Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Kentucky Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

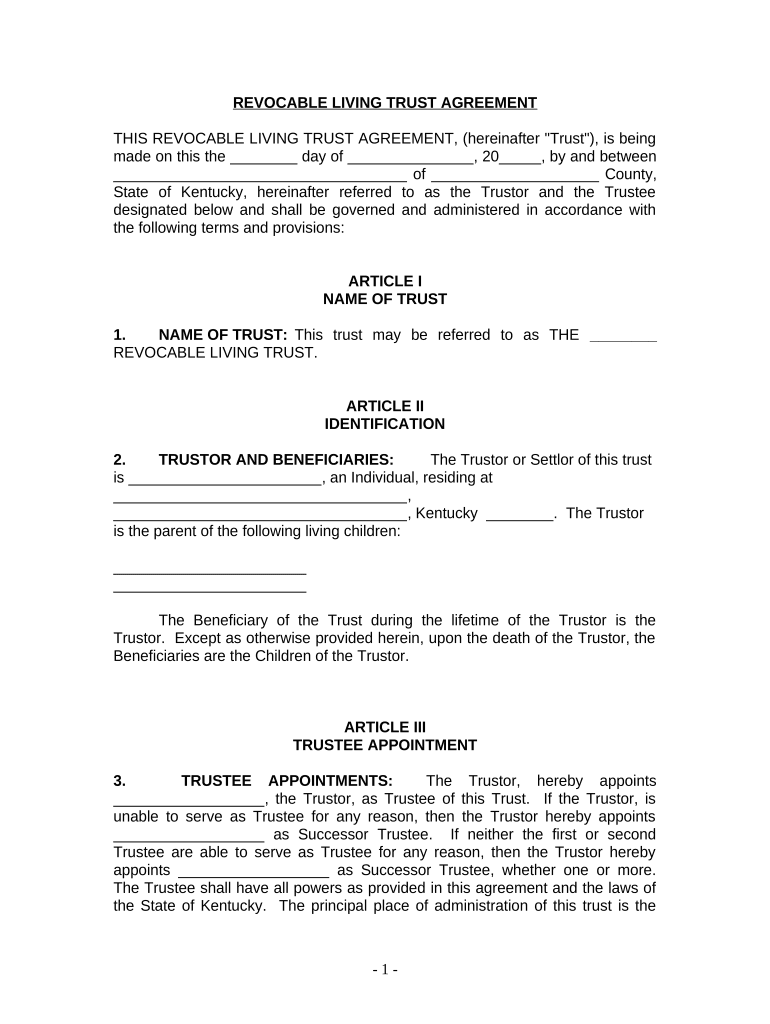

A living trust for an individual who is single, divorced, or a widow or widower with children in Kentucky is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust is particularly beneficial for individuals with children, as it provides a clear framework for asset distribution, ensuring that your children are cared for according to your wishes. Unlike a will, a living trust can help avoid the probate process, which can be time-consuming and costly.

How to use the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

Using a living trust involves several steps. First, you need to create the trust document, which outlines your assets, beneficiaries, and the terms of the trust. Once the trust is established, you will transfer your assets into the trust. This means changing the title of your properties, bank accounts, and other assets to reflect the trust's name. After these steps, you can manage the assets as usual, and upon your passing, the assets will be distributed according to the terms specified in the trust without going through probate.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

Completing a living trust involves a systematic approach:

- Determine your assets: List all assets you want to include in the trust.

- Choose your beneficiaries: Decide who will inherit your assets.

- Draft the trust document: You can use templates or consult an attorney to ensure legal compliance.

- Fund the trust: Transfer ownership of your assets to the trust.

- Review and update: Regularly check the trust to ensure it reflects your current wishes and circumstances.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

The legal use of a living trust in Kentucky allows individuals to maintain control over their assets while providing for their children. It is recognized by the state as a valid estate planning tool. When properly executed, a living trust can help minimize estate taxes and avoid the probate process, making it a preferred choice for many. It is important to ensure that the trust complies with Kentucky state laws to be enforceable.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

Key elements of this living trust include:

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive the assets from the trust.

- Assets: Properties, bank accounts, and other valuables included in the trust.

- Terms of distribution: Specific instructions on how and when the assets should be distributed to beneficiaries.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

Kentucky has specific regulations governing living trusts. It is essential to follow state laws regarding the creation and management of the trust. This includes ensuring that the trust document is signed and notarized, and that assets are properly transferred into the trust. Additionally, Kentucky law allows for revocable living trusts, which can be changed or revoked at any time during the grantor's lifetime, providing flexibility in estate planning.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children kentucky

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky on Any Device

Digital document management has become increasingly popular among both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly without delays. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to Edit and Electronically Sign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky with Ease

- Obtain Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides for that specific purpose.

- Generate your eSignature using the Sign tool, which takes merely seconds and holds the same legal validity as a customary wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky to ensure excellent communication at any phase of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky is a legal document that helps manage your assets during your lifetime and specifies how they will be distributed after your death. This type of trust allows you to maintain control over your assets while simplifying the transfer for your beneficiaries, especially your children.

-

How does a Living Trust benefit individuals in Kentucky who are single, divorced or widowed?

A Living Trust can provide signNow benefits for individuals in Kentucky who are single, divorced or widowed. It enables you to avoid probate, which can save time and legal fees, ensuring a smoother process for your heirs. Additionally, it helps you specify how your assets are distributed, offering peace of mind for you and your children.

-

What are the costs associated with setting up a Living Trust in Kentucky?

Setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky typically involves initial setup fees that vary based on complexity. While costs may range from a few hundred to several thousand dollars, investing in a trust can be economical in the long run by avoiding probate expenses. It's advisable to consult with an estate planning attorney for precise cost estimates.

-

Can I customize my Living Trust To suit my specific needs in Kentucky?

Yes, you can absolutely customize your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky to reflect your unique situation. You can designate specific assets to your children or conditions for their inheritance. Customization ensures the trust aligns with your wishes and the needs of your family.

-

Will a Living Trust affect my eligibility for government benefits in Kentucky?

Establishing a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky may impact eligibility for certain government benefits, depending on the value of the assets included. It’s crucial to explore how your trust can align with your financial situation. Consulting with a financial advisor can help you understand the implications.

-

How can airSlate SignNow assist me in creating a Living Trust in Kentucky?

airSlate SignNow offers user-friendly solutions for creating and managing your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children in Kentucky. Our platform allows you to eSign and securely store your documents online, making it accessible anytime. This simplicity and efficiency make the process of trust management hassle-free.

-

What happens to my Living Trust if I move out of Kentucky?

If you move out of Kentucky, your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children may still be valid, but it's advisable to review and possibly update it according to the new state's laws. Each state has unique regulations that may affect how your trust operates. Consulting with an estate planning attorney in your new state is essential for compliance.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Kentucky

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online