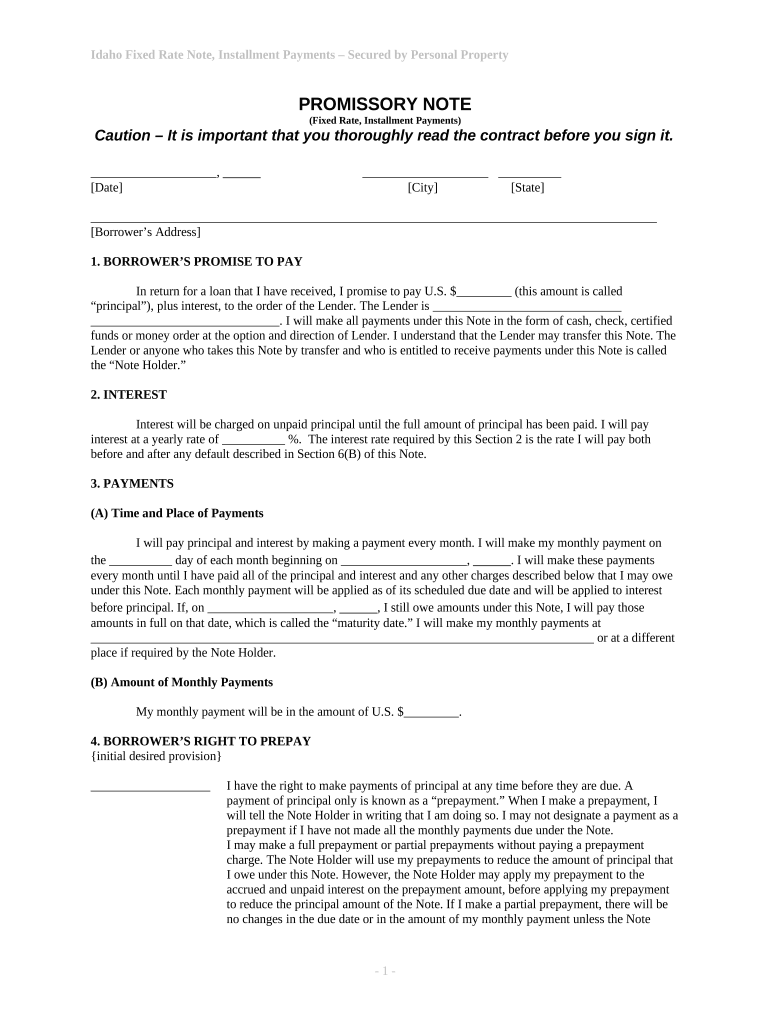

The Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This form is secured by personal property, meaning that the borrower pledges an asset as collateral for the loan. This arrangement provides security for the lender, as they can claim the collateral if the borrower defaults on the loan. The document typically includes details such as the loan amount, interest rate, payment schedule, and the description of the secured property.

How to use the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

Using the Installments Fixed Rate Promissory Note involves several steps to ensure that both parties understand their rights and obligations. First, the borrower must fill out the form accurately, providing necessary information about the loan and the collateral. Once completed, both the borrower and lender should review the document to ensure clarity and agreement on all terms. After both parties are satisfied, the document must be signed, preferably in the presence of a witness or notary. This process ensures the note is legally binding and enforceable in Idaho.

Steps to complete the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

Completing the Installments Fixed Rate Promissory Note requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the loan amount, interest rate, repayment schedule, and details of the collateral.

- Fill out the form, ensuring all sections are completed accurately.

- Review the document with the lender to confirm all terms are understood and agreed upon.

- Sign the document in the presence of a witness or notary to enhance its legal validity.

- Keep a copy of the signed document for your records.

Key elements of the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

Several key elements are essential for the effectiveness of the Installments Fixed Rate Promissory Note. These include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Payment Schedule: The timeline for repayments, including the frequency and amount of each installment.

- Collateral Description: A detailed description of the personal property securing the loan.

- Signatures: The signatures of both the borrower and lender, which validate the agreement.

Legal use of the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

The Installments Fixed Rate Promissory Note is legally binding in Idaho when properly executed. For it to be enforceable, the document must meet specific legal requirements, including clear terms regarding the loan and collateral. Both parties must voluntarily agree to the terms, and the note should comply with Idaho state laws governing secured transactions. This legal framework ensures that the lender has recourse to the collateral in case of default, providing a layer of protection for the lender.

State-specific rules for the Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

Idaho has specific rules governing the use of promissory notes secured by personal property. These rules include the requirement for a clear description of the collateral and adherence to the Uniform Commercial Code (UCC) provisions applicable in Idaho. It is important for both borrowers and lenders to be aware of these regulations to ensure compliance and avoid potential legal issues. Additionally, the document may need to be filed with the appropriate state agency to perfect the security interest in the collateral.

Quick guide on how to complete installments fixed rate promissory note secured by personal property for idaho idaho

Complete Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho effortlessly on any device

Digital document handling has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without interruptions. Manage Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho with ease

- Locate Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from your preferred device. Modify and eSign Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho?

An Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho is a legal document that establishes a borrower's promise to repay a loan in installments, with a fixed interest rate, and is secured against personal property. This type of promissory note is tailored for Idaho residents, providing clarity and security for both lenders and borrowers.

-

How does airSlate SignNow facilitate the signing of Installments Fixed Rate Promissory Notes?

airSlate SignNow offers an intuitive platform that allows you to easily create, send, and eSign Installments Fixed Rate Promissory Notes Secured By Personal Property For Idaho Idaho. With just a few clicks, you can manage the signing process digitally, ensuring that all parties can access and sign the document securely from anywhere.

-

What are the benefits of using airSlate SignNow for Installments Fixed Rate Promissory Notes?

Using airSlate SignNow for your Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho offers numerous benefits, including faster processing times, enhanced security, and reduced paper usage. Moreover, the platform helps maintain compliance with legal standards, giving you peace of mind during the transaction.

-

What features does airSlate SignNow provide for drafting promissory notes?

airSlate SignNow provides a range of features for drafting Installments Fixed Rate Promissory Notes Secured By Personal Property For Idaho Idaho, including customizable templates, collaborative editing, and advanced security options. These features streamline the document creation process, making it easier to tailor notes to specific requirements.

-

Is there a cost associated with creating Installments Fixed Rate Promissory Notes on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow to create Installments Fixed Rate Promissory Notes Secured By Personal Property For Idaho Idaho. However, the pricing is designed to be cost-effective, offering various plans that suit different business needs and budgets while providing comprehensive document management solutions.

-

Can I integrate airSlate SignNow with other business tools for managing promissory notes?

Absolutely! airSlate SignNow can be seamlessly integrated with various business tools, enhancing the management of your Installments Fixed Rate Promissory Notes Secured By Personal Property For Idaho Idaho. This integration helps streamline workflows and ensures that your documents are efficiently organized across platforms.

-

What legal considerations should I keep in mind when using Installments Fixed Rate Promissory Notes in Idaho?

When utilizing Installments Fixed Rate Promissory Notes Secured By Personal Property For Idaho Idaho, it is crucial to adhere to state regulations regarding loan agreements. Consulting with a legal professional can help ensure compliance with Idaho laws, protecting both lenders and borrowers during the transaction.

Get more for Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

- Chemistry a molecular approach 3e tro chapter 7 the quantum websites rcc form

- Procedure mac process form catamaran rx

- Standard form for presentation of loss and damage claim instructions

- Estoppel letter template form

- Ashant dhara application form

- Monumental life claim for life insurance benefits form

- Eviction appeal bond dallascounty form

- Motion to retain case on docket sample 100853564 form

Find out other Installments Fixed Rate Promissory Note Secured By Personal Property For Idaho Idaho

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word