Louisiana Property Disclosure Form

What is the Louisiana Property Disclosure Form

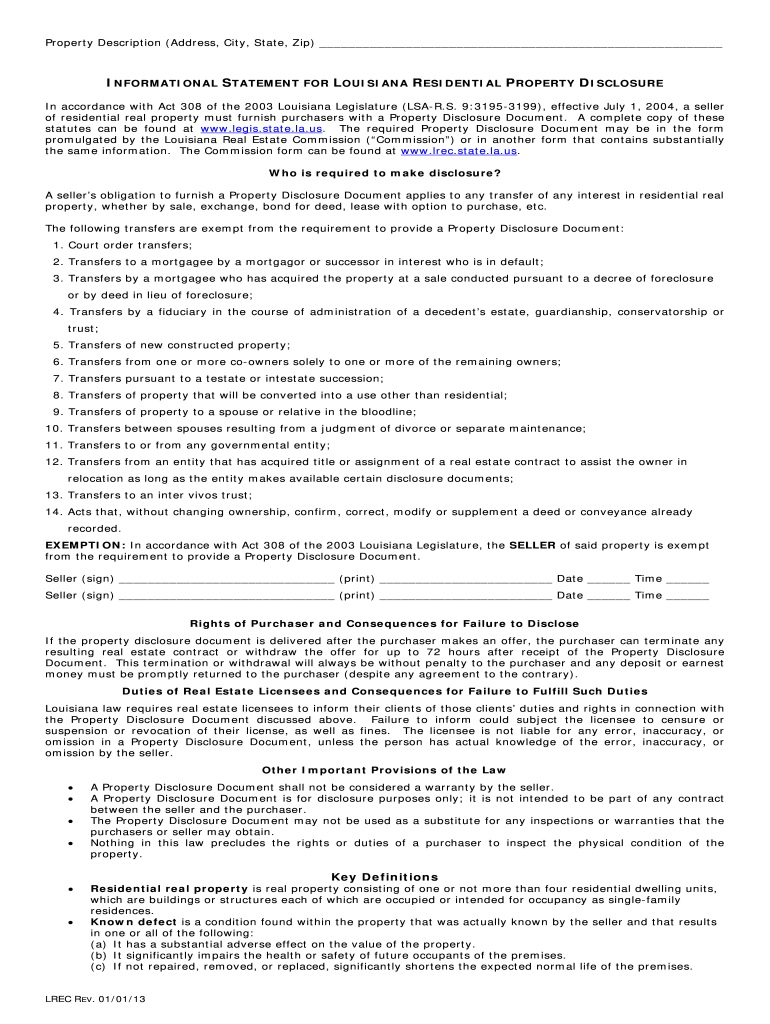

The Louisiana Property Disclosure Form is a legal document that sellers of real estate in Louisiana are required to complete. This form provides potential buyers with essential information about the property's condition and any known issues. The form is designed to promote transparency in real estate transactions, ensuring that buyers are informed about the property's history and any defects that may affect its value or desirability.

How to use the Louisiana Property Disclosure Form

To use the Louisiana Property Disclosure Form, sellers must accurately disclose all relevant information regarding the property's condition. This includes details about structural issues, plumbing and electrical systems, and any past or present pest infestations. Once completed, the form should be provided to prospective buyers during the negotiation process. It is important for sellers to ensure that the information is truthful and comprehensive, as failure to disclose known issues can lead to legal consequences.

Steps to complete the Louisiana Property Disclosure Form

Completing the Louisiana Property Disclosure Form involves several key steps:

- Obtain the official Louisiana Property Disclosure Form from a reliable source.

- Review the form carefully to understand all required disclosures.

- Gather information about the property, including any repairs, renovations, or issues encountered.

- Fill out the form accurately, ensuring all sections are completed.

- Sign and date the form to validate it.

- Provide the completed form to potential buyers as part of the sales process.

Legal use of the Louisiana Property Disclosure Form

The Louisiana Property Disclosure Form is legally binding when properly completed and signed. It serves as a critical document in real estate transactions, protecting both the seller and the buyer. Sellers are legally obligated to disclose known defects, and failure to do so can result in legal action from buyers who may feel misled. Therefore, it is essential for sellers to understand their legal responsibilities when filling out this form.

Key elements of the Louisiana Property Disclosure Form

Key elements of the Louisiana Property Disclosure Form include:

- Property address and ownership details.

- Disclosure of any known defects or issues related to the property.

- Information about the property's systems, such as heating, cooling, plumbing, and electrical.

- Details regarding any past repairs or renovations.

- Signature of the seller, confirming the accuracy of the information provided.

State-specific rules for the Louisiana Property Disclosure Form

In Louisiana, specific rules govern the use of the Property Disclosure Form. Sellers must adhere to the Louisiana Real Estate Commission (LREC) guidelines, which mandate that the form be provided to buyers before the sale is finalized. Additionally, the form must be filled out completely and truthfully to avoid potential legal repercussions. Understanding these state-specific rules is crucial for ensuring compliance and protecting the interests of all parties involved in the transaction.

Quick guide on how to complete louisiana property disclosure document for residential real estate form

Complete Louisiana Property Disclosure Form with ease on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Louisiana Property Disclosure Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Louisiana Property Disclosure Form effortlessly

- Find Louisiana Property Disclosure Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Louisiana Property Disclosure Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are the documents that residential real estate investors need to keep in their records for each property they own and lease?

In MAHARASHTRA STATE, INDIAFOR OWNERSHIP FLATS, SHOP, COMMERCIAL, Excluding Land.1 Registered Sale Agreement2 7/12 EXTRACT3 TITLE SEARCH REPORT4 BLUE PRINT5 CHAIN DOCUMENT (If Owner is 2nd Party or More)6 NA ORDER7 COMPLETATION CERTIFICATE (CC) or OCCUPANCY CERTIFICATE8 INDEX 29 SHARE CERTIFICATE (If SOCIETY is REGISTERED)10 REGISTRATION ReceiptThis Documents are Important for ALL CITYs in MMR - MUMBAI METROPOLITAN REGION

-

How much leverage is too much, for a real estate investor who buys and holds residential properties while renting them out?

The easiest way to answer this question is to ask “by how much would rents need to fall or expenses need to rise before I could not pay my mortgage”.At the asset level, lenders use a formula called debt service coverage ratio to try to answer this question. DSCR is: (annual rent - annual expenses) / annual debt service payments.Annual debt service is your total annual mortgage payments, including interest and principal (in any).Since annual rent - annual expenses = Net operating income, another way of saying this is just Net Operating Income / Annual Debt Service.Lenders generally want to see the ratio at something like 1.25, which is to say $1.25 of NOI for each $1 of debt service.Here’s a real world example:Rent $100kExpenses $30kAnnual debt service $55kSo, DSCR = (100k - 30k) / 55k = 1.27Now, imagine expenses stay constant but rents come dow 15% to $85k. NOI is $85k - $30k = $55k. At that point, there is literally no margin for error… every last dollar of NOI is going to service the mortgage.So, if you want to be safe at the asset level, I would suggest keeping your DSCR to more like 1.3–1.4… eg keeping your mortgage small enough that you have $1.30 or $1.40 for each $1 of mortgage payments.One final note: DSCR works at the asset level. But it’s also worthwhile to consider your whole portfolio. After all, if rents fall but you have lots of other income coming in from stable sources (say, a stock portfolio, other properties, good jobs, etc.), you might be willing / able to subsidize the mortgage on your income property. So, in that scenario, if borrowing against the income property is the cheapest path, it may make sense for you to take a larger-than-normally-prudent loan against the property.

-

How did the New York Times get access to private property documents for the latest New York real estate feature?

Probably by using New York's Freedom of Information Law ("FOIL"), which requires government agencies to provide specific pubic records upon written request. Condominium units are separate parcels of real estate, each with a separate lot number and tax ID number. Public tax assessment rolls will show the fee owner of each parcel of real estate in NYC. If a condominium is owned by "XYZ, LLC," and they want to know who the person or persons are who own this entity, they would submit a written FOIL request to the New York State Department of State, requesting its records for the establishment or registration of that entity. Those records will often reveal the true owner behind the LLC.

-

How much can a land entitlement for commercial use add to the value of my prime residential property in the city center?

Honestly it really depends. Here are the factors.Is there demand for commercial space in your city center? The fact is that computers and cars drastically reduced the demand for office and retail space in American city centers. Downtowns became the place for lively entertainment venues and art galleries because the owners of those businesses could take over shuttered former Downtown retail that had all moved to the suburban shopping mall. They did so because the real estate was much cheaper. It may be commercial rents can’t actually cover the cost of switching residential to commercialIs commercial rent higher than residential? I know in my city it isn’t. Commercial rent is highly dependent on traffic counts both car and pedestrian. Residential is based on whether it’s a convenient and nice place to live. Typically in a high end neighborhood the residential uses are much more valuable than the commercial ones.If the answer to either of those is no, then the answer is probably no. Nearly all of the residential construction you read about revitalizing city centers is actually happening on land or in buildings once used or planned for commercial uses. Odds are the most valuable option for a piece of downtown land almost anywhere in the world is either multifamily residential or maybe a hotel(if it’s the best spot to build a hotel on that doesn't already have one).

-

How do very mixed race people fill out official documents and forms that ask for race if one is only allowed to choose one race?

None of the above?

-

How big is the real estate investment market? Assuming a startup wants to create a service for individuals owning rental property, how many possible customers are out there?

Assuming you're talking about the US, it is vast, huge, and amorphous. There is no way you'll be able to get a measurement.Outside of major cities, 40 to 60% of the buildings, are owned by individuals, or single member LLCs. The rental market has shockingly many single family, or duplexes that are being rented out. There are no centralized listings of these people, not statewide not countywide in very few cities track landlords.There are national statistics which say how many people on versus how many people rent, but looking at the people who rent you do not know whether they are renting single-family house, or a studio apartment in a complex. Getting your hands around the number of landlords in the US is impossible. It's been tried before

-

How does real estate investing work in Robert Kiyosaki's Cashflow game? Why do I only pay for a down payment? Shouldn't I eventually have to buy out the property?

Not necessarily,The reason you only make the downpayment is because (assuming you ran the numbers correctly) a downpayment can be the only payment you make on a property. Every other expense (repair, mortgage, taxes, insurance, utilities, etc.) Will be paid by the incoming rent from tenants, ans you would never need to put another penny into the property. Assuming you budgetted correctly!Www.frommilitarytomillionaire.com

Create this form in 5 minutes!

How to create an eSignature for the louisiana property disclosure document for residential real estate form

How to create an electronic signature for the Louisiana Property Disclosure Document For Residential Real Estate Form online

How to make an eSignature for the Louisiana Property Disclosure Document For Residential Real Estate Form in Chrome

How to create an eSignature for signing the Louisiana Property Disclosure Document For Residential Real Estate Form in Gmail

How to make an eSignature for the Louisiana Property Disclosure Document For Residential Real Estate Form right from your smartphone

How to generate an electronic signature for the Louisiana Property Disclosure Document For Residential Real Estate Form on iOS

How to generate an electronic signature for the Louisiana Property Disclosure Document For Residential Real Estate Form on Android

People also ask

-

What are Louisiana real estate disclosure laws?

Louisiana real estate disclosure laws require sellers to disclose specific information about a property's condition and history to potential buyers. These laws aim to protect buyers from purchasing properties with hidden defects or issues. Understanding these regulations is crucial for both buyers and sellers in ensuring a transparent transaction.

-

How does airSlate SignNow assist with Louisiana real estate disclosure laws?

AirSlate SignNow streamlines the process of preparing and eSigning disclosure documents required by Louisiana real estate disclosure laws. Our platform allows users to create, send, and sign disclosure forms electronically, ensuring compliance with state regulations while saving time and avoiding paperwork hassles.

-

Are there costs associated with using airSlate SignNow for real estate transactions?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs. The cost is competitive, providing an affordable solution for managing documents, including those required by Louisiana real estate disclosure laws. You can explore our pricing options to find the plan that best suits your requirements.

-

What features does airSlate SignNow offer for real estate professionals?

AirSlate SignNow provides features such as customizable document templates, secure eSigning, and real-time tracking of document status. These features are essential for compliance with Louisiana real estate disclosure laws, making it easier for professionals to manage their transactions efficiently and securely.

-

How can I integrate airSlate SignNow with other tools I use?

AirSlate SignNow offers seamless integrations with various business applications, enhancing your workflow efficiency. Whether you use CRM systems, project management tools, or cloud storage services, our platform can be integrated to support compliance with Louisiana real estate disclosure laws and improve document management.

-

What benefits does eSigning offer compared to traditional signing methods?

eSigning with airSlate SignNow offers numerous advantages, including speed, convenience, and enhanced security. Unlike traditional signing methods, electronic signatures meet all legal requirements, including those outlined in Louisiana real estate disclosure laws. This ensures faster transactions and reduces delays associated with paperwork.

-

Is airSlate SignNow legally compliant with Louisiana laws?

Absolutely! AirSlate SignNow is designed to be compliant with all relevant laws, including Louisiana real estate disclosure laws. Our electronic signature process adheres to state and federal regulations, assuring users that their documentation is valid and enforceable.

Get more for Louisiana Property Disclosure Form

Find out other Louisiana Property Disclosure Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document