Minnesota Levy Form

What is the Minnesota Levy

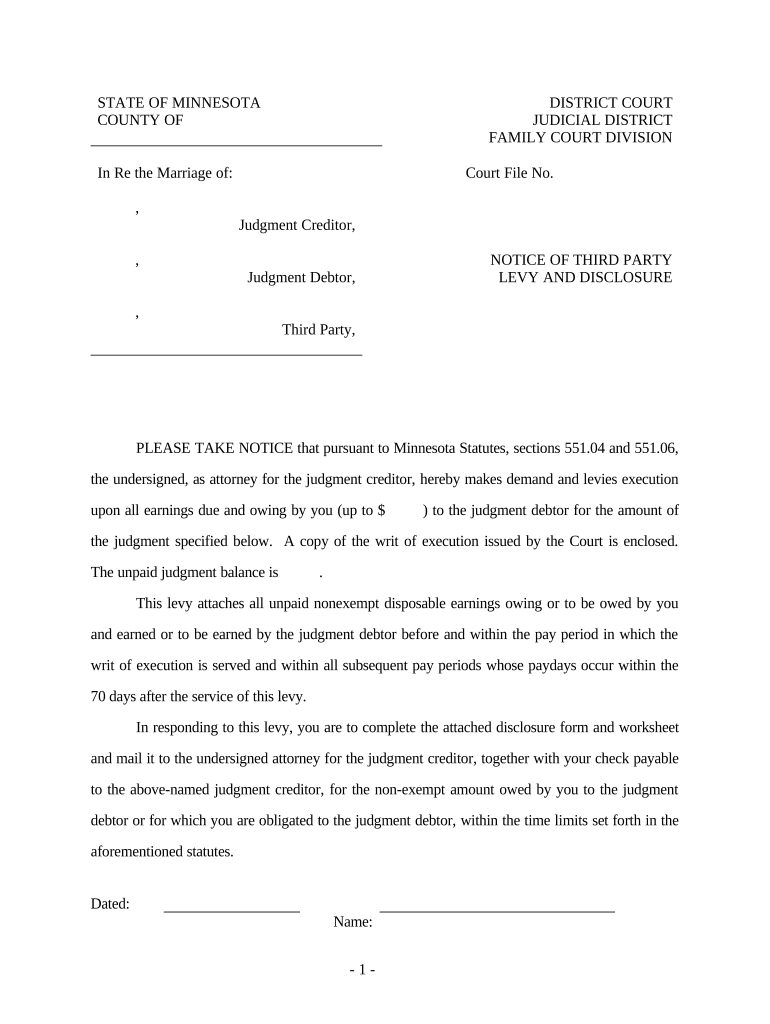

The Minnesota levy refers to a legal process that allows creditors to collect debts by seizing a debtor's property or income. This process is often initiated through a levy disclosure statement, which outlines the details of the garnishment. The Minnesota levy is a critical tool for creditors to enforce judgments and ensure that debts are paid. It is essential for both creditors and debtors to understand the implications of this process, including the rights and responsibilities involved.

Steps to complete the Minnesota Levy

Completing the Minnesota levy involves several key steps to ensure compliance with state laws. First, the creditor must obtain a judgment against the debtor, which serves as the basis for the levy. Next, the creditor needs to fill out the appropriate mn disclosure form, providing necessary information about the debtor and the amount owed. Once the form is completed, it must be filed with the court and served to the debtor, informing them of the levy. It is crucial to follow all procedural requirements to avoid delays or complications.

Key elements of the Minnesota Levy

Understanding the key elements of the Minnesota levy can help both creditors and debtors navigate the process effectively. Important components include:

- Judgment Requirement: A court judgment is necessary to initiate a levy.

- Disclosure Statement: The mn disclosure form must be accurately completed and filed.

- Notification: The debtor must be formally notified of the levy.

- Exemptions: Certain income and property may be exempt from levies under state law.

Legal use of the Minnesota Levy

The legal use of the Minnesota levy is governed by state laws that outline how and when a creditor can initiate a levy. It is essential for creditors to adhere to these regulations to ensure that the levy is enforceable. Debtors also have rights during this process, including the ability to contest the levy or claim exemptions. Understanding these legal frameworks can help both parties navigate the complexities of debt collection.

Required Documents

To initiate a Minnesota levy, specific documents are required to ensure compliance with state laws. These typically include:

- The completed mn disclosure form, detailing the debtor's information and the amount owed.

- A copy of the court judgment that grants the creditor the right to levy.

- Any additional documentation that may be required by the court or local jurisdiction.

Form Submission Methods

The mn disclosure form can be submitted through various methods, depending on local court rules. Common submission methods include:

- Online: Many courts allow electronic filing of documents through their websites.

- Mail: The form can be sent via postal service to the appropriate court.

- In-Person: Creditors may also choose to file the form in person at the courthouse.

Quick guide on how to complete minnesota levy

Complete Minnesota Levy with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Handle Minnesota Levy on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and eSign Minnesota Levy effortlessly

- Find Minnesota Levy and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click Done to save your changes.

- Select how you wish to submit your form, either by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks on any device you choose. Edit and eSign Minnesota Levy to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the MN disclosure form and why is it important?

The MN disclosure form is a document required in Minnesota that outlines specific information regarding a property transaction. It informs potential buyers about the condition of the property and any known issues. Understanding this form is crucial for both buyers and sellers to ensure compliance with state regulations.

-

How can airSlate SignNow help with the MN disclosure form?

airSlate SignNow streamlines the process of completing and signing the MN disclosure form by providing an intuitive platform for document management. You can upload, edit, and securely send the form to all necessary parties. This ensures that your transactions are efficient and compliant with Minnesota laws.

-

Is there a cost associated with using airSlate SignNow for the MN disclosure form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling the MN disclosure form. Each plan includes all essential features, so businesses can choose one that fits their budget and volume needs. A free trial is available for new users to explore the platform.

-

Are there any features specific to the MN disclosure form in airSlate SignNow?

airSlate SignNow provides features like template creation and easy document sharing, specifically suited for the MN disclosure form. Users can save frequently used details, making it easier to fill out forms quickly. This streamlines transactions and reduces the likelihood of errors.

-

Can I integrate airSlate SignNow with other tools for managing the MN disclosure form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as real estate CRMs and management systems to facilitate the handling of the MN disclosure form. These integrations help maintain efficient workflows and enhance productivity by connecting your existing tools.

-

How secure is the data when using airSlate SignNow for the MN disclosure form?

Security is a top priority at airSlate SignNow. When dealing with the MN disclosure form or any other documents, data is encrypted both in transit and at rest. Additionally, the platform complies with industry standards to protect sensitive information throughout the signing process.

-

What are the benefits of using airSlate SignNow for the MN disclosure form?

By using airSlate SignNow for the MN disclosure form, users benefit from faster turnaround times and reduced paperwork. The platform also offers tracking features, so you can monitor who has viewed and signed the document. This leads to increased transparency and better communication within transactions.

Get more for Minnesota Levy

- How to change address on paylocity form

- Family law financial affidavit short form

- Teacher loan forgiveness application fillable form 26576830

- Certificate of exemption out of statecitycounty delivery revenue alabama form

- Expert witness disclosure form

- Iiaril i form

- Home equity sharing agreement template form

- Home loan agreement template form

Find out other Minnesota Levy

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word