Ad Valorem Tax Form

What is the Ad Valorem Tax

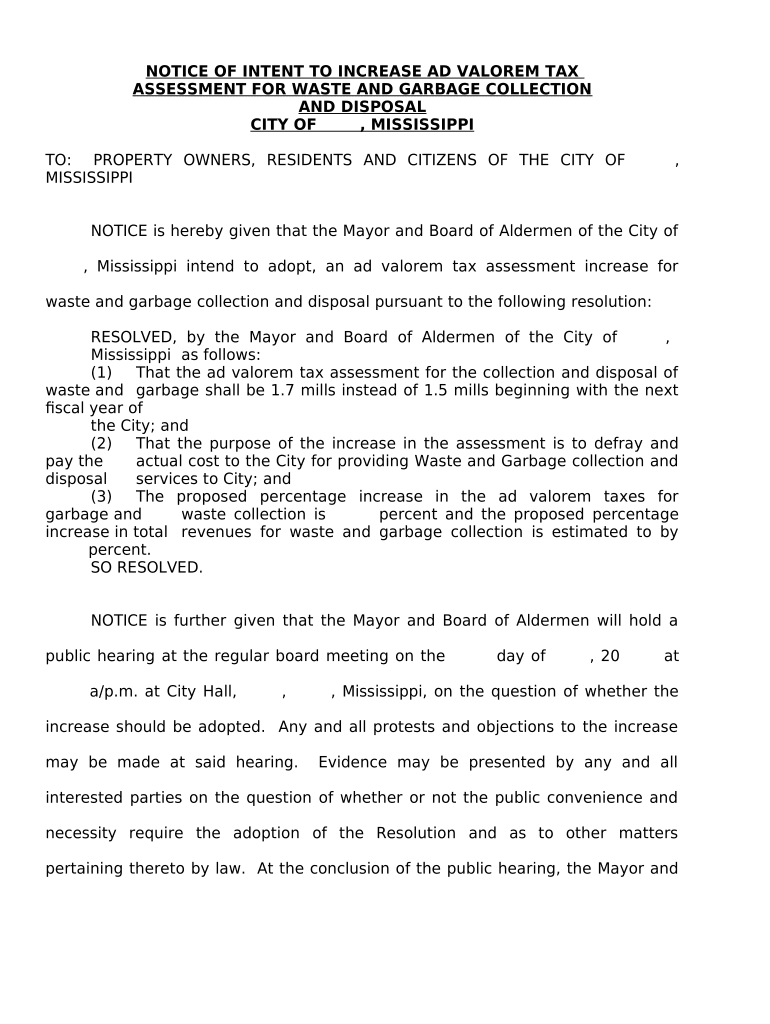

The ad valorem tax, often referred to as property tax, is a tax based on the assessed value of real estate or personal property. In Mississippi, this tax is levied by local governments and is crucial for funding essential services such as education, public safety, and infrastructure. The term "ad valorem" translates to "according to value," which means the tax amount is directly proportional to the value of the property being taxed. Understanding this tax is essential for property owners and businesses alike, as it impacts financial planning and compliance with state regulations.

Steps to Complete the Ad Valorem Tax

Completing the Mississippi ad valorem tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property, including its assessed value, ownership details, and any applicable exemptions. Next, fill out the ad valorem tax form, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline, either online, by mail, or in person, depending on your local jurisdiction's requirements. Keeping a copy of the submitted form for your records is also advisable.

Legal Use of the Ad Valorem Tax

The legal framework surrounding the ad valorem tax in Mississippi mandates that property taxes must be assessed fairly and uniformly. Local assessors are responsible for determining property values, which must be done in accordance with state laws and regulations. It is important for property owners to understand their rights regarding assessments and appeals if they believe their property has been overvalued. Compliance with these legal standards ensures that the tax system remains equitable and transparent for all taxpayers.

Required Documents

To complete the ad valorem tax form in Mississippi, several documents may be required. These typically include proof of property ownership, such as a deed or title, recent property tax statements, and any documentation supporting claims for exemptions or deductions. Additionally, if the property has undergone recent improvements or changes, relevant permits or inspection reports may be necessary. Having these documents prepared in advance can streamline the process and help avoid delays in submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Mississippi ad valorem tax is crucial for compliance. Typically, property tax assessments are conducted annually, and property owners are notified of their assessed values. The deadline to file the ad valorem tax form usually falls on a specific date each year, often in the spring. It is essential to check with local tax authorities for the exact dates, as they may vary by county. Missing the deadline can result in penalties or loss of eligibility for certain exemptions.

Examples of Using the Ad Valorem Tax

Ad valorem taxes are applied in various scenarios, impacting both residential and commercial properties. For instance, a homeowner may receive a property tax bill based on the assessed value of their home, which contributes to local school funding. Similarly, a business may be assessed taxes on its commercial property and equipment, which helps finance municipal services. Understanding these examples can help property owners better anticipate their tax obligations and plan accordingly.

Quick guide on how to complete ad valorem tax

Effortlessly Prepare Ad Valorem Tax on Any Gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the instruments needed to create, modify, and eSign your documents quickly without waiting. Manage Ad Valorem Tax on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Method to Modify and eSign Ad Valorem Tax Without Stress

- Obtain Ad Valorem Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ad Valorem Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Mississippi ad tax, and how does it affect my business?

The Mississippi ad tax refers to the advertising tax imposed on businesses that engage in advertising activities within the state. It is essential for businesses to understand this tax to ensure compliance and optimize their advertising budgets. Using airSlate SignNow, you can easily manage and sign important documents related to your advertising expenditures while staying compliant with the Mississippi ad tax.

-

How can airSlate SignNow help with managing documents related to the Mississippi ad tax?

airSlate SignNow allows businesses to streamline document management by providing an easy-to-use platform for sending and signing documents electronically. This capability is particularly beneficial for managing contracts and agreements that may be affected by the Mississippi ad tax. With airSlate SignNow, your team can ensure timely document execution, which can aid in better management of your tax obligations.

-

Are there any specific features in airSlate SignNow that cater to tax-related documents?

Yes, airSlate SignNow offers features such as customizable templates and secure storage that can be particularly useful for handling tax-related documents like those involving the Mississippi ad tax. These features ensure that your documents are compliant and can be easily accessed whenever necessary. Additionally, the audit trail feature provides transparency for all signed documents, aiding in tax preparation.

-

Is airSlate SignNow a cost-effective solution for managing the Mississippi ad tax documentation?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their document signing needs, including those related to the Mississippi ad tax. By reducing printing and mailing costs and streamlining the document signing process, airSlate SignNow can help your business save money while ensuring compliance with local tax regulations.

-

What types of integrations does airSlate SignNow offer to help with Mississippi ad tax documentation?

airSlate SignNow seamlessly integrates with various platforms such as CRM systems, accounting software, and project management tools, making it easier for businesses to handle their documentation related to the Mississippi ad tax. These integrations enable users to pull in necessary data and documents directly, which enhances efficiency and accuracy when managing tax-related tasks.

-

How secure is airSlate SignNow for handling sensitive Mississippi ad tax documents?

Security is a top priority at airSlate SignNow, which employs advanced encryption methods and secure cloud storage for all documents, including those related to the Mississippi ad tax. This ensures that your sensitive information is protected from unauthorized access while still being accessible to authorized users. By using airSlate SignNow, businesses can confidently manage their tax documents without compromising security.

-

Can I track the status of documents related to the Mississippi ad tax with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of documents related to the Mississippi ad tax. This includes notifications when documents are viewed and signed, enhancing transparency and ensuring that important tax-related documents are processed timely. You can stay informed about the entire signing process, reducing uncertainties associated with tax documentation.

Get more for Ad Valorem Tax

- Tattoo artist license form

- Consent for change of name minor child ren florida form

- Answer key to tabe form 10a answer key to tabe form 10a

- Fca permission slip form

- Qld weapons licence change of address form

- Stira alternatives form

- Hepatitis a forms

- Client intake forms holistic counseling amp therapy 17 printable client information sheet templates 17 printable client

Find out other Ad Valorem Tax

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast