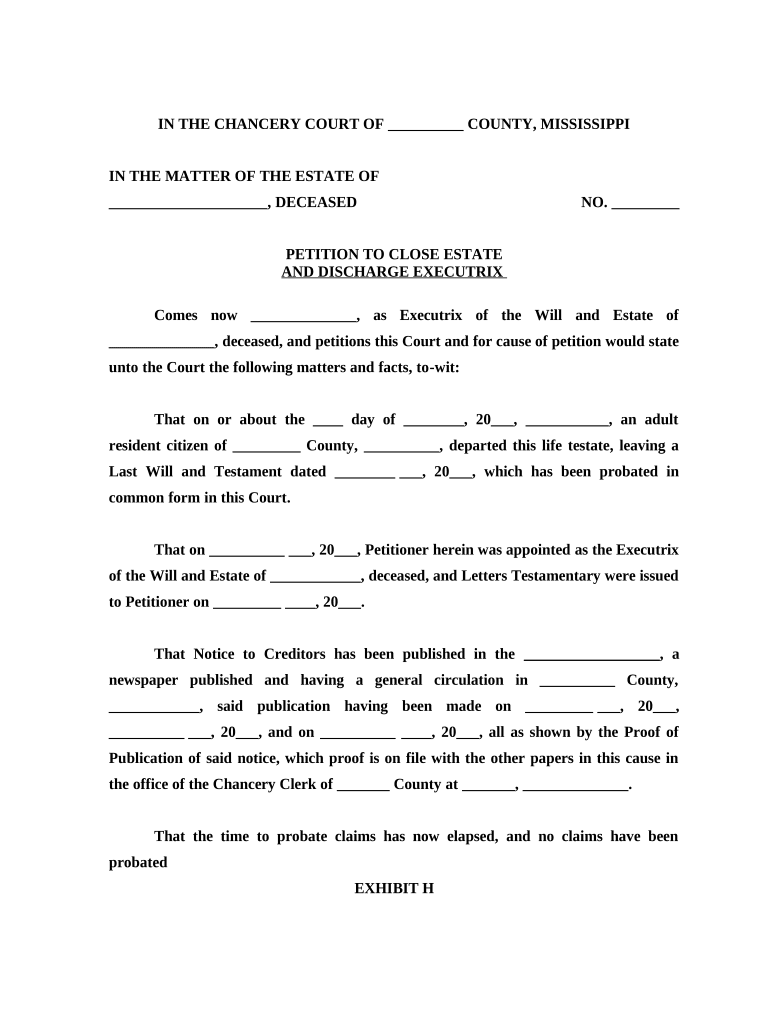

Executor Form

What is the Executor?

An executor is a person or institution appointed to administer a deceased individual's estate. Their primary responsibility is to ensure that the deceased's wishes, as outlined in their will, are fulfilled. This includes gathering assets, paying debts, and distributing the remaining property to beneficiaries. Executors must adhere to state laws and the specific instructions laid out in the will, making their role crucial in the estate settlement process.

Steps to Complete the Executor

Completing the executor process involves several key steps:

- Review the Will: Examine the deceased's will to understand their wishes and identify the appointed executor.

- File the Will: Submit the will to the probate court to initiate the probate process, which legally validates the will.

- Notify Beneficiaries: Inform all beneficiaries named in the will about their rights and the probate process.

- Inventory Assets: Compile a detailed list of all assets, including real estate, bank accounts, and personal property.

- Pay Debts and Taxes: Settle any outstanding debts and taxes owed by the estate before distributing assets.

- Distribute Assets: Distribute the remaining assets to beneficiaries according to the instructions in the will.

Legal Use of the Executor

The executor has a legal obligation to act in the best interest of the estate and its beneficiaries. This includes following the law and adhering to the terms of the will. Executors must maintain transparency with beneficiaries and provide regular updates regarding the estate's status. Failure to fulfill these legal responsibilities can result in personal liability for the executor.

Required Documents

To effectively carry out their duties, an executor needs several important documents, including:

- The Will: The primary document outlining the deceased's wishes.

- Death Certificate: Official proof of the individual's passing.

- Inventory of Assets: A comprehensive list of all estate assets.

- Financial Statements: Documentation of any debts, taxes, and financial obligations.

State-Specific Rules for the Executor

Each state has its own laws governing the role and responsibilities of an executor. It is essential for executors to be familiar with these regulations to ensure compliance. For instance, some states may require the executor to obtain a bond, while others may have specific timelines for filing documents with the probate court. Understanding these nuances can help executors navigate the probate process more effectively.

How to Obtain the Executor

To obtain the executor designation, an individual must be named in the will. If no executor is specified, the court may appoint one, typically a close relative or a trusted friend of the deceased. The appointed executor must then file the will with the probate court and may need to complete additional paperwork to officially accept the role.

Quick guide on how to complete executor 497313780

Complete Executor effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Executor on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Executor with ease

- Locate Executor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Executor while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an executor document?

An executor document is a legal document that appoints an executor to manage the estate of a deceased person. This document outlines the executor's responsibilities and authority, ensuring that the deceased's wishes are honored. Understanding how to create an executor document is crucial for effective estate planning.

-

How does airSlate SignNow simplify creating an executor document?

airSlate SignNow provides an intuitive interface that makes it easy to create, edit, and send executor documents. Users can select from customizable templates tailored for executor documents, ensuring that all legal requirements are met. Additionally, the platform streamlines the signing process, allowing for secure electronic signatures.

-

What are the pricing options for using airSlate SignNow for executor documents?

airSlate SignNow offers several pricing plans to accommodate different needs, making it cost-effective for businesses and individuals alike. The plans are designed to provide flexibility, whether you need to manage a single executor document or multiple documents for your organization. Interested users can explore these options on our pricing page.

-

Can I ensure the legality of my executor document with airSlate SignNow?

Yes, airSlate SignNow ensures that your executor document is legally binding with its state-compliant electronic signature technology. The platform adheres to industry standards and legal requirements, providing users with peace of mind. Each executed document is securely stored and retrievable at any time.

-

Are there integrations available for my executor document needs?

airSlate SignNow seamlessly integrates with various applications, enhancing the management of your executor documents. Whether you need to link with cloud storage services or CRM systems, our platform provides flexible integration options. This allows for a streamlined workflow and easier access to important documents.

-

What features does airSlate SignNow offer for executor documents?

airSlate SignNow offers a host of features for managing executor documents, including customizable templates, secure electronic signatures, and real-time tracking of document status. Additionally, you can utilize features like reminders and notifications to keep all parties informed. These tools enhance efficiency and simplify the document management process.

-

How can airSlate SignNow benefit businesses handling executor documents?

By using airSlate SignNow, businesses can reduce the time and costs associated with managing executor documents. The platform streamlines the signing process, enhances collaboration, and ensures that all documents are properly executed. This efficiency can lead to improved workflow and customer satisfaction.

Get more for Executor

- Ie461 form

- Withdrawal request form gbebrokers com

- Direct bill application form

- Horse bill of sale 3995093 form

- Date bill of lading short form not negotiable bb dalor

- Dallas county community colleges 100 distance education affidavit richlandcollege form

- Female weight height form

- Passaic pediatrics p form

Find out other Executor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors