Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Minnesota Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

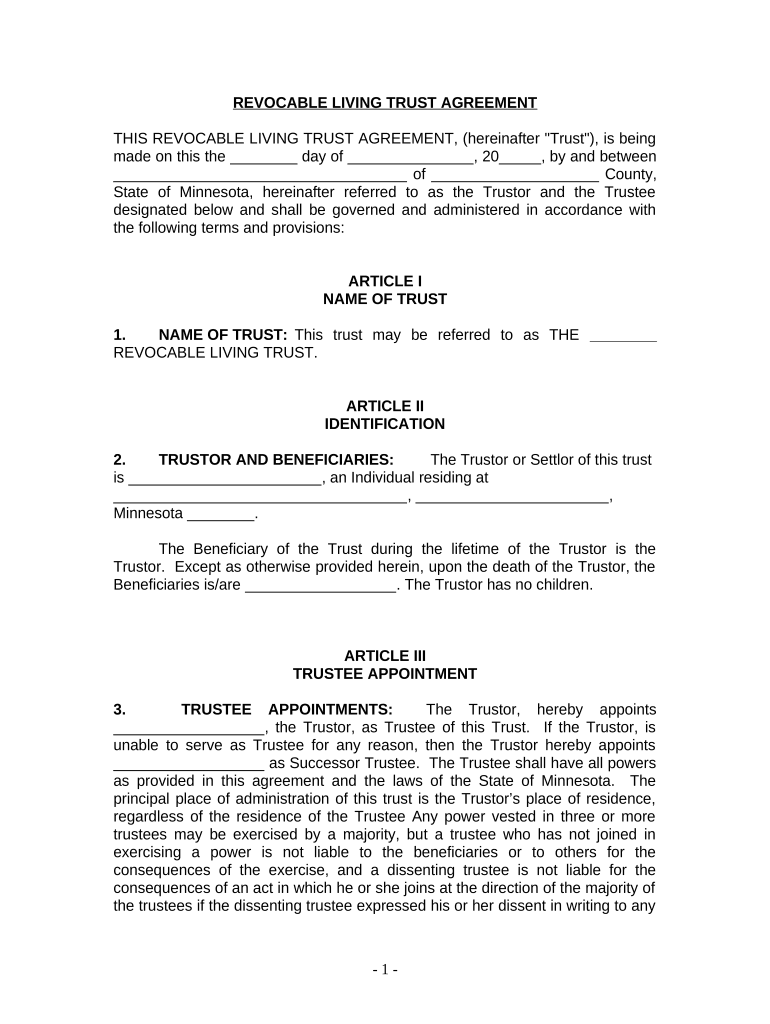

A living trust for individuals who are single, divorced, or widowed with no children in Minnesota is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, which is the legal process of validating a will and distributing assets. By establishing a living trust, the individual retains control over their assets while providing clear instructions for their distribution, minimizing potential disputes among heirs.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

Completing a living trust involves several key steps:

- Gather Information: Collect details about your assets, including bank accounts, real estate, investments, and personal property.

- Choose a Trustee: Decide who will manage the trust. This can be yourself or another trusted individual.

- Draft the Trust Document: Create the trust document, outlining how assets will be managed and distributed. This can be done with legal assistance or using trusted software.

- Fund the Trust: Transfer ownership of your assets into the trust. This may involve changing titles or account names.

- Sign the Document: Ensure the trust document is signed according to Minnesota laws, which may require witnesses or notarization.

- Store the Document Safely: Keep the trust document in a secure location and inform your trustee of its whereabouts.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

Several key elements are essential in a living trust:

- Trustee: The individual responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the trust creator's death.

- Assets: The property and funds included in the trust, which can be real estate, bank accounts, or personal belongings.

- Distribution Instructions: Clear directives on how and when the assets should be distributed to beneficiaries.

- Revocation Clause: A provision that allows the trust creator to amend or revoke the trust at any time during their lifetime.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

In Minnesota, specific rules apply to living trusts. The trust must be created in writing and signed by the trust creator. Minnesota law also requires that the trust document clearly identifies the trustee and beneficiaries. Additionally, the trust should comply with state laws regarding property transfer and asset management. It is advisable to consult with a legal professional familiar with Minnesota estate planning laws to ensure compliance and effectiveness.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

Obtaining a living trust in Minnesota can be accomplished through various means:

- Legal Assistance: Engaging an estate planning attorney can provide tailored guidance and ensure legal compliance.

- Online Resources: Many legal websites offer templates and tools for creating a living trust.

- Software Solutions: Utilizing estate planning software can help streamline the process and provide necessary forms.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

The legal use of a living trust in Minnesota is to manage assets during the creator's lifetime and facilitate the distribution of those assets after death. It is a recognized legal instrument that can help avoid probate and provide privacy regarding asset distribution. The trust must comply with state laws to be enforceable, including proper execution, funding, and adherence to the terms outlined within the document. Consulting with a legal professional can ensure that the trust is valid and serves its intended purpose.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children minnesota

Effortlessly Prepare Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Modify and Electronically Sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota with Ease

- Find Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and press the Done button to save your updates.

- Select your preferred method to share your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota to ensure outstanding communication at every stage of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can help simplify the estate planning process, ensuring your wishes are honored without the need for probate.

-

How much does it cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota?

The cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota can vary based on the complexity of your estate and the services used. Typically, you can expect to pay between $1,500 to $5,000 for professional assistance, but using online services may reduce the costs.

-

What are the benefits of setting up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota?

The benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota include avoiding probate, maintaining privacy, and ensuring a smoother transition of your assets. This trust also allows for more control over when and how your assets are distributed, which can be particularly advantageous for individuals without children.

-

Can I change my Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota later on?

Yes, you can make changes to your Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota as your circumstances or wishes change. Most trusts are revocable, allowing you to modify terms, add or remove assets, and even dissolve the trust entirely if necessary.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota work with your other estate planning documents?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota works in conjunction with other estate planning tools, like wills and powers of attorney. It can effectively manage your assets during your lifetime and streamline the transfer of property after your passing, while your will can address any assets not included in the trust.

-

What assets can be included in a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota?

You can include various types of assets in your Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota, such as real estate, bank accounts, investments, and personal property. However, it's essential to ensure that all assets are officially transferred into the trust to take advantage of its benefits.

-

Does a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota help with taxes?

While a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota does not offer tax advantages per se, it can still help simplify your estate's tax situation by avoiding probate and potentially reducing estate taxes upon your death. It's advisable to consult a tax professional for personalized advice.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

- C22 form 30378368

- General liability incident report mpie form

- Download hyatt registration form gomactech net

- Glucometer competency test answers form

- Erp modificationcustomization request form morehead state moreheadstate

- M1pr form 100061237

- Fema brochures form

- Parent child living agreement template form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Minnesota

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive